The Bitcoin extraction company, Hut 8, took $ 331 million in net profit in 2024, according to the company’s latest financial report. The company has considerably benefited from the increase in the Bitcoin price during the year.

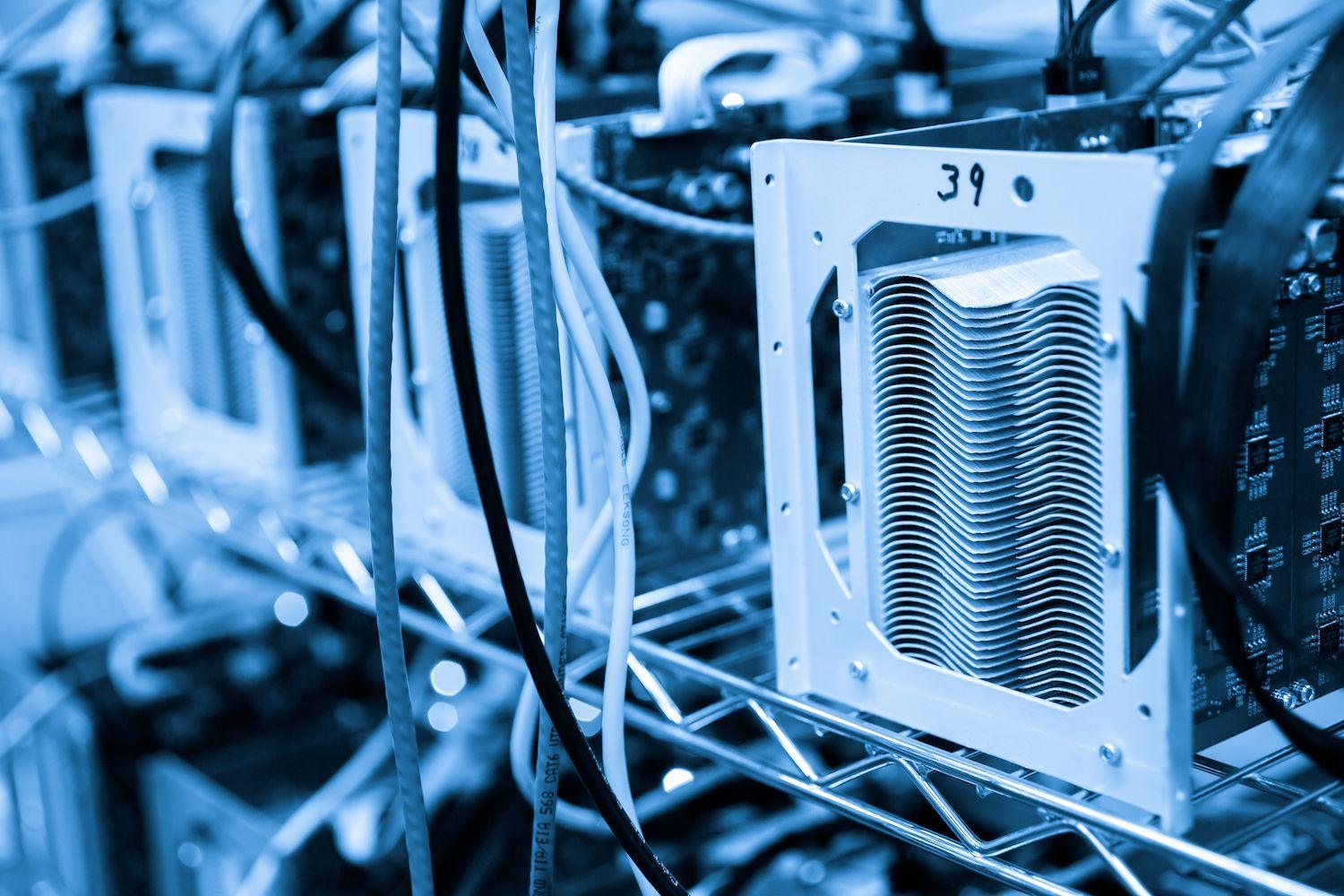

Hut 8 ended the year with a reserve of 10,171 bitcoin (BTC), worth around $ 905 million at the time of writing this document. The vast majority of this reserve have been committed as a guarantee to buy more ASIC mining machines.

The minor experienced a sharp reduction in energy costs, with fourth quarter costs per megawatt-hour dropping from 30% of the previous year to $ 31.63. While Hut 8 managed approximately 1,020 MW at the end of December, it has more than 12,300 MW in the pipeline.

The company deepened its relationship with Bitmain, one of the largest Bitcoin extraction companies in the world. HUT 8 obtained a Bitmain sharedhouse agreement which is expected to generate $ 125 million in annual income, it is also associated with the company to develop a new generation ASIC minor.

Hut 8 increases its investments in IA infrastructure. Its subsidiary, Highrise IA, has signed a five-year customer agreement for GPU-as-a-service. The company has also closed a strategic investment of $ 150 million in coastal to support the development of AI.

The company’s shares are down 7.25% compared to the day, promoting 1.5 billion dollars.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to ensure accuracy and membership of our standards. For more information, see the complete Coindesk AI policy.