The blockchain and crypto have a complicated status in China: Beijing says no to the crypto but yes to the blockchain. It prohibits trade while constructs infrastructure.

Now, with Hong Kong offering regulated cryptographic markets, the initiates say that an escape emerges.

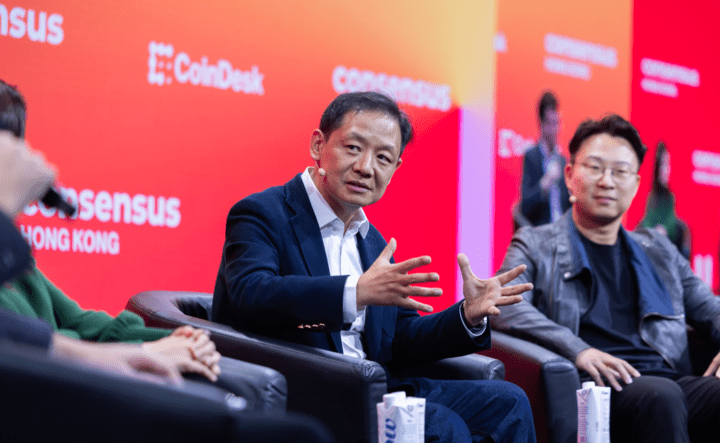

If China already authorizes investors to buy American actions via its qualified program of national institutional investors (QDII), why not Bitcoin? The key, has argued an expert on stage with Hong Kong consensus, is control, and Beijing may have just found a way to keep it.

In China, there are two systems for mainstream investors to buy and sell stocks outside China. First of all, there is QDII, which allows selected investors to buy us FNB using RMB.

Then there is also the Shanghai-Hong Kong Connect and Shenzhen-Hong Kong Connect, which allow Chinese investors to buy and sell Hong Kong shares through continental securities companies, all the professions have settled in RMB.

“The key [with these systems] Does the capital never flow freely from China, and if you apply this same logic to the crypto, there is no reason why he cannot work in the same way, “said Yifan, CEO of Red Date Technology, on stage at the Hong Kong consensus.

He stressed that the largest regulatory obstacle is not the crypto itself, but capital controls, ensuring that funds do not progress freely in and outside China.

These capital controls are in place because they prevent excessive currency fluctuations and capital flight, in order to maintain the stability and the value of the RMB. They are also one of the reasons why Hong Kong FNB Crypto, with their acquisitions in kind, were not authorized on the continent.

“What is the difference between a regulated stock in Hong Kong and a regulated cryptographic asset in Hong Kong?” He continued. “If they have a system to buy and sell in RMB, but do not move money outside China, then it is only another regulated investment product.”

This system would not allow Chinese self-assurance investors their crypto. Instead, purchases would be held by an intermediary, such as an approved securities company.

“They buy the crypto directly, but it is not as if they held it themselves,” he said. “The safety company in the middle actually holds it for you.”

This model is aligned with the Chinese approach to investment in equity and ETF.

Just as the continent’s investors can exchange American FNB via QDII but never take on duty directly, they could expose themselves to the crypto without having the underlying assets – no money through borders.

For a nation with 200 million retail investors and an economy that needs stimulus, access to regulated cryptography via Hong Kong sand could offer Beijing a calculated compromise

Blockchain vs crypto

China has long been a supporter of blockchain technology, while adopting a cold approach to crypto.

“We do not authorize weapons in China, but we can always do steel,” he explained as an analogy. “The technology is not regulated so that you can create all kinds of applications. But when an application triggers regulations, it’s different.”

But on the basis of his conversations with financial regulators, this could change.

“I see a signal from financial regulators,” he said. “They are starting to talk about Bitcoin, saying that we have to pay more attention and do more research on digital assets.”

Could this lead to a wider adoption? Two years ago, he would have said “zero luck”.

“Now I would say that there are more than 50% chance in three years,” he concluded.

And you can bring these chances to Polymarket.