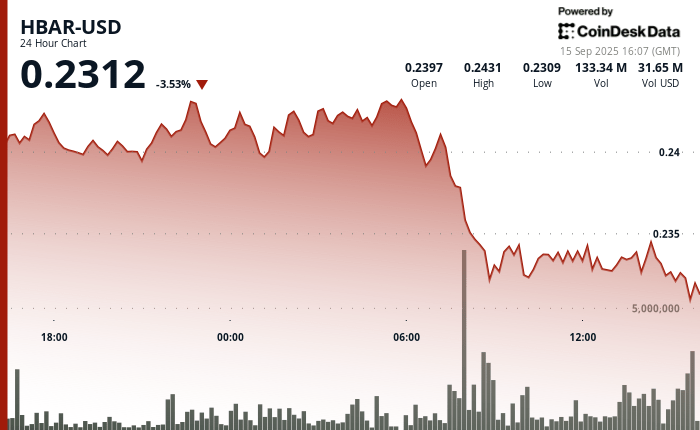

The Hedera Hashgraph Hbar token has suffered steep losses on a 24 -hour volatile window between September 14 and 15, from $ 5% to $ 0.23. The token negotiation range increased by $ 0.01 – a decision often linked to disproportionate institutional activity – because a heavy company selling outdated support levels. The clearest movement came between 07:00 and 08:00 UTC on September 15, when the concentrated liquidation lowered prices after days of resistance around $ 0.24.

Institutional negotiation volumes increased during the session, with more than 126 million tokens changing the hands on the morning of September 15 – almost three times the standard for business flows. Market players awarded the peak to the rebalancing of the portfolio by the main stakeholders, with agitation of the business adoption and a regulatory assembly examination providing the backdrop of the sale.

Recovery efforts have briefly emerged during the last hour of negotiation, when business buyers tested the level of $ 0.24 before retiring. Between 13:32 and 13:35 UTC, an accumulation thrust saw 2.47 million tokens deployed in order to establish a price price. However, the purchase of Momentum has finally weakened, Hbar is reflected in $ 0.23.

Turbulence highlights the vulnerability of the token to institutional distribution events. Analysts highlight the failure of failure over $ 0.24 as a confirmation of the cool resistance, $ 0.23 now serving as a critical support zone. The sharp increase in volume suggests that the main participants in companies reposition before regulatory changes, leaving HBAR’s short-term prospects according to the question of whether business buyers can set up defenses supported above key support.

Summary of technical indicators

- Business resistance levels crystallized at $ 0.24 where institutional sales pressure has constantly exceeded the purchasing interests of companies through several trading sessions.

- Institutional support structures emerged approximately $ 0.23 in business purchase programs systematically absorbed the retail pressure and smaller institutional participants.

- The unprecedented commercial volume reaches 126.38 million tokens during the 8:00 am morning session reflects distribution strategies on the scale of the company which submerged the demand of companies on the main trading platforms.

- The subsequent institutional impulse proved to be unsustainable, because the systematic sales pressure resumed between 13: 37-13: 44, which brings participants to companies to $ 0.23 in support areas with sustained volumes exceeding 1 million tokens, indicating a continuous institutional distribution.

- The final negotiation periods have shown a decreased business activity with a volume registered between 13: 13-14: 14, suggesting that institutional participants adopted defensive positioning strategies while Hbar was consolidated at $ 0.23 in the middle of the company’s uncertainty.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.