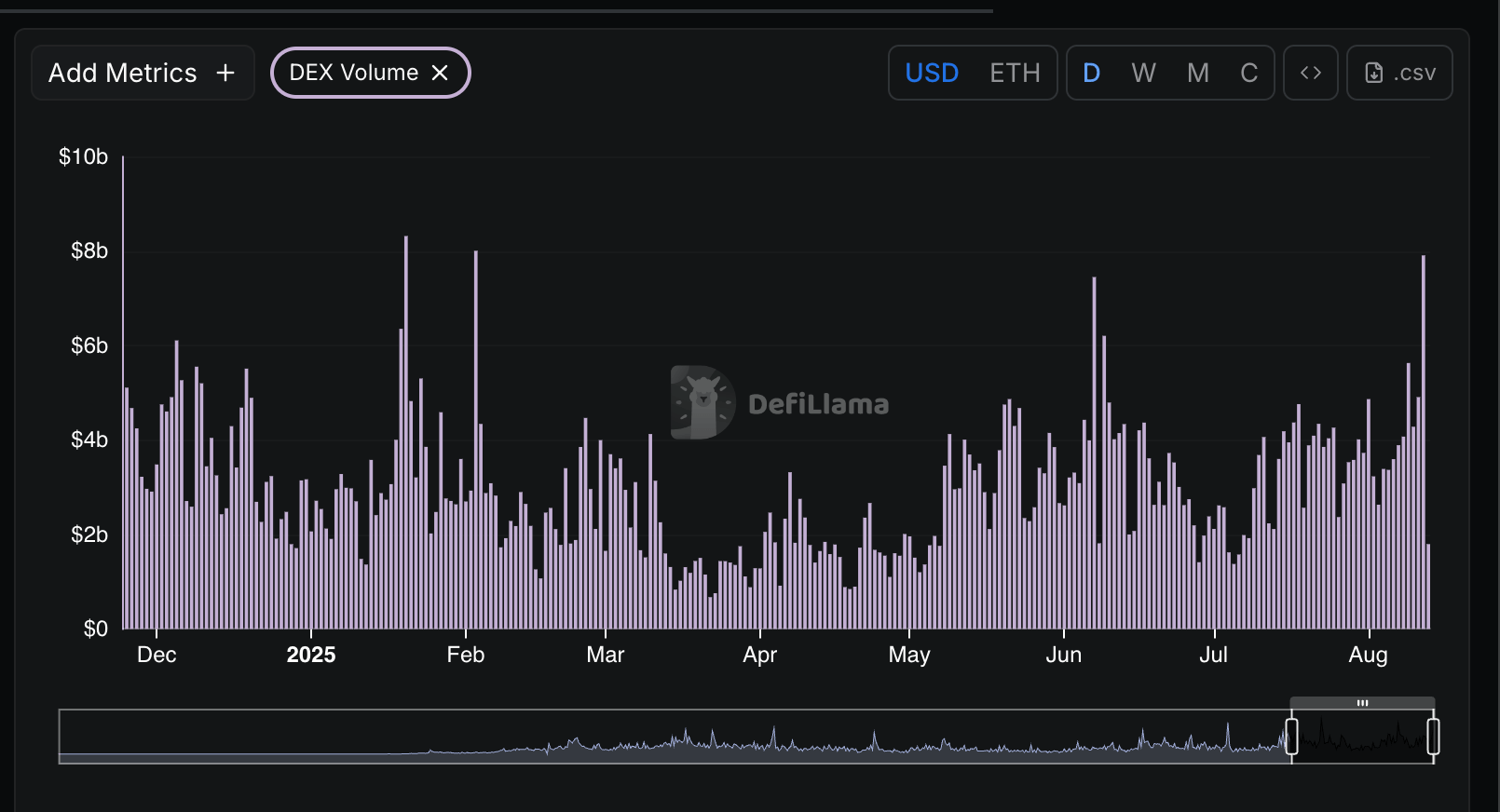

Decentralized exchange (Dex) The volumes on Ethereum have jumped Solana for the first time since April after a rapid change in feeling of the same in Solana and towards Ether Ethn In the midst of a wave of institutional activities.

In the last 48 hours, Dex based on Ethereum have facilitated the negotiation volume of $ 24.5 billion compared to the total of $ 10 billion in Solana, according to Defillama.

The two weeks earlier were also dominated by Ethereum, with a total of $ 28 billion and 27 billion dollars, beating the total of $ 20 billion in Solana and 24 billion dollars.

This represents a contrast in the behavior of merchants earlier this year, which was dominated by Solana and the BNB chain in a spell of speculative trading in the same.

However, institutional flows in the ETHERs of the Spot ether supported the second largest cryptocurrency, which brought it to $ 4,680 this month after a gain of 53% in the last 30 days.

Coinglass data show that Monday’s net entries at ETF exceeded $ 1 billion for the first time, it was followed by a more relentless purchase on Tuesday with another $ 523 million entry.

Solana, on the other hand, seems to have lost her magic in the second quarter of this year. In January, for example, DEX volumes exceeded $ 98 billion in a week and 84 billion dollars. This hype calmed down after US President Donald Trump released Trump Memecoin, who finally lost more than 88% of his value over the following seven months, a moment that erases the confidence of investors in the same.

UNISWAP remains the most commonly used DEX on Ethereum with 8.6 billion dollars exchanged in the last 24 hours, the next best being the fluid, which has exceeded $ 1 billion in the same period.

The behavior change may well increase for stimulation tokens based on Ethereum, which experienced a boost after the drying of the dry last week. Tokens like LDO, the governance token of Liquid Staking Protocol Lido is up 65% in last week.