Strategy (MSTR), the world’s largest publicly traded Bitcoin holder, increased its Bitcoin holdings and cash reserves in the final days of 2025 and early 2026.

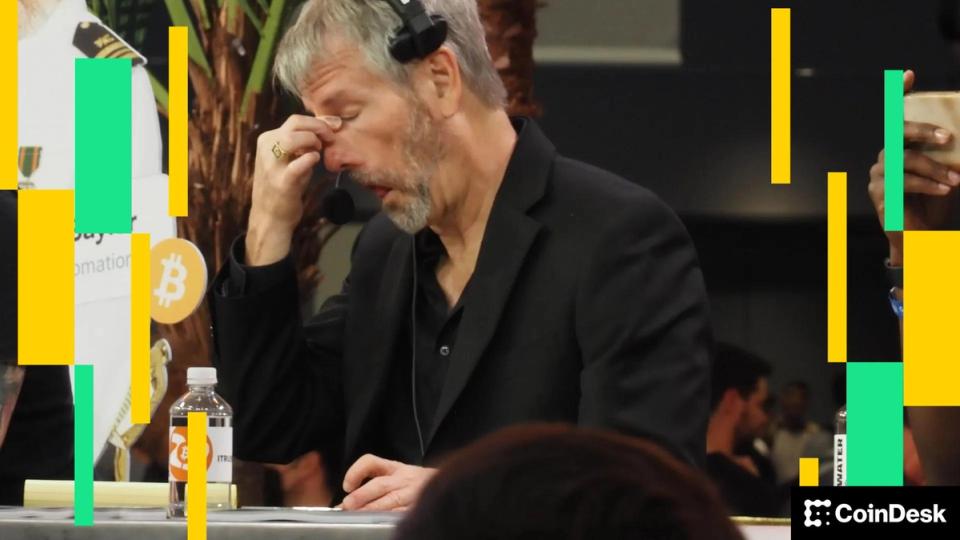

Led by Executive Chairman Michael Saylor, the company added 1,287 bitcoins for just over $116 million, averaging around $90,000 each. The company’s holdings now stand at 673,783 bitcoins purchased for $50.55 billion, an average price of $75,026 each.

Last week, the company also added $62 million to its cash reserves, bringing that total to $2.25 billion.

The increase in cash and BTC reserves was financed by the sale of common shares.

The cash reserve is intended to finance the payment of dividends on the company’s perpetual preferred shares. At current levels, Strategy has enough cash to fund 32.5 months of dividend coverage, according to the company’s dashboard.

MSTR shares rose 4.5% in the premarket alongside a weekend rally in bitcoin’s price, currently at $92,900.