The provider of digital assets based in the United States, Lukka, has teamed up with Coindesk indices to integrate the rate of implementation of composite ether (CESR) in its offers.

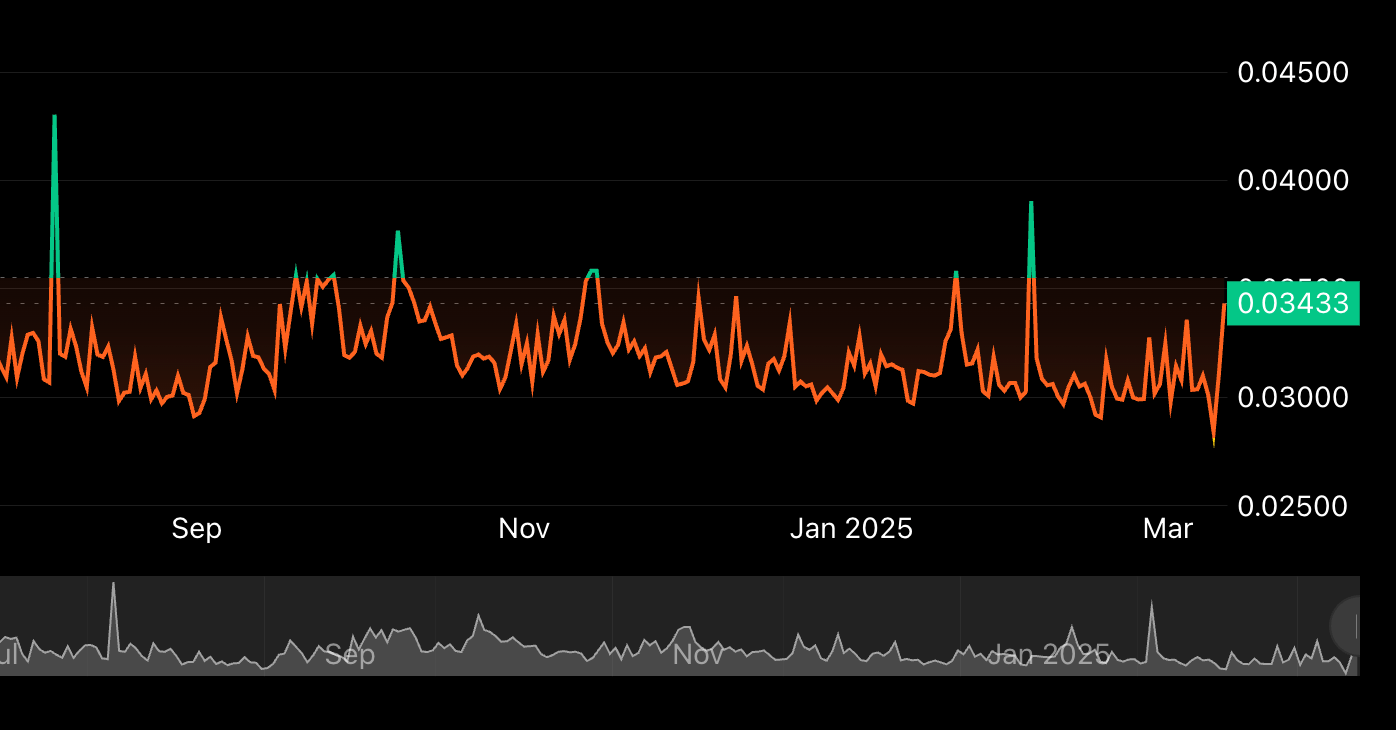

The CESR will capture the average annualized implementation yield won by Ethereum validators, including consensual incentives and priority transaction costs. Financial institutions, asset managers and analysts can use CESR as a reference for the relative ether ether performance

“Our collaboration with Coinfund on CESR offers a critical reference for the development of Ethereum, offering institutions a rate of confidence and standardized,” said Alan Campbell, president of Coindesk Indices.

Dan Husher, product manager of Lukka data, added that the agreement illustrates a “higher standard for institutional cryptography data”.

Ethereum Staking has increased since the blockchain went from a consensus evidence to proof of proof of proof in September 2022. There are currently 37 billion dollars of total locked value (TVL) in the liquid implementation protocols, which allow users to gain additional yield thanks to the delivery of liquid layoff (LST).

“The change of Ethereum into proof of participation has transformed the security of the blockchain of a commitment to calculation power in a financial commitment,” said Andy Baehr, CFA, manager of ATCOindeK product and research indices. “Since the ignition rate, actually a performance of public services to display the ETH in the network, is accessible and measurable, it is an integral part of the investment case for ETH.”

Update (4:45 pm UTC, March 12): Add the quote from Andy Baehr.