HONG KONG — Hong Kong is ready to start issuing the first of its stable licenses next month, the financial secretary of the special administration region said Wednesday.

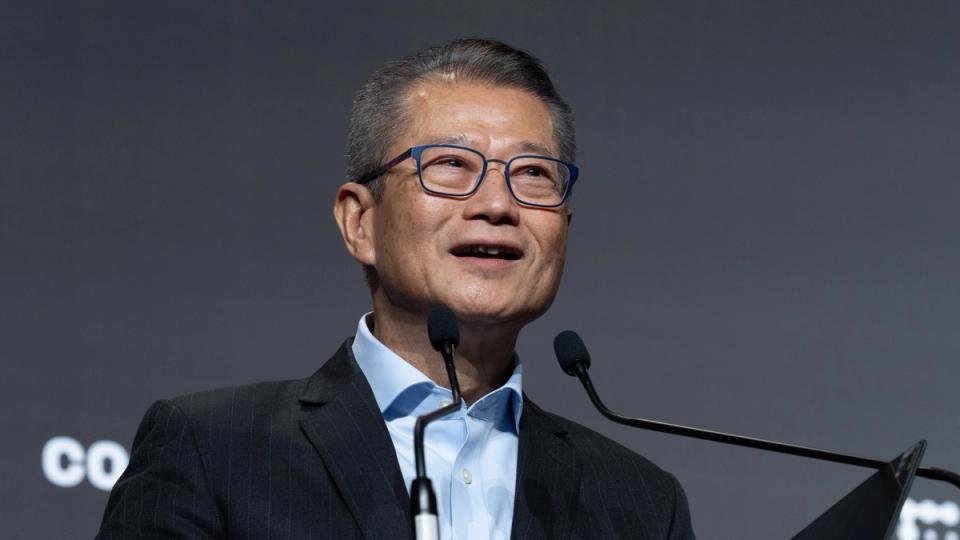

Hong Kong will initially issue only a small batch of licenses, Hong Kong’s Paul Chan Mo-Po said Wednesday at CoinDesk’s Consensus Hong Kong conference.

“By granting our licenses, we ensure that licensees have new use cases, a credible and sustainable business model and strong regulatory compliance capabilities,” he said.

Hong Kong is also preparing to finalize its licensing regime for childcare providers, he said, and plans to introduce legislation this summer.

“In addition to the framework already in place, this will ensure that our regulatory regime fully covers the digital asset ecosystem,” he said.

More generally, Chan highlighted three trends that are particularly maturing at the moment: the growth of tokenized products in the real world, the growing interaction between decentralized finance (DeFi) and traditional finance, and the growing connections between artificial intelligence (AI) and digital assets.

“Tokenization initiatives are moving from proof of concept to real-world deployment supported by more institutional adoption. Government bonds, money market funds, and other more traditional financial instruments are increasingly being issued on-chain, using digital ledgers to improve settlement efficiency, enable fractional ownership, and unlock liquidity in traditionally less liquid assets.”

He also highlighted the increasing growth of AI.

“As AI agents become capable of making and executing decisions independently, we may begin to see the first forms of what some call the machine economy, in which AI agents can hold and transfer digital assets, pay for services, and transact with each other on-chain,” Chan said.