Litecoin

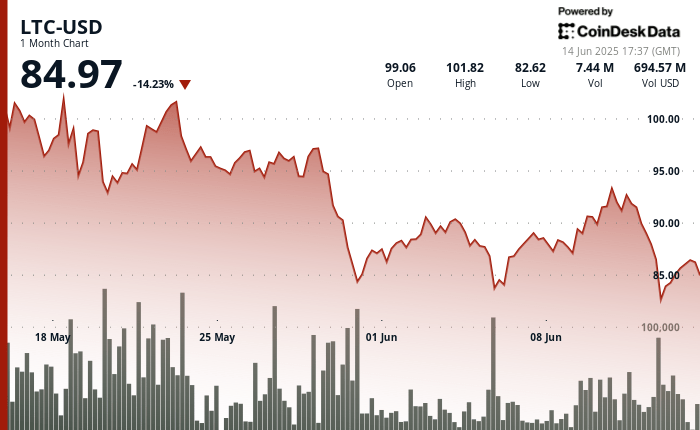

fell by more than 4.3% in last week and is down more than 14% for the last 30 -day period, the last sale that is part of a wider sale of risky assets.

This sale occurred after Israel attacked Iran in order to end its nuclear program and to harm its missile capacities, and Iran then retaliated with a salve of missiles.

The conflict has frightened the world markets, reducing the total market capitalization of the cryptocurrency by more than $ 150 billion.

The SLD was seriously affected by the sale. As the dust settled, Litecoin tried a fragile rebound, raised above $ 86. But recovery is dead under increasing technical resistance.

The level of $ 97.80, coinciding with Fibonacci’s retrace of 23.6%, according to the Technical Analysis Data model of Coindesk Research, has been difficult to rape. Dumination indicators like RSI at 43.46 and a flat MacD histogram show limited energy behind movement, suggesting a consolidation phase.

The volume tells a similar story. Litecoin’s negotiation activity dropped 42% after the initial dive, even though it briefly jumped through the level of resistance of $ 85.90 during a high volume peak on Friday evening. This escape, however, quickly encountered profits that brought him back to $ 85.

In the background is the hope of a Litecoin ETF spot. Analysts from Bloomberg ETF Eric Balchunas and James Seyffart estimate 90% of approval.