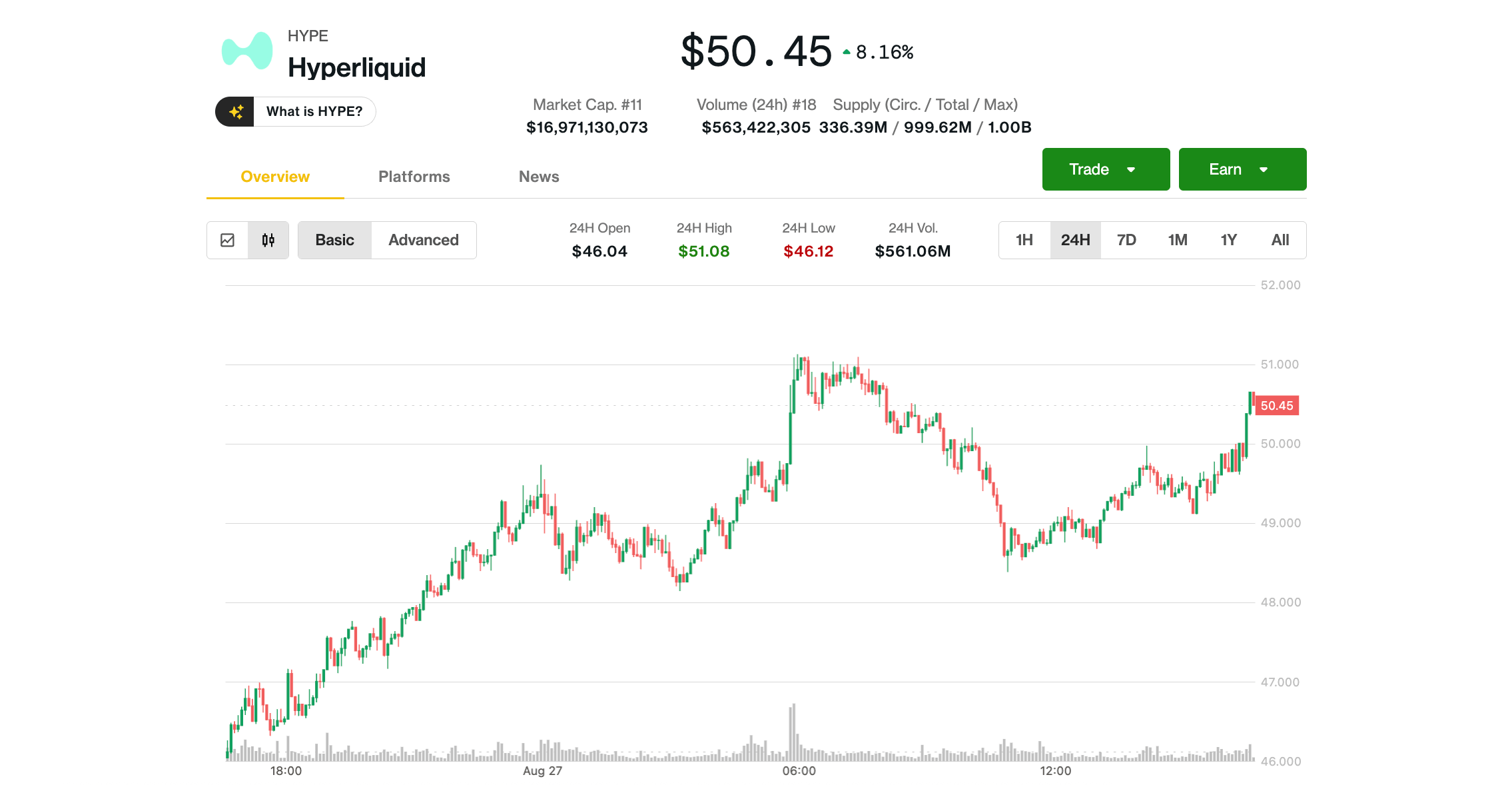

The native hyperliquid token (THRESHING) reached a new record of all time Wednesday, continuing its meteoric climb this year while the most famous decentralized exchange for perpetual chain trading has attracted record activity.

The token has crossed the $ 50 bar for the first time, earning around 8% in the last 24 hours. Threshing media has now increased by 430% since April Nadir and about 15 times since it started negotiating at the end of November at around $ 3.

The rally was fed by a record negotiation activity through the stock market and its automated buyout mechanism, which regularly absorbs chips on the market and reduces the circulating offer.

Read more: hyperliquid now dominates DEFI derivatives, the treatment of $ 30 billion per day

Commercial boom

The decentralized scholarship recorded more than $ 357 billion in volume of derivatives in August, according to Defillama, against $ 319 billion in July and almost ten times higher than a year ago. Trading Spot volumes also set a record, exceeding $ 3 billion for the week ending on August 24, according to blockworks data.

These flows resulted in a boon for the protocol. Hyperliquid reserved $ 105 million in negotiation costs in August, the highest this year, according to Defilma data.

A large part of these profits are directed directly in the purchase of media threshing on the market through the hyperliquid assistance fund. Installation is an automated chain mechanism that buys tokens on the free market, creating sustained purchase pressure for media threshing and effectively reducing food in circulation.

Since its launch in January, the assets of the fund has increased from 3 million tokens to 29.8 million media threw, worth more than $ 1.5 billion, feeding the tokens rally.

In terms of news, the Guardian of the Digital Asset Bitgo added the support on Tuesday for the Hyperevm network, which underpins the hyperliquid ecosystem, unlocking institutional access to the media and related applications.

Analysts excite risks in the midst of solid fundamentals

In a recent research note, analysts bytree Shehriyar Ali and Charlie Morris described the hyperliquid as a “power” which has become the largest place in a decentralized perpetual term.

“All well considered, the hyperliquid is among the most convincing protocols of Defi today,” they wrote. “Its solid fundamental principles, its generation of record costs and its dominant market share make it impossible.”

Despite the bullish fundamentals, the report also reported concerns about the token assessment. Hype is currently negotiated with a fully diluted assessment (FDV) Of more than $ 50 billion, with only around thirds of the supply in circulation with a market capitalization of 16.8 billion.

Unlocking tokens planned from November could also introduce sales pressure, potentially testing the force of demand, noted the report.

“Although the token has already experienced a clear break in recent months, its solid activity on the chain continues to underline its evaluation,” said analysts.

Read more: Future XPL on hyperliquidal see $ 130 million destroyed before the launch of the plasma token