Merchants use the lever effect to try to lift bitcoin Back to the recorded summits, creating a high -risk environment that could lead to a derivative derivatives if the price begins to change in the other direction.

The SKEW market analyst warned a trader with the intention of opening a long-figure position to “maybe waiting for Sport to carry the purchase so that he does not create toxic flows”.

The Bears also add a lever effect, a separate merchant currently dealing with an unrealized loss of $ 7.5 million after having short-circuited BTC up to $ 234 million with $ 111,386 entry. This merchant added for $ 10 million in stablescoins to maintain their position, the liquidation is currently located at $ 121,510.

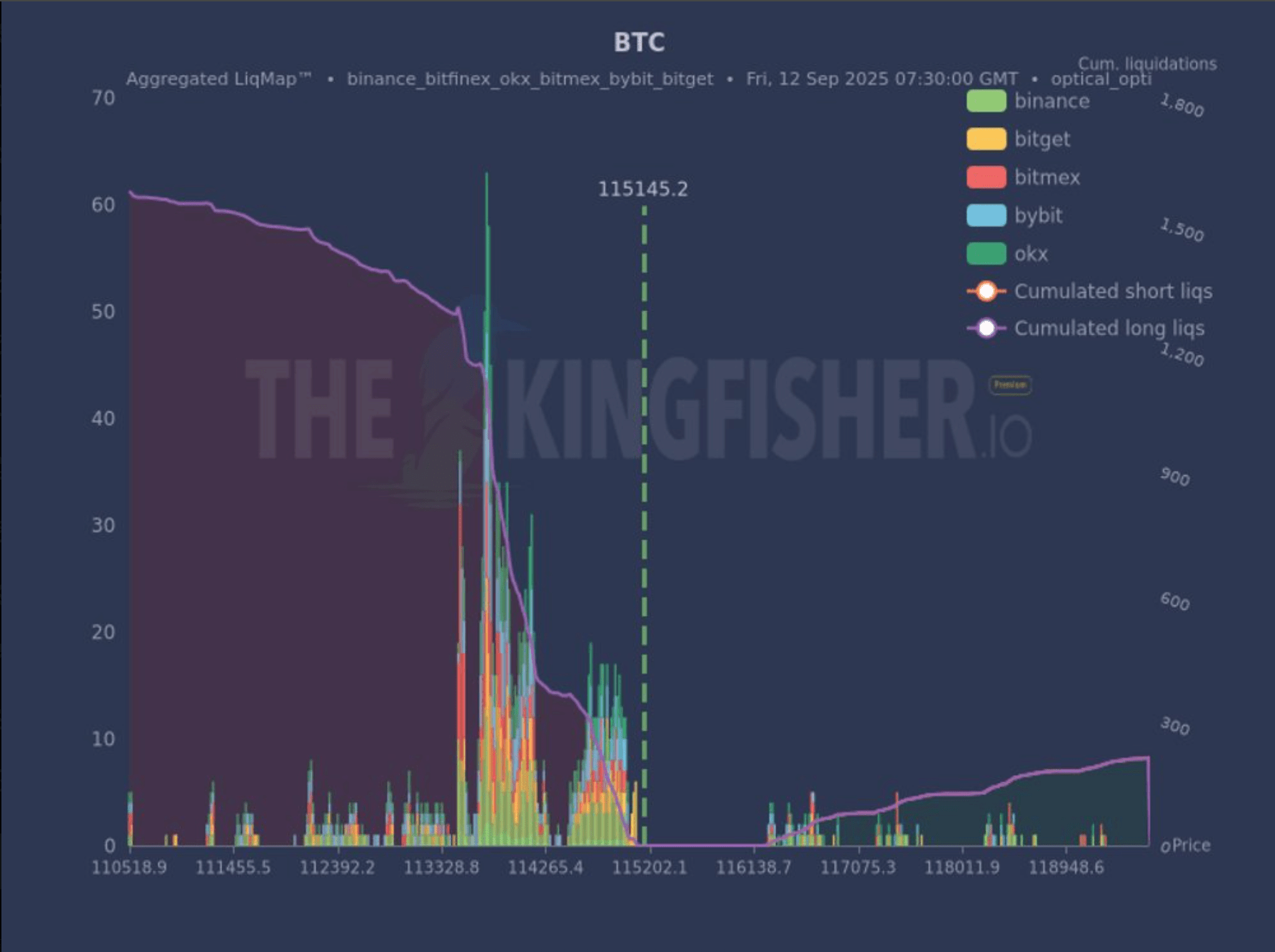

But the risk of major liquidation is present down, Kingfisher data showing a large pocket of derivatives will be liquidated between $ 113,300 and $ 114,500, which could potentially encourage a liquidation cascade in terms of support of $ 110,000.

“This graph shows where merchants are over-deposed,” wrote the Martin-Pêcheur. “It is a pain card. The price tends to be sucked in these areas to eliminate the positions. Use these data so as not to find yourself on the wrong side of a large movement.”

Bitcoin is currently negotiating quietly, about $ 115,000 after grasping a period of low volatility, not leaving its current range for more than two months.