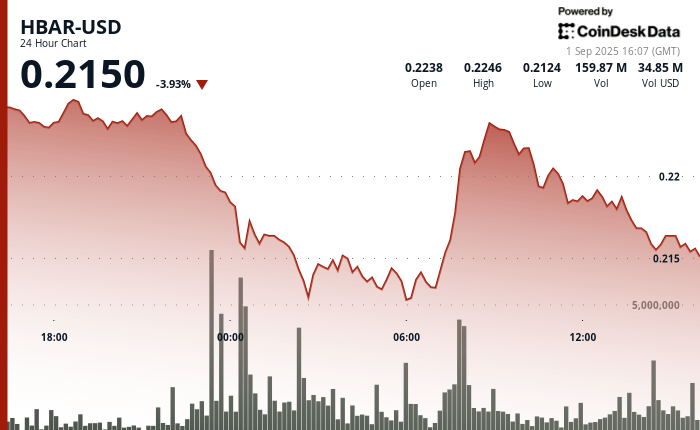

The Hedera Hbar token faced a renewed sales pressure while institutional investors reduced the exhibition, pushing the asset to around 4% between August 31 and September 1. The commercial activity was concentrated around the bar of $ 0.22, with intraday swings ranging from $ 0.23 high to $ 0.22.

The heaviest sale emerged in after-hour, when more than 110 million tokens exchanged hands, stressing the signs of coordinated disinvestment. Market manufacturers have sought to stabilize the price from $ 0.21 to $ 0.22, but the hardened resistance just above $ 0.22, capping any significant recovery.

Despite the slowdown, Hedera continues to position herself as a business adoption platform. The daily negotiation volume fell 46% to 172.85 million dollars while the network maintained market capitalization nearly $ 9.5 billion.

The sales pressure has accelerated in the last hour of September 1, when Hbar briefly violated several levels of support. About 3.5 million tokens changed hands in a single minute while the token slipped below its resistance of $ 0.22, closing the session near its stockings. Sellers retaining control and institutional flows leaning on negative, the market indicates that a new repositioning of companies could continue in the short term.

The analysis of the market structure reveals institutional repositioning

- The share price went from $ 0.22 to $ 0.22 representing negotiation ranges of $ 0.01 or 5% between maximum and minimum session levels.

- The negotiation volume exceeded 110 million tokens during night hours indicating significant institutional activity and a potential portfolio rebalancing.

- The support levels emerged around the range from $ 0.21 to $ 0.22 with subsequent recovery attempts that have not obtained institutional support.

- The resistance was formed nearly $ 0.22 to $ 0.23 where the discovery of prices systematically suffered a sale pressure throughout the negotiation period.

- Multiple support violations occurred at $ 0.22 and $ 0.22, sellers retaining market control.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.