The confidential protocols put in place to face the news of regulatory failures by one of the first five exchanges of cryptography, OKX, suggest that the company is probably expecting a settlement with the American authorities for some time.

This happened on Monday when OKX announced a regulation of more than $ 500 million with the United States Ministry of Justice after failing to obtain a silver issuer license and would have facilitated $ 5 billion in “suspicious transactions and criminal products “.

OKX’s meticulous planning makes a fascinating reading. The management document of the secret crisis observed by Coindesk refers to a “swat team” of messaging which can be mobilized to implement various ways in which the company’s senior executives can communicate a regulation via social media and when They speak to journalists.

Long before the big fine and the confiscation on Monday, OKX had produced specific advice with regard to the installation with the DOJ, as well as the control of the Office of Foreign Assets of the American Treasury Department (OFAC or Watchdog of Sanctions), For example.

A privileged approach is to emphasize that the whole cryptography industry has been largely examined and that Whit cooperates fully with regulators, according to the document. This was resumed in the press release on Monday which said that OKX “appreciates” the “collaboration” of the DoJ.

Since the administration of President Donald Trump resumed last month, the main objective of regulatory organizations in the crypto has been to overthrow their previously aggressive application position, the SEC deleting current disputes and the closing of investigations. But this is not the case in the case of OKX, which, like Kucoin with his recent penalty of $ 300 million and his binance in 2023, was forced to costly colonies.

The directives refer to what is expected of the star of the founder of the OKX, President Hong Fang and other leaders with regard “their actions on social networks in two scenarios: 1) Disclosure before the colony of OFAC, 2) on the OFAC Settlement ”.

In addition, on the question of the OFAC, if the managers are invited to know if OKX served sanctioned markets, a suggestion is to say: “Customers of the sanctioned markets have slipped when we had controls and compliance systems immature […] This is a very small and insignificant part of the OKcoin or OKX customers. »»

Indeed, the press release on Monday from OKX acknowledged that American customers could discuss the world exchange.

“The total number of American customers involved – who are no longer on the platform – represented a small percentage of the company’s global customer population,” the statement said.

Awareness of the brand

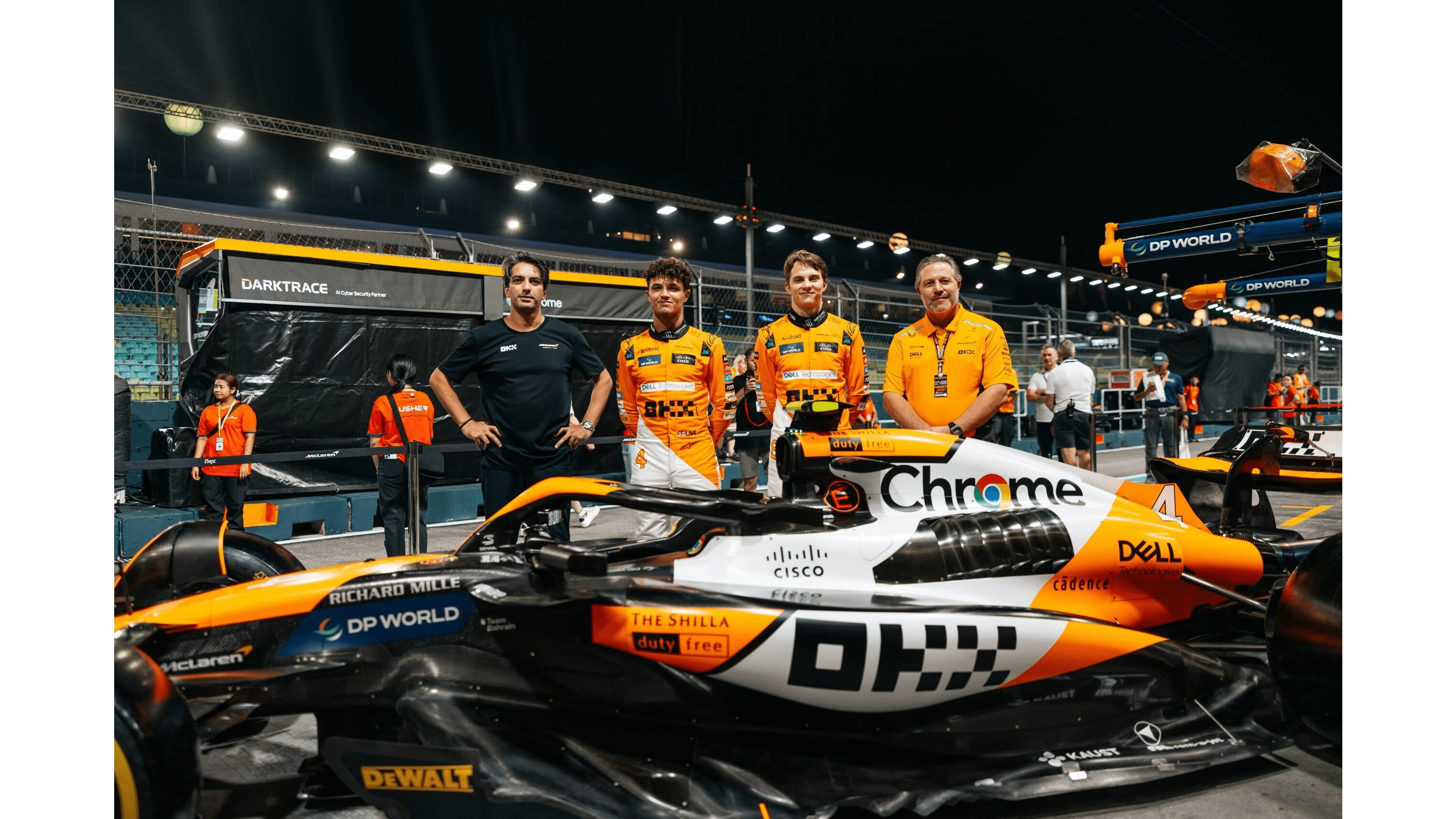

Another priority for OKX is the way the company choreographed its sponsorship arrangements for big tickets with the Manchester City Football Club, the F1 McLaren team and the Tribeca Film Festival. The company estimates that around 100 million dollars per year have been spent on these partnerships in the past three years.

The Action Plan for the brand’s partners implies the OKX marketing chief giving each partner a telephone call “at the last hour before the break.”

The recommended strategy here is to say that OKX has prepared for a regulatory examination, given the increased examination of cryptographic companies. If we ask why the exchange did not share information on this subject, the document stipulates that these are waiting requests and non -public questions. There is also a chip suggesting that the manager of “OKX and OKX examination clauses in our brand partner contracts again”.

Don’t mention Okb

Another detail that draws attention to the Okx Planning document is the native cryptocurrency of the exchange, OKB. An obvious concern following FTX is any suggestion that OKB was used as a guarantee or to finance OKX operations, as was the case with the FTX FTT token.

Of course, the OKB exchange token did nothing like the iniquities of the FTX exchange token. However, he was involved in a sudden flash accident in January 2024, after which OKX quickly proposed to compensate for the users who had lost. The token, which has a trading volume and relatively thin liquidity, has seen 10 dormant wallets become active and start to exchange just before the accident, according to Marina Khaustova, COO Crystal Intelligence, an analysis company from Blockchain.

Shortly after the OKB crash, the leaders of OKX Tim Byun, the former CEO of Okcoin and the head of the world’s government relations, and the Chief of the Wei Lan product were released by OKX. A source familiar with the situation said byun had been “sacrificed” after the OKB crash.

Unsurprisingly, the Okx Comms protocol stresses that managers must “refrain from mentioning OKB and reference this only if you are requested”.

Media management

Another part of the puzzle is how exchange should manage media requests. If OKX receives emails or a phone call from a journalist looking for comments on current surveys, the Swat team and the public relations team should enter the action to “buy time by offering leadership schedules »

Meanwhile, the plan is “to contact key user -friendly publications for a parallel story to sow in a story complementary to the history of origin”, indicates the document.

“1. Push for the delay 2. Confirm the friendly publications 3. Make an asynchronous queue in internal / external communications, so we struck Send as the story comes out, “he said.

Okx did not provide a comment in press meters