Peshawar:

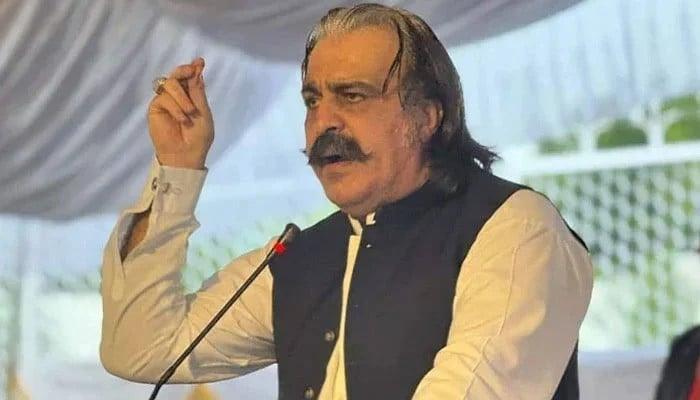

Khyber-Pakhtunkhwa, Ali Amin Gandapur Khyber-Pakhtunkhwa, announced that the provincial government would not impose new taxes this exercise.

Speaking on the province’s financial discipline on Tuesday, Gandapur said KP has not taken new loans so far.

However, a billion significant rupees was allocated to loan reimbursements, stressing the government’s commitment to manage existing debt in a responsible manner.

Stressing the development plans, the CM said that the province launched mega projects, with work already underway on the Peshawar-Dera Ismail Khan motorway, a key infrastructure initiative aimed at improving regional connectivity.

In order to empower young people, Gandapur revealed that the government planned to further extend the regimes of interest -free loans, allowing young people to become financially autonomous.

He also declared an “education emergency” throughout the province, stressing that improving educational standards is an absolute priority for his administration.

The upcoming budget will reflect the emphasis on the provincial government on budgetary responsibility, public well-being and long-term development, he added.

Meanwhile, the Khyber-Pakhtunkhwa government has launched a long-term interest-free microfinance program for entrepreneurs to support small businesses and improve livelihoods in merged districts.

The initiative, which extends over 13 years (2021-2034), has already made substantial progress, 66,557 people benefiting so far from the program, while 22,150s others are currently receiving financial support as part of the program.

The program offers unanswered loans ranging from RS25,000 to RS75,000, with a flexible reimbursement period of up to 36 months.

This structure has been designed to ensure that beneficiaries can reimburse the loan in easy payments without the load of interest, which makes it particularly accessible to low -income and poorly served populations.

The project is implemented by the Khyber-Pakhtunkhwa Small Industries Development Board (SIDB), with a total allowance of 2.007 billion rupees.

Operational execution is carried out in partnership with the Akhuwat Pakistan Foundation, one of the country’s most reliable microfinance institutions.

Currently, 36 Akhuwat branches operate in various merged districts, allowing local residents to ask for loans near them. The program is aimed at a wide range of economic sectors.

The beneficiaries used funds to start new businesses, expand existing companies, buy necessary equipment and machines and invest in the development of agriculture and livestock.

This multisectoral approach guarantees that people from all walks of life, in particular those of rural and economically marginalized horizons, can benefit from financial inclusion.

SIDB monitoring and evaluation officer, Sikandar Shah, recently led an official visit to the Akhuwat branches located in the Bajaur district, Di Khan and Lakki Marwat.

App (with input of our correspondent)