With the third quarter now entirely in books, the Bitcoin Treasury Company (MSTR) original strategy reported a gain of $ 3.9 billion on its gigantic BTC assets for this three -month period.

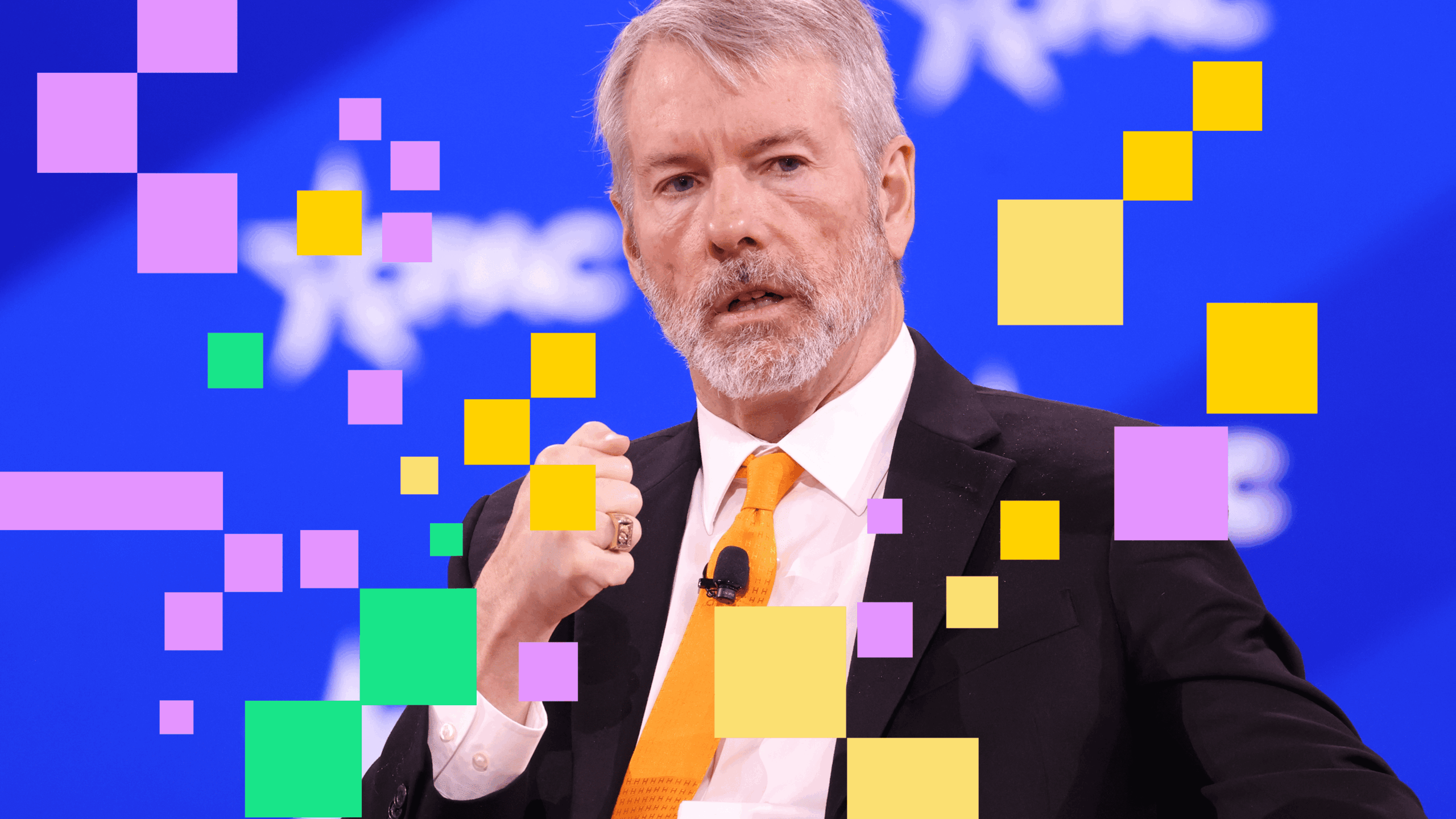

At the same time, the Compenay confirmed what had been teased by its executive president Michael Saylor during the weekend – which he did not add to his battery of 640,000 last week – the first time since April that he did not do it.

The average purchase price of the strategy in its Bitcoin holdings is $ 73,983 per room. With the current Bitcoin price around $ 124,000, these assets are now estimated at around $ 78.7 billion, which represents around $ 31.4 billion in unabled earnings.

Private facts for financial update

For the closed quarter on September 30, the company announced an unrealized gain of $ 3.89 billion on its digital assets, as well as a delayed tax charge of $ 1.12 billion.

Since September 30, the company’s digital asset value brought $ 73.21 billion, with a delayed related tax obligation of $ 7.43 billion.

MSTR shares increased by 2.5% in trade prior to the market alongside Bitcoin weekend gains at current $ 124,500.