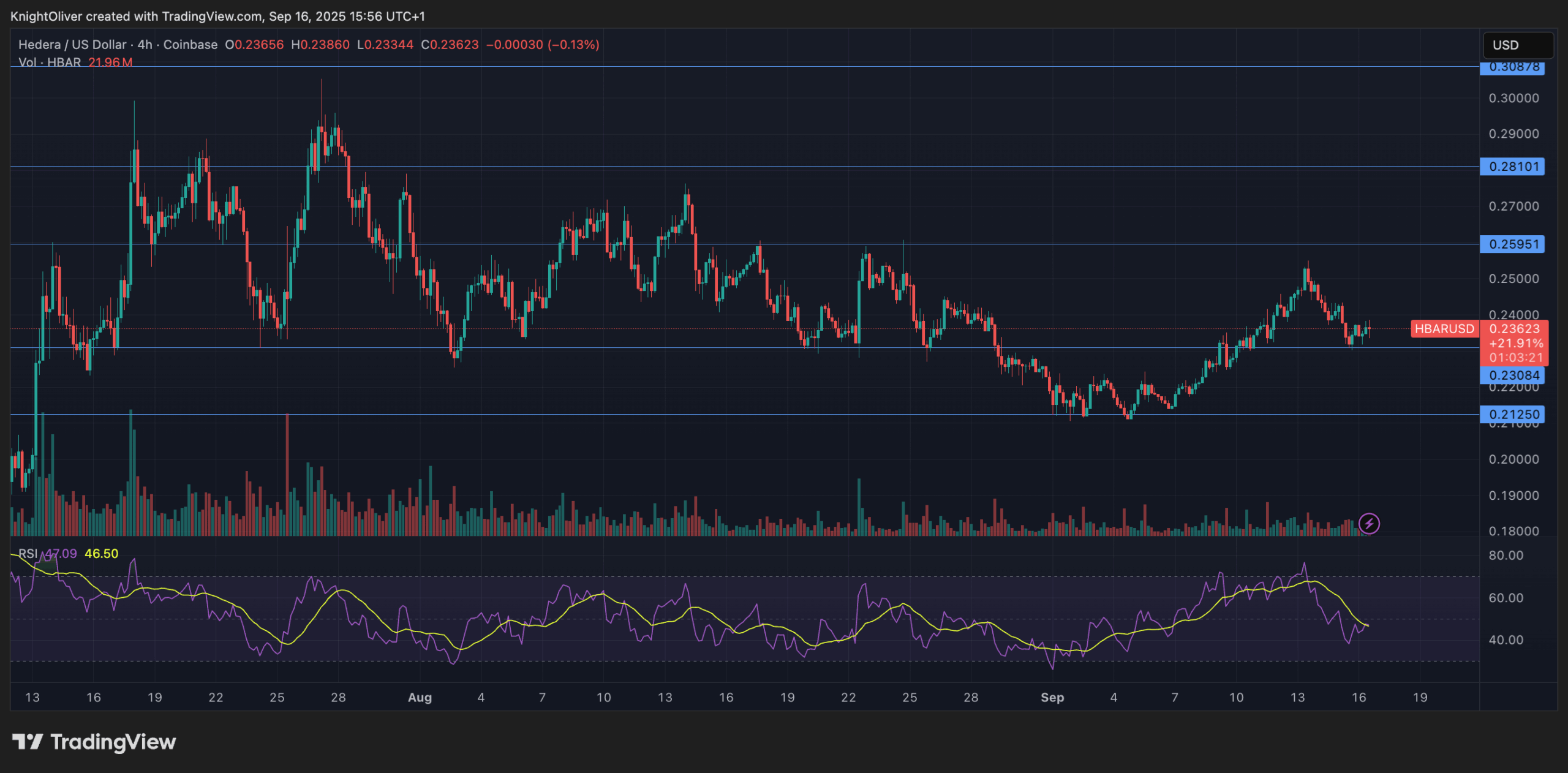

Hbar experienced strong sales pressure in the last hour of negotiation on September 16, erasing previous gains. The token went from $ 0.237 to $ 0.235 between 1:15 p.m. and 14:14 UTC, a decrease of 1.05%, after reaching an intraday summit of $ 0.2385. This decision marked a reversal of the 23 -hour section previous, when Hbar had regularly increased from $ 0.23 to $ 0.24.

The sale at the end of the session was accompanied by a peak of commercial activity, in particular between 13:45 and 13:51 UTC, when volumes exceeded 5.6 million – near the double of the reference base for the session. The model suggests an institutional distribution, while cryptocurrency broke out by successive support levels at $ 0.237, $ 0.236 and, ultimately, $ 0.235. The fact of not recovering above these levels of the left dynamic deteriorating at the end.

Despite the brutal reversal, the wider performance of Hbar reflected underlying resilience. The token increased by around 1% during this period, negotiating in a wide range of $ 0.231 to $ 0.239 and showing a strong purchase activity earlier on September 16. However, the inability to maintain higher levels in the face of the concentrated sales pressure highlights the fragility of the recent bullish feeling.

Technical indicators display mixed market signals

- Hbar sailed in a fork of $ 0.01 spanning a floor of $ 0.23 and a ceiling of $ 0.24, offering a total fluctuation of 3%.

- The key resistance materialized at the threshold of $ 0.24 where the price was reversed over a high volume of 72.03 million in 1:00 p.m.

- Support established about $ 0.23 to $ 0.23 with several successful defense attempts.

- The volume was considerably intensified throughout the decline, in particular for 13: 45-13: 51 during the sale of the accelerated momentum with volumes exceeding 5.6 million.

- The technical configuration indicates that Hbar maintains a bullish momentum with considerable institutional interest demonstrated by the volume greater than the average during key inversion points.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.