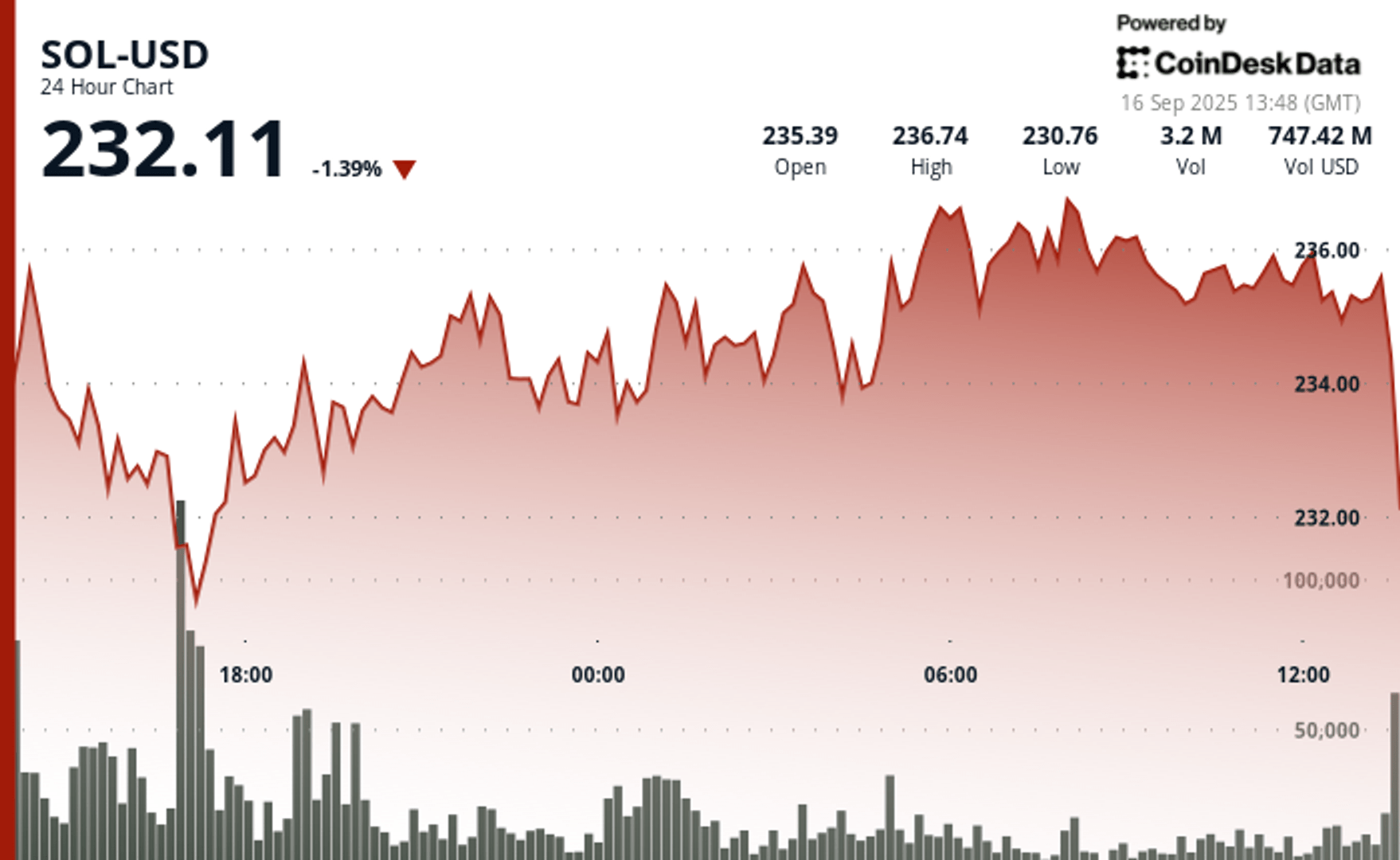

According to Coindesk data, Solana exchanged $ 232.11 at 12:30 p.m. UTC on September 16, holding relatively firm after a hectic day that saw the prices test the levels of $ 230 and $ 238.

The analyst’s point of view

Altcoin Sherpa, a largely followed merchant, said earlier in the day on X that he considered soil and BNB as betting stronger than ETH. He noted that new funding flows and market structures seem more oriented towards the ground, while ETH has already made a substantial race and may need time to consolidate.

He added that the majors always move in step with BTC: if BTC is weakening, it is unlikely that Sol, BNB or ETH continues to climb. But if Bitcoin gathers on positive macro developments, it expects the majors to follow – with Sol and BNB probably leading in performance. Sherpa said that there was long and BNB long stayed, while its ether position is relatively low.

Technical analysis of Coindesk Research

According to the Technical Analysis Data model of Coindesk Research, Sol exchanged in a range of $ 8 between September 15 to 16, 16, moving between a top of $ 238.09 and a level of $ 230.13.

The heaviest sale occurred between 12:00 p.m. and 5:00 p.m. UTC on September 15, when Sol slipped nearly $ 8 from a peak in the hollow. The volume increased to 1.5 million units during this drop, marking intense sales pressure.

Subsequently, the buyers repeatedly defended the area from $ 233 to $ 234, establishing a short -term “floor”. Consolidated soil with participation of around 650,000 volume units, suggesting a mixture of institutional distribution and retail accumulation.

Towards the end of the session, prices have improved. Between 07:00 and 8:00 UTC on September 16, Sol came out of a tight band from $ 235.52 to $ 236.50, briefly passing to $ 236.90 over a touch of 46,000 units in minutes. This increase pushed the price to a resistance zone of $ 237.50 to $ 238 before momentum cooling.

Overall, the data shows that Sol stabilizes after sharp swings, with a clear support base nearly $ 233 and a ceiling forming between $ 237.50 and $ 238.

Latest graphic analysis 24 hours a day and a month

The latest Coindesk 24 -hour data table, ending at 12:30 p.m. UTC on September 16, shows $ 232.11 after withdrawing an intraday zone from $ 236 to $ 237. Exchanges have shrunk in the band from $ 232 to $ 234, strengthening this area as short -term support.

The graph of one month shows that Sol always tends to increase overall, although the recent reductive underlines that Sol tests its base of support rather than extension of gains. Consolidation suggests that the token may need to take momentum before another higher attempt.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.