Litecoin

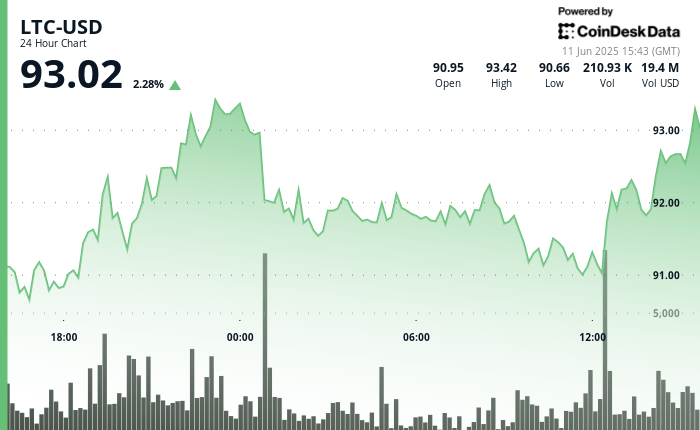

Recovered from the AM night sale, increasing by more than 2% and reaffirming support nearly $ 93. The rebound has coincided with traditional market gains after a cooler US CPI report.

The digital currency slipped after midnight UTC, losing ground of a peak of $ 93.58, before attracting interest on the buy on the one who helped stabilize the price around $ 91.

The analysis suggests that market players can position a potential approval of the Stock Exchange (ETF) fund. Bloomberg analyst James Seyffart awarded a probability of 90% of such approval later this year, placing LTS alongside Sola

As the main candidates in a possible “ETF Altcoin Etf”.

Preview of technical analysis

Litecoin prices share varied from $ 90.97 to $ 93.58 in the last 24 hours, a Swing of 2.88%, according to the Technical Analysis Data model of Coindesk Research. The highest drop occurred during maximum Asian negotiation hours, when the price dropped 1.55% in minutes before supporting $ 91.

While the merchants of the Americas woke up, the high volume purchase postponed LTC to $ 92. The most intense trading came around Midi UTC, with 249,812 tokens changing hands and fueling net recovery.

An ascending price channel seems to be formed, with resistance nearly $ 93.50 and support for consolidation of around $ 91. Volatility has increased again with a decrease of 3.4%, although prices stabilized shortly after, suggesting that the floor of $ 91 is under pressure.

LTC now oscillates nearly $ 92.95, showing signs of regular recovery.

Warning: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee accuracy and membership of our standards. For more information, see the complete Coindesk AI policy.