Link’s price (link), a native token of the supplier of Oracle Chainlink, climbed 4% on Monday by extending his rebound in crypto-carnage last week.

The token reached $ 17 during the session, up almost 10% compared to the low weekend levels, according to Coindesk data.

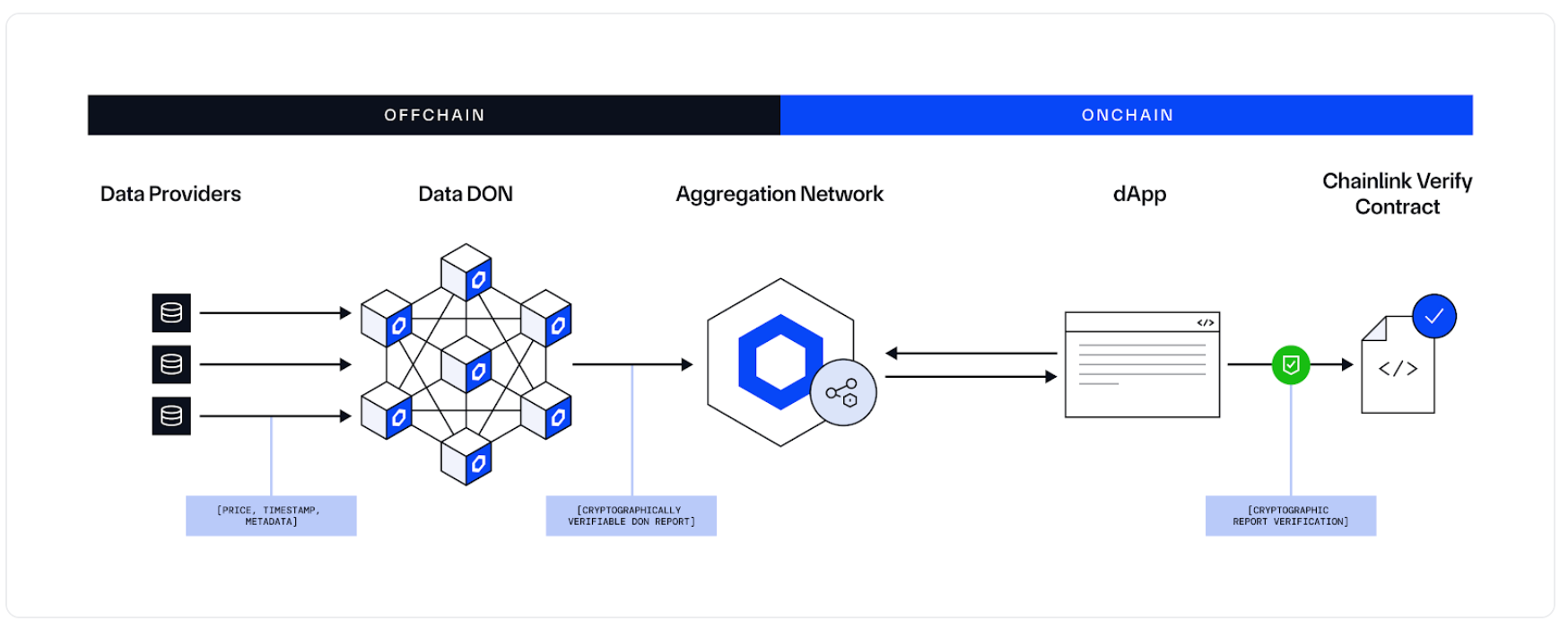

This decision occurred when ChainLink has deployed market data for the American stocks and FNBs, aimed at connecting the traditional financial instrument with chain capital markets. Chainlink data flows now provide “real -speed price in real -time” for assets such as SPY, QQQ, NVDA, AAPPL, MSFT and other instruments on 37 Blockchain networks, according to a blog article. The function allows use cases such as tokenized stock market negotiations, perpetual term contracts and synthetic ETFs on blockchain rails.

The DEFI protocol of the Solana protocol and the decentralized perpetual trading place GMX have already started to use the service, according to the post.

“This is a leap forward for the tokenized markets – filling a critical gap between traditional finances and blockchain infrastructure,” said Johann Eid, director of business at Chainlink Labs, in the post.

Technical analysis shows an important momentum

Link has shown remarkable upward performance throughout the negotiation session 24 hours a day, from $ 16.16 to $ 16.87 and offering a substantial gain of 4.39%, according to the Technical Analysis model of Coindesk Research.

The persistent ascending momentum, distinguished by gradually higher stockings and a volume constantly greater than the average during the rally phases, indicates a sustainable bull’s market feeling with a strong additional gains potential targeting the $ 17.00 psychological threshold, the model said.

Technical indicators

- Normal support established at $ 16.11 representing the drop in the initial session during the period 24 hours a day.

- A high volume support confirmed at $ 16.29 during the Midnight UTC overvoltage with significant commercial activity.

- Key resistance formed at $ 16.87 with high volume confirmation and several test attempts.

- The volume increases to 1,533,754 units during August 4 1:00 p.m., almost triple the average volume.

- Confirmed escape model from $ 16.65 to $ 16.83, establishing critical resistance transformed the level of support.

- Higher bottom model maintained throughout the rally indicating sustained bullish momentum.

- Confirmation of volume greater than 30,000 units during the key rally phases taking charge of increasing prices.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.