Litecoin

Rallied more than 2% on Monday, winning the field while investors occupy possible approval from the Stock Exchange Fund (ETF) and sail in a trembling geopolitical backdrop.

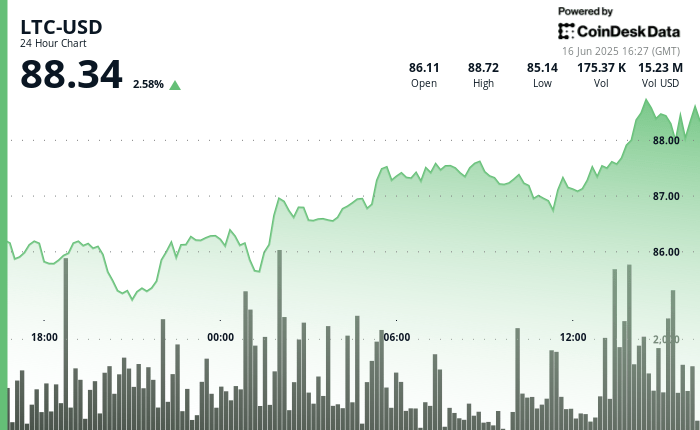

LTC increased from $ 85.05 to $ 88 in a period of 24 hours, an increased trend marked by higher hollows and a heavy volume. The rise coincides with the growing expectations that the American Commission for Securities and Exchange (SEC) could in light an FNB Spot giving investors an exposure to the LTC.

According to Bloomberg ETF analysts, Eric Balchunas and James Seyffart, the chances of such approval are 90%, while traders on Polymarket weigh 76%.

Meanwhile, whales, portfolios holding significant sums, increased their LTC assets from 25.8 million to 27.8 million tokens since mid-April, according to the Santiment Blockchain Data Company.

Preview of technical analysis

The action of Litecoin prices in the last 24 hours shows a potential optimistic inversion, according to the Technical Analysis Data model of Coindesk Research.

Its ascent was marked by a lower and higher high -top scheme, often associated with growing demand, while a significant commercial activity accompanied each leg. The volume peaks, well above the daily averages, suggest constant institutional interest rather than the enthusiasm of sporadic retail.

The support emerged near the $ 86.50 range, where buyers intervened several times, and the resistance almost $ 87.80 was finally broken following a concentrated increase in trades, according to the model.

Three separate purchase waves pushed the past levels of resistance of LTC. During a single burst, nearly 28,000 tokens changed hands, helping to transform the previous resistance into a new support floor just above $ 88.

The sale pressure collapsed after the move.

Warning: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee accuracy and membership of our standards. For more information, see the complete Coindesk AI policy.