- Intel and SoftBank collaborate to develop next-generation Z-angle stacked memory

- Prototypes are expected in 2028, with commercial deployment planned for 2029

- Power consumption expected to drop by 40-50% compared to HBM

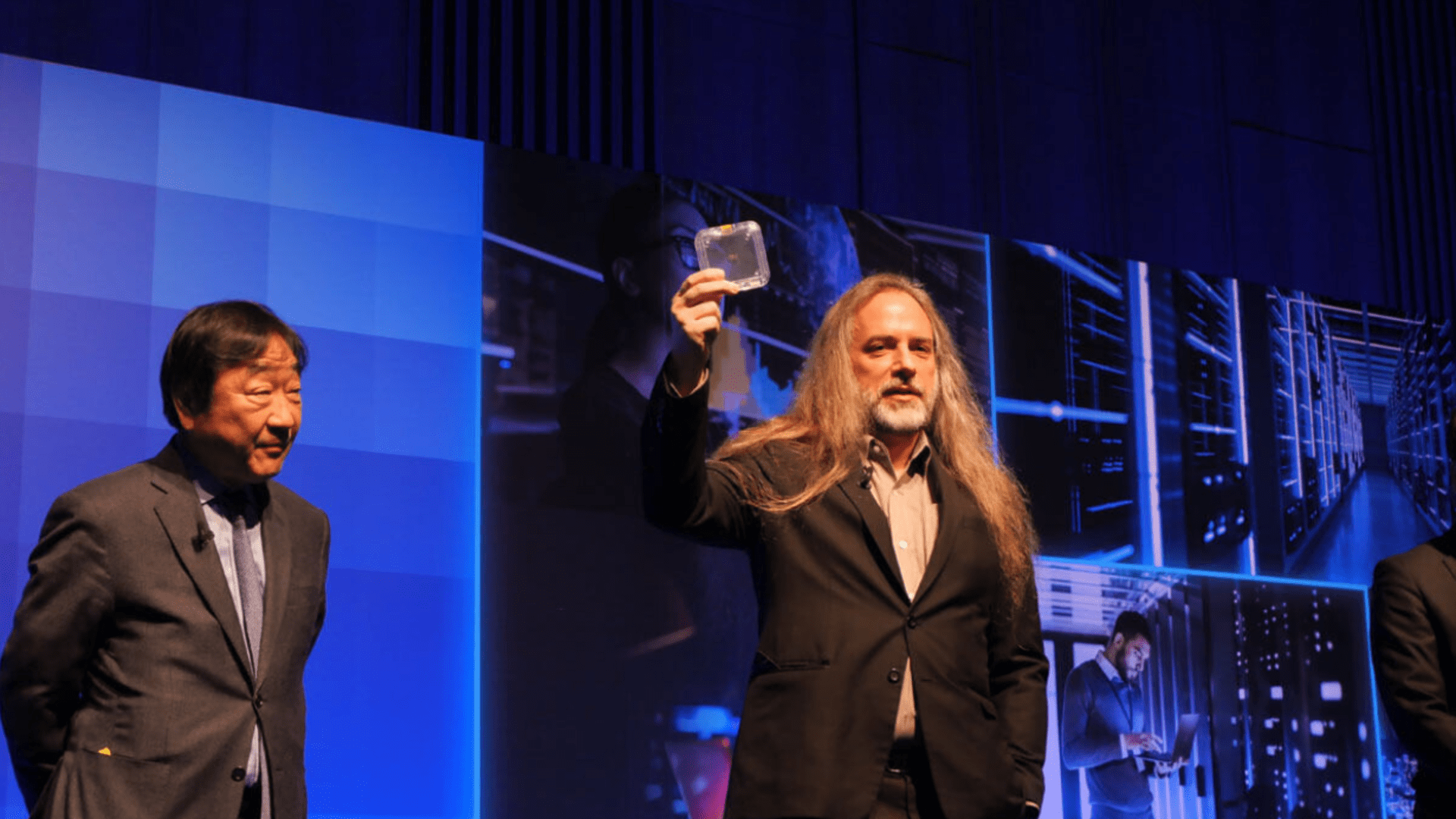

Intel and SoftBank-backed Saimemory have confirmed a partnership to develop Z-Angle memory, a stacked DRAM architecture aimed at AI and high-performance computing workloads.

Reports of Nikkei Asia And Wallstreet.cn describe the technology as a vertical memory design that aims to surpass current high-bandwidth memory in terms of capacity and efficiency.

Reports claim that the architecture builds on Intel’s previous research into next-generation DRAM bonding, which demonstrated working multi-layer DRAM stacks as part of a US-backed research program.

Complaints regarding capacity, power and cost

Prototypes would be expected in early 2028, with commercial availability planned for 2029.

Saimemory aims for 2-3 times the capacity of current HBM products while reducing energy consumption by approximately 40-50%.

It says one of the fundamental requirements for this technology is cost competitiveness, although no pricing details have been disclosed.

SoftBank reportedly invested around 3 billion yen (around $19 million) during the prototype phase, with Intel providing technology rather than capital.

Memory targets large-scale AI data center deployments, where bandwidth density and power consumption increasingly affect operating costs.

For Intel, this collaboration marks a renewed involvement in advanced memory development after leaving the DRAM business decades ago.

The effort is also part of broader attempts to regain relevance in critical semiconductor segments while expanding foundry operations.

For SoftBank, the project supports ambitions to strengthen domestic semiconductor capabilities and reduce dependence on South Korean suppliers.

Japan once dominated global DRAM production, but it left the market as its competitors consolidated their power, leaving a long gap that Saimemory now aims to fill.

The 2029 marketing target places Z-Angle Memory several product cycles behind Samsung and SK Hynix, which already dominate HBM’s offering.

By the time Saimemory reaches volume production, incumbent suppliers should have progressed further into new generations of HBM.

SoftBank executives’ push for prioritized sourcing shows that the project is still in its early stages and that technical ambition alone cannot overcome scale, yield and ecosystem challenges.

As interesting as it may sound, it’s hard to forget the story of Intel Optane and 3D XPoint, which ended in obvious financial losses rather than lasting adoption.

In July 2022, Intel shuttered its Optane memory business and recorded a $559 million inventory write-off, officially acknowledging the technology’s failure.

Micron, which inherited part of the legacy DRAM ecosystem through Elpida after its 2012 bankruptcy, has also been affected by the broader collapse of alternative memory strategies.

Z-Angle memory is technically distinct, but it enters a market where previous allegations of architectural disruption have resulted in the loss of hundreds of millions of dollars.

Follow TechRadar on Google News And add us as your favorite source to get our news, reviews and expert opinions in your feeds. Make sure to click the Follow button!

And of course you can too follow TechRadar on TikTok for news, reviews, unboxings in video form and receive regular updates from us on WhatsApp Also.