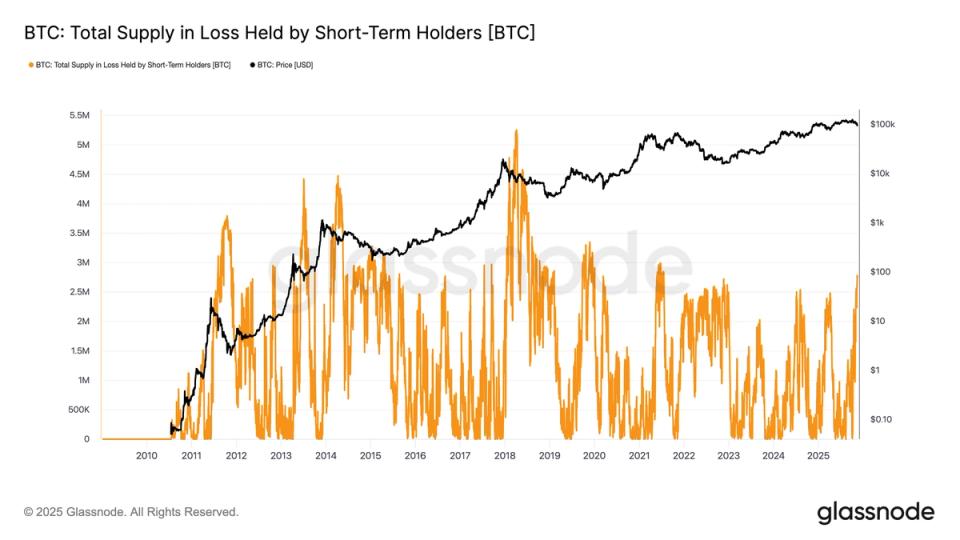

Short-term holders (STH) are now almost entirely overwhelmed by their recent bitcoin purchases. Glassnode defines STHs as entities that have held bitcoin for less than 155 days.

On June 15 (155 days ago), bitcoin was trading at $104,000, meaning almost every coin acquired since then is above current spot levels.

Glassnode data shows that 2.8 million BTC held by STHs are in losses, the highest level since the FTX collapse in November 2022, when bitcoin was trading at nearly $15,000 per coin.

Bitcoin is now down about 25% from its all-time high in October, which is well within the typical 20-30% range for bull market corrections. Unlike STHs, long-term holders (LTHs) continued to distribute. Data from Glassnode shows that LTH supply fell from 14,755,530 BTC in July to 14,302,998 BTC as of November 16, a reduction of 452,532 BTC.

“Many long-time holders have chosen to sell in 2025 after many years of accumulation,” said Nicholas Gregory, director of Bitcoin OG and Fragrant Board.

“These sales are primarily driven by lifestyle rather than negative views of the asset, and the launch of US ETFs and a $100,000 price target have created an attractive and highly liquid selling window.”

This decline in Bitcoin has created a notable divergence with Bitcoin spot exchange-traded funds (ETFs) in the United States, which have demonstrated remarkable stability. US ETF assets under management (AUM) remain near their all-time highs when measured in terms of BTC. Current AUM stands at 1.33 million BTC, compared to the October 10 peak of 1.38 million BTC, a decline of 3.6%, according to checkonchain.

Measuring assets under management in BTC rather than dollars avoids distortions due to price volatility. This divergence suggests that the recent price decline is not primarily driven by ETF outflows but by longer-term holders.