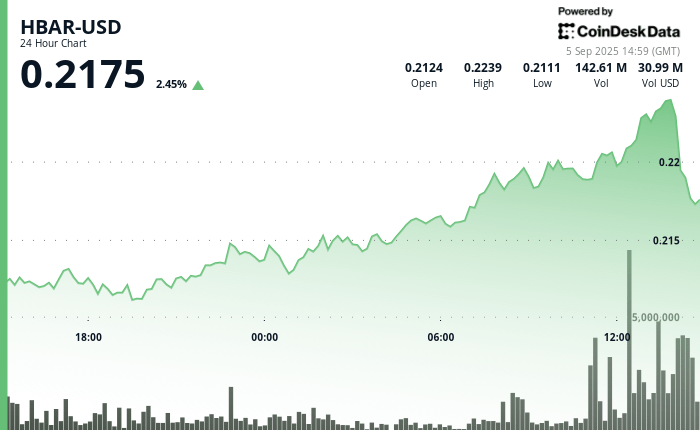

The Hedera Hbar token organized an early rally, but finished the session on Thursday, because a strong pressure erased the gains and pierced critical technical levels. The token climbed $ 0.21 from $ 0.21 to $ 0.21 within 11 p.m. preceding at 2:00 p.m. UTC on September 5, establishing a modest negotiation range of $ 0.013. However, the move quickly happened while the sellers emerged in increased volumes, which doubled the average from 24 hours to 77.6 million tokens.

The reversal came quickly in the last hour of negotiation. Between 13:26 and 14:25 UTC, Hbar returned to $ 0.22, breaking a key support level at 2:16 p.m. This decision launched a stop-loss cascade and an acceleration of institutional liquidations. In two minutes, the volume increased to 6 million tokens – the triple of the average time roll, which obtained the intensity of the retirement.

The rupture overshadowed an important regulatory step for Hedera. The stable token commission of Wyoming appointed the network The Exclusive candidate for his stable border token supported by the State (Frnt)Citing Hedera’s speed and reliability to issue a sustained digital currency of a dollar. The decision marked one of the strongest signs of institutional validation for the great public book.

Despite the breakthrough, the markets have largely raised the shoulders of the news. Hbar lost 12% in the last month, the request for detail was upset. Chain data show that social domination falling from 55% to 0.74%, while the intelligent monetary index – an indirect indicator of institutional flows – has increased to 1.108, indicating that sophisticated traders reduce exposure. With $ 0.19 emerging as the next main support zone, Hedera faces a mounting pressure to translate validation at the level of the supported confidence of investors.

Commercial data point to continuous weakness

- The support is $ 0.21 with a volume confirmation at the start of the session

- The resistance emerges at $ 0.22 while the sales pressure increases more than 77.6 million volumes

- Multiple support breaks at levels of $ 0.22 before temporary stabilization of $ 0.22

- Surge two minutes to 6 million institutional sales signals for 14: 17-14: 18 windows

- Social measures drop from 55% to 0.74% showing retail exodus

- The intelligent monetary index at 1.108 confirms the retirement of professional trader

- Key support of $ 0.19 threatened by the acceleration of sales pressure

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.