Shiba Inu (Shib), the second largest same in the world, had a difficult week. However, cryptocurrency appears on the right track to record a two-digit monthly gain.

Shib fell to $ 0.00001263 early today, the lowest since July 10. Prices have dropped by almost 9% for the week, with a loss of more than 2% in the last 24 hours. The weakness is consistent with the mood observed in the same sector. The Memecoin Coindesk (CDMEME) index decreased by 10% in seven days.

Price volatility in SHIB is aligned with broader changes in the cryptography market, because political uncertainty reshapes the allocation of digital assets. The failure of the token to rally despite the aggressive burning programs underlines the preference of investors for public services on public services on pure speculation games.

AI key badges

- Shib plunges 2,28% from 0.000013107 to 0.000012809 $ at a 24 -hour window ending on July 30, 2:00 p.m.

- The burn mechanism destroyed 600 million tokens in a single session, marking a 16,710% increase in the destruction rate

- Competitors Bonk, Pingou and Remittix capture trader focused on public services take place while Shib loses the direction of the same corner.

Technical levels

- The price dropped 2.28% from 0.000013107 to 0.000012809 $ over the period 24 hours a day.

- The commercial bandwidth extends over 0.000000005215, which is equivalent to 4.12% of the total range.

- Capped resistance advances $ 0.000013184 with rejection during the 5:00 p.m. session.

- The support appeared at $ 0.000012663, supported by a volume of token of 1.25 Billion.

- The downward trend intensified after 10:00 am on July 30, with consecutive lower peaks.

- Bounce at the end of the session achieved a 0.25% gain during the time of final negotiation.

- The volume explosion reached 43.5 billion tokens during the rally phase of 13: 57-13: 59.

- The three wave model appeared: consolidation, distribution, then short-circuit.

Bullish clues

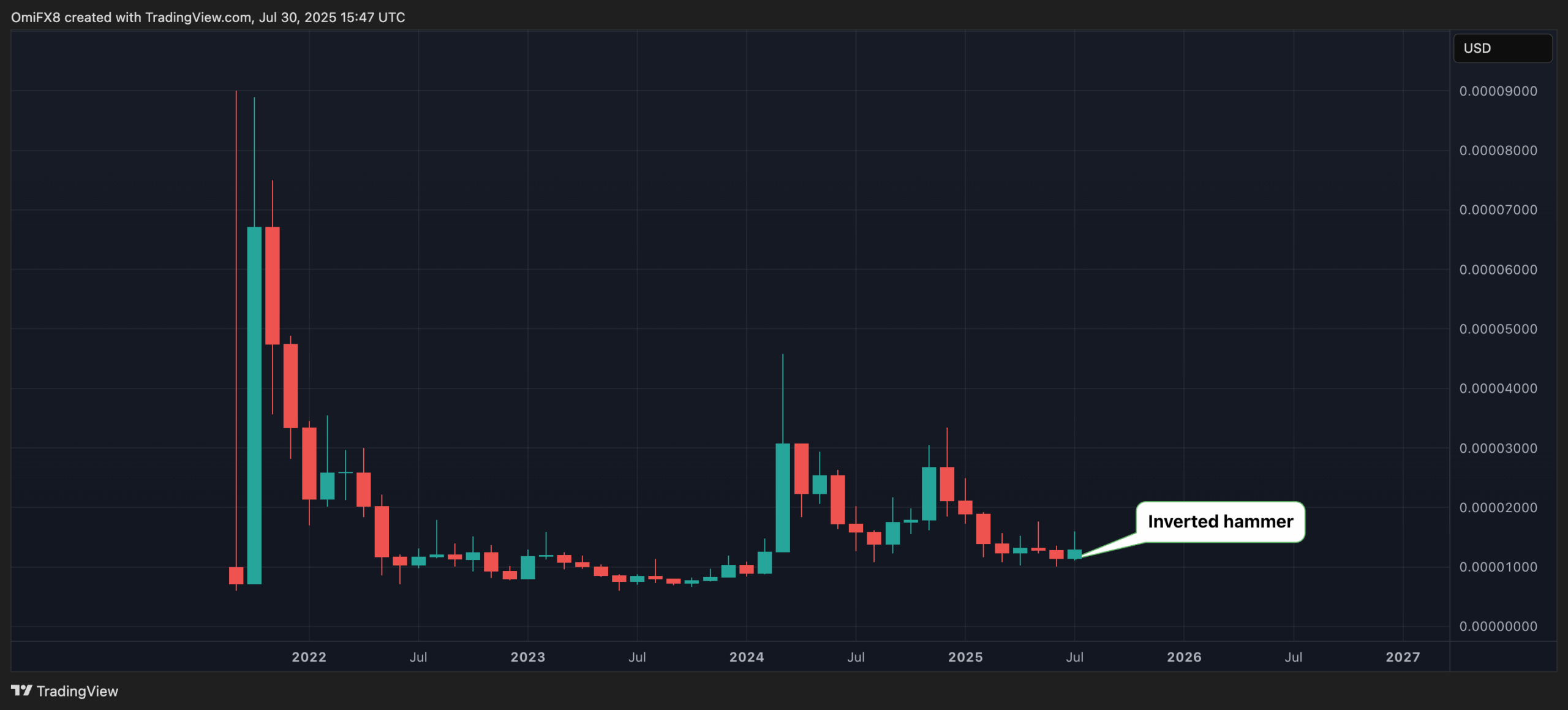

Shib’s monthly price graph shows that the token should end in July with an inverted hammer candle as it seeks to bounce from the bottom of the year.

Reverse hammering appearing after the downward trend or market stockings indicates that buyers tried to push the price much higher during the period, but the sellers ultimately controlled buyers, repelling prices until near the opening price.

However, the pure presence of the long upper shade indicates that the purchase of interest reappears to these low levels, referring to a higher potential optimistic inversion.

Warning: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee accuracy and membership of our standards. For more information, see the complete Coindesk AI policy.