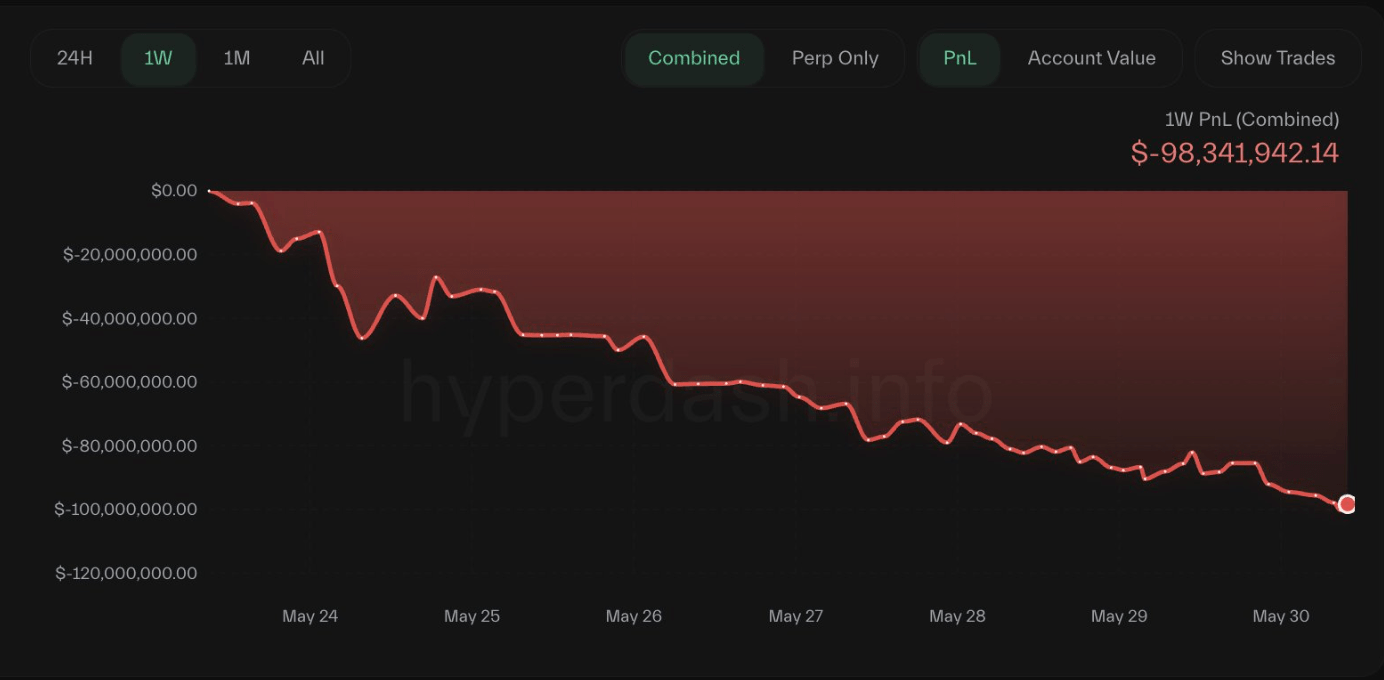

The James Wynn derivative merchant came out of the wood a few weeks ago, displaying 9 -digit Bitcoin positions on the hyperliquidal while he was on an apparently disabled race that resulted in around $ 100 million in profits.

But this race, as is often the case with trading derived from cryptography, ended shocking – Wynn liquidated all its account despite the fact that the BTC was only moving a few percent.

“I decided to take a break to Perp Trading,” Wynn wrote on X after the last explosion. “It was a funny driving. About $ 4 million in $ 100 million, then falling back to a total loss of $ 17.5 million.”

The story of Wynn is nothing new. In 2021, for example, the industry saw the rise of Alex Wice’s public – a poker player became a derivative merchant – who also lost $ 100 million after having made huge bets with the lever effect. And even in 2017, at the time of Bitmex Trollbox, pseudonym figures like Steves and Theboot boast of their 10 million profits and losses before vanishing to always in darkness.

The problem with Crypto derivatives

Cryptocurrency derivatives can be an incredibly useful tool; If a merchant contains 500 BTC ($ 52 million) and estimates that the market will drop, it can cover its position by passing short – reducing exposure without having to sell its punctual assets, which could in itself shift or frontal race.

A range of Delta’s neutral strategies can also be used as the classic basic trade which has become popular among institutional traders on the Bitcoin CME -term market, which simultaneously involve long and short to collect the funding rate as a yield.

But problems are starting to train when cryptographic traders, the majority of which are inexperienced retail traders, use platforms that offer up to 100x lever.

Imagine that a newcomer had $ 5,000 in commercial capital, of course, he could make some intraday transactions and earn $ 50 or 100 per exchange, but if they used 100x, they could make $ 50,000 per 10%move. It is the slippery slope of emotional trading induced by the game in which many fall.

Newtrading data show that only 3% of day traders make a profit and 1% do so consistently. And the game becomes even more difficult when, in this case, traders open positions of a hundreds of millions of dollars.

James Wynn exists the casino

The fall of James Wynn came in part because of his inability to deal with the emotional oscillations of trading, but also the size of his positions.

Wynn often published on being partially liquidated and reopening the position at a highest point. This indicates a merchant out of its depth by a sur-levier. As Wynn used in some cases a 40x lever effect, its liquidation point has left no margin of error, this meant that traders or clever commercial companies could drive out its point of liquidation and force it in an impulsive trade.

The hyperliquid is a relatively liquid place of derivatives, it has millions in depth of market at less than 1% of the price of an asset, but it does not have hundreds of millions, which was necessary to absorb the leverage of Wynn.

In reality, Wynn’s commercial thesis was based around the Bitcoin Las Vegas event and any potential announcement that could raise Bitcoin over a new record. If this materializes, Wynn would have had hundreds of millions of unpaid profits, but unfortunately in his case, Bitcoin began to collapse at the conference while the speeches of Michael Saylor and Ross Ulbricht failed to arouse an upward momentum.

The absence of volatility and the insatiable appetite of Wynn to continue the bets led him to get the market. His losses have become so remarkable that a merchant has decided to counter the trade while going through at the same time as Wynn went for a long time, this merchant has won $ 17 million, according to Lookonchain.

While the sun was finally placed on the route of Wynn derivatives, he announced that he “returned to the trenches” to exchange pieces even, of course.