Notice of non-responsibility: The analyst who wrote this article has actions in the strategy.

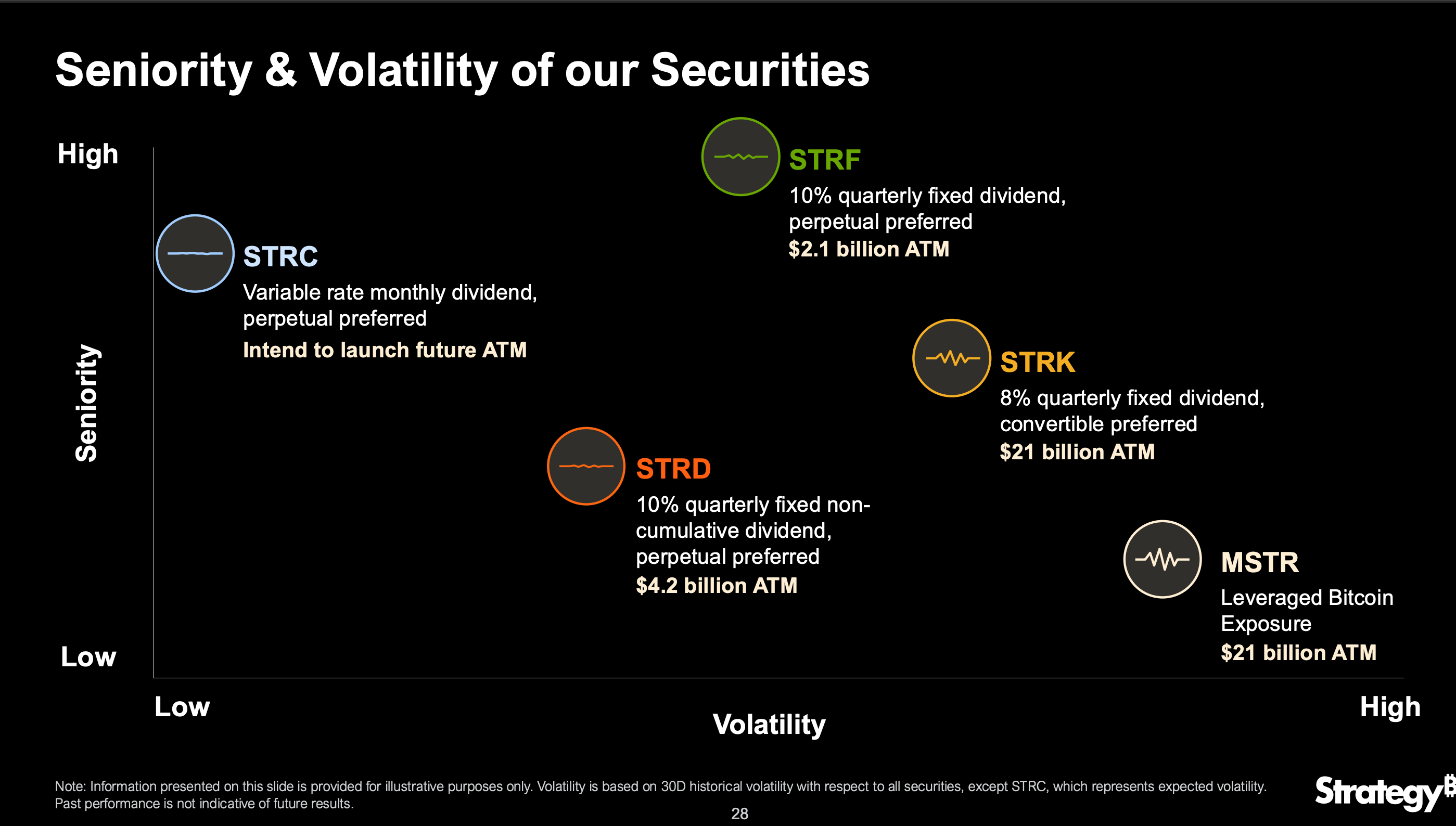

The strategy (MSTR), under the leadership of the executive president Michael Saylor, has perhaps just finalizing his greatest program of privileged actions to date with a STRC (stretch) offering STRD, STRF and STRK actions to build the company’s credit yield curve.

Among these, Strc is listed high in seniority and low in expected volatility. It adds a new short -term layer to the mixture of funding for the strategy and diversifies how the company can raise capital for the acquisition of BTC.

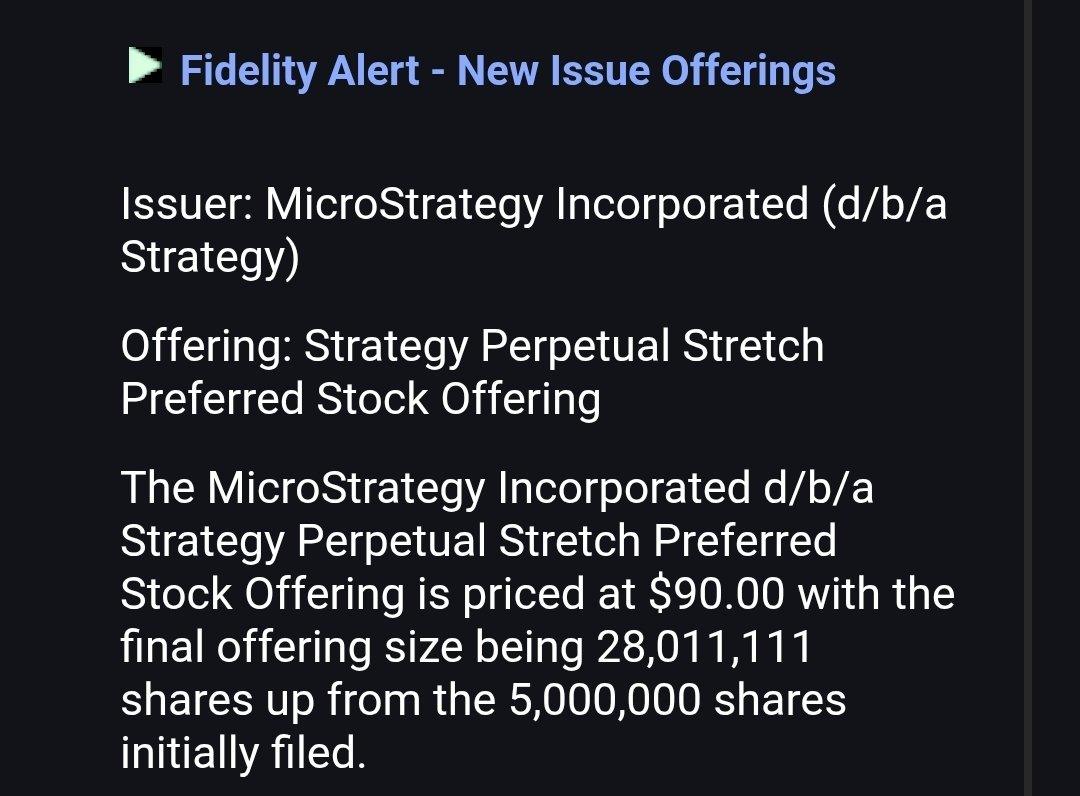

According to a Fidelity alert on X, the agreement is 28 million shares at a price of $ 90 each, totaling more than $ 2.52 billion. This represents a spectacular increase compared to the initial goal of $ 500 million announced a few days earlier and highlights the company’s continuing ambition to extend its Bitcoin BTC assets.

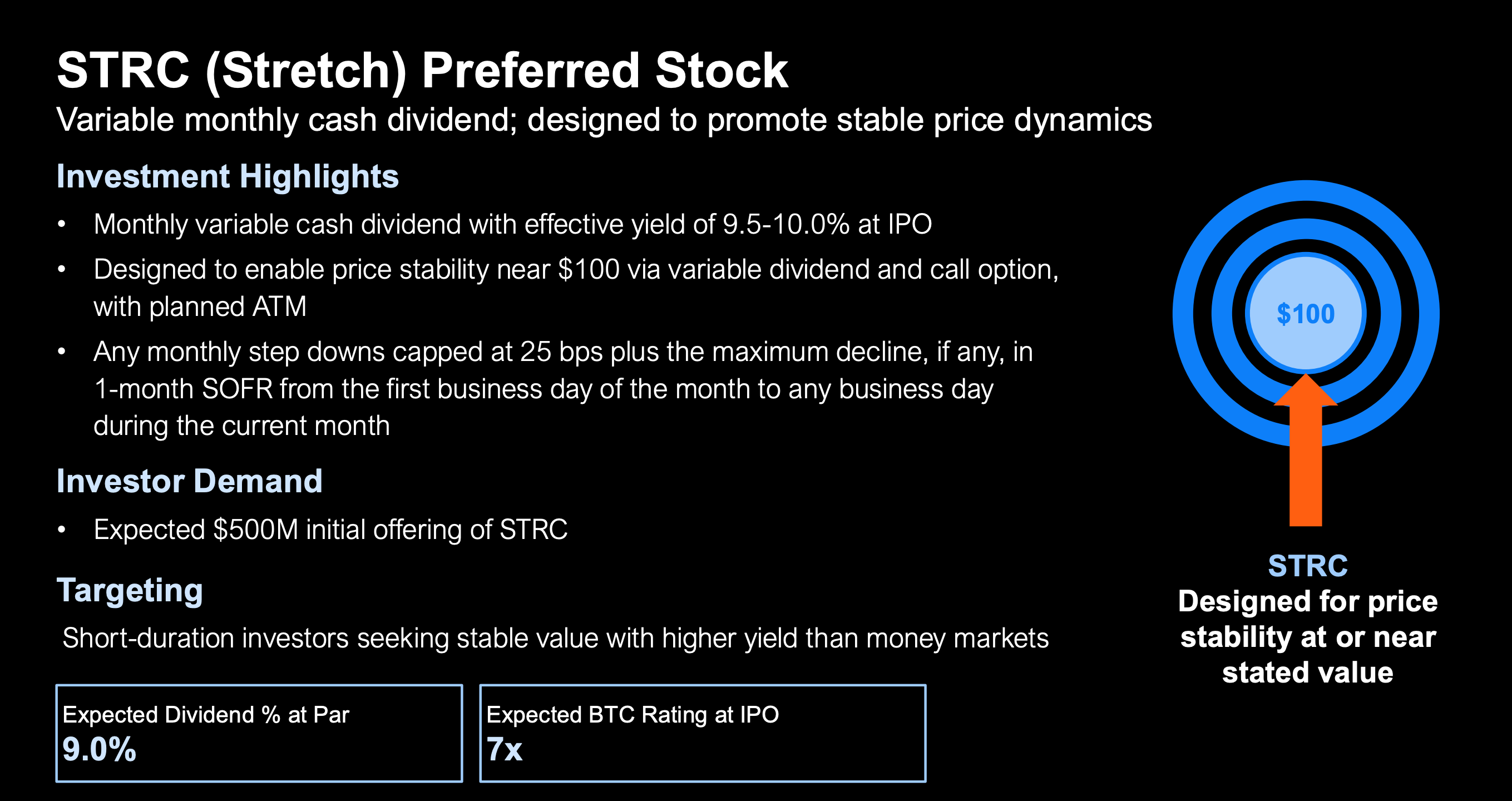

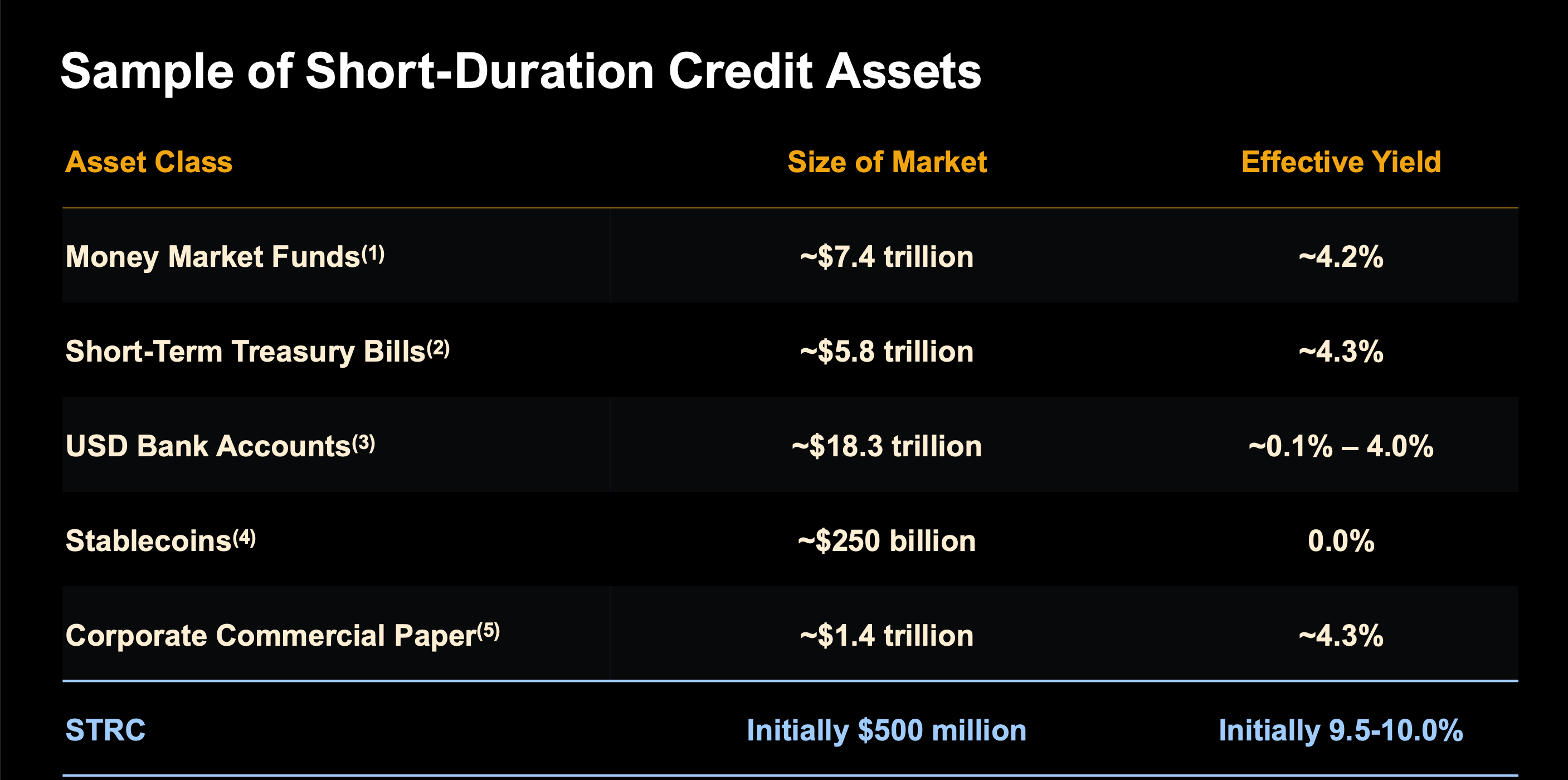

STRC is a privileged senior and perpetual actions offering a variable monthly dividend designed to call upon return on return investors who wish stability near the nominal value. At the time of the offer, STRC made an effective yield of 9.5% to 10.0% paid monthly. It contains mechanisms to maintain a negotiation range close to $ 100, including adjustable dividend rates, secondary emission windows and call options higher than by.

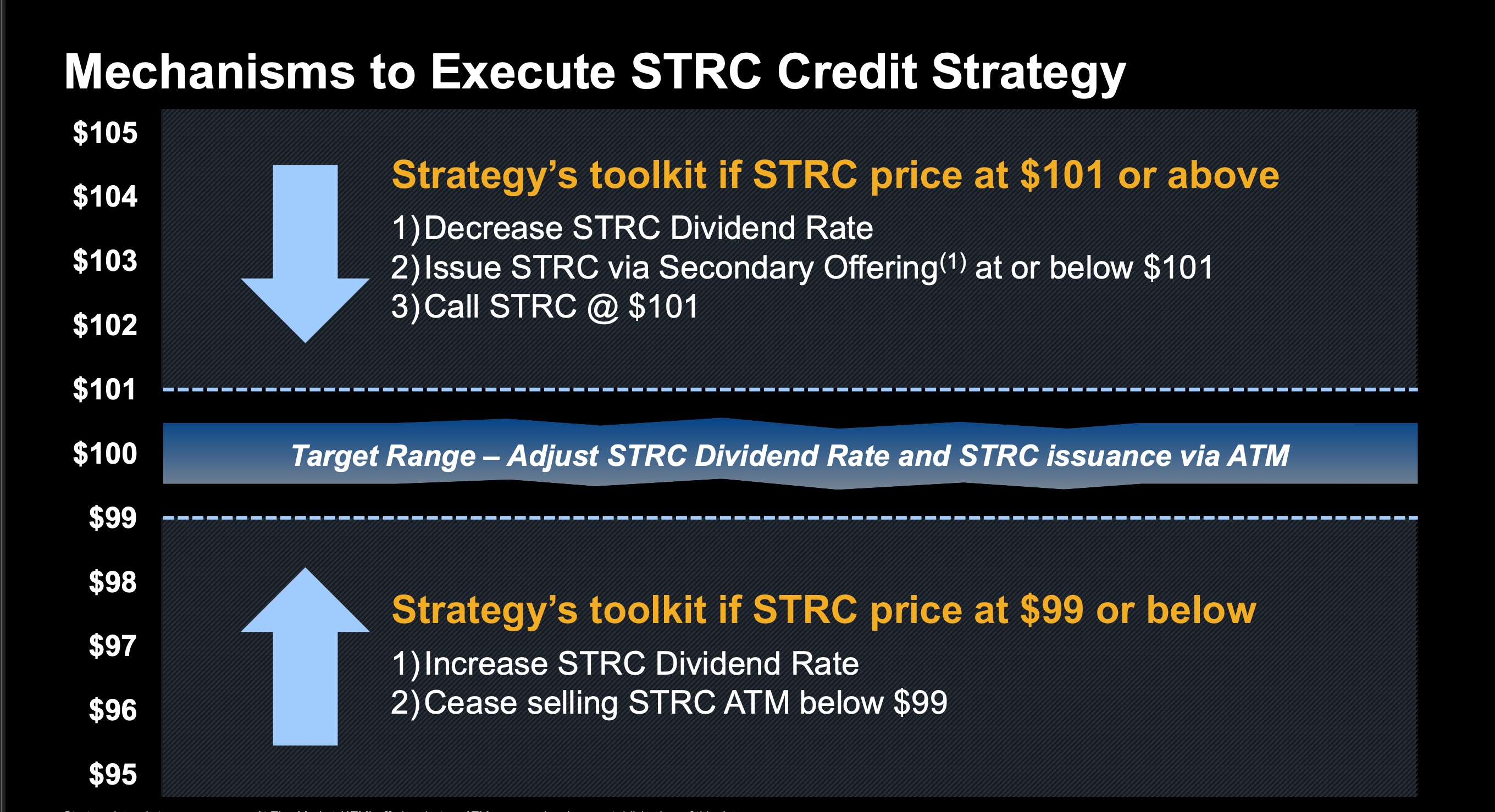

The toolbox includes the increase in dividends and sales stop when Strc is negotiated below $ 99, or issuing new actions and calling for action if it exceeds $ 101. These levers are designed to create a self-body system that promotes market stability while providing attractive yields in the current interest rate environment.

All the bass of the dividend are capped at 25 base points plus the maximum drop in the night financing rate obtained of one month (SFR) over the period.

Compared to conventional short -term credit options, STRC stands out, offering more than double of the 4% available from money market funds and cash bills. It targets investors looking for a higher performance without significant price volatility, positioning it competitively against traditional instruments such as commercial paper and bank deposits.