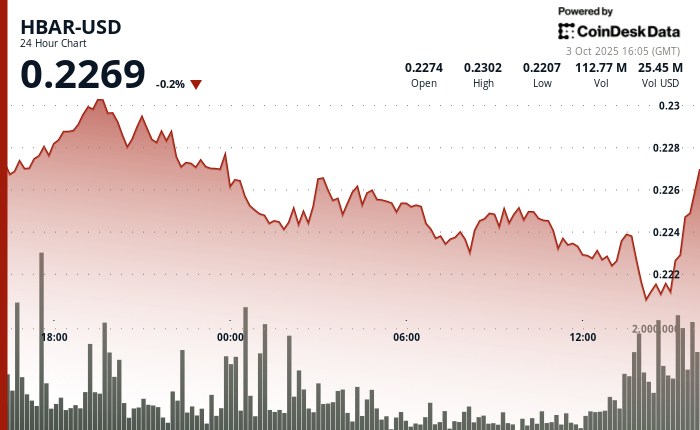

Hbar experienced strong sales pressure on October 3, with the intensification of the momentum in the last hour of negotiation. After briefly reached $ 0.224, the token fell to $ 0.222, raising key support and finishing the session down 0.9%.

The most steep decline took place between 1:50 p.m. and 2:00 p.m., when volumes increased above 3 million, signaling institutional distribution and panic sale. Repeated failures to recover $ 0.224 leave Hbar vulnerable to a new drop to $ 0.220.

During the larger period from 11 p.m. from October 2 to 3, Hbar fell 3.6% from $ 0.23 to $ 0.22 over a growing volume of 51.3 million, highlighting a strong institutional participation in sale.

Despite short -term weakness, attention remains on a potential dry decision in November on FNB Crypto. With the support of the members of the board of directors such as Google and IBM, Hedera could benefit from regulatory approval even if its techniques indicate continuous pressure.

Technical measures indicate continuous weakness

- Hbar formed a separate decrease trajectory after its peak at $ 0.23 on October 2 7:00 p.m., the resistance developing at the threshold of $ 0.23 where prices have reversed several times for several negotiation sessions.

- The essential support developed at $ 0.23 around midnight on October 3, followed by an additional support area close to $ 0.22, although the two thresholds have demonstrated a vulnerability under a continuous time of sale.

- The characteristics of the volume of negotiation revealed a high activity throughout the initial decline and subsequently during the 1:00 p.m. session on October 3 with 51.3 million volumes, indicating institutional engagement in the lower movement.

- Technical deterioration intensified during the last hour, because Hbar has struggled to maintain recovery efforts over $ 0.22 of resistance threshold, validating the violation of essential support thresholds.

- Substantial volume overvoltages exceeding 3 million and 2.5 million during the window 13: 50-14: 00 coincided with an intense sales activity, demonstrating an institutional distribution and a sale focused on fear.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.