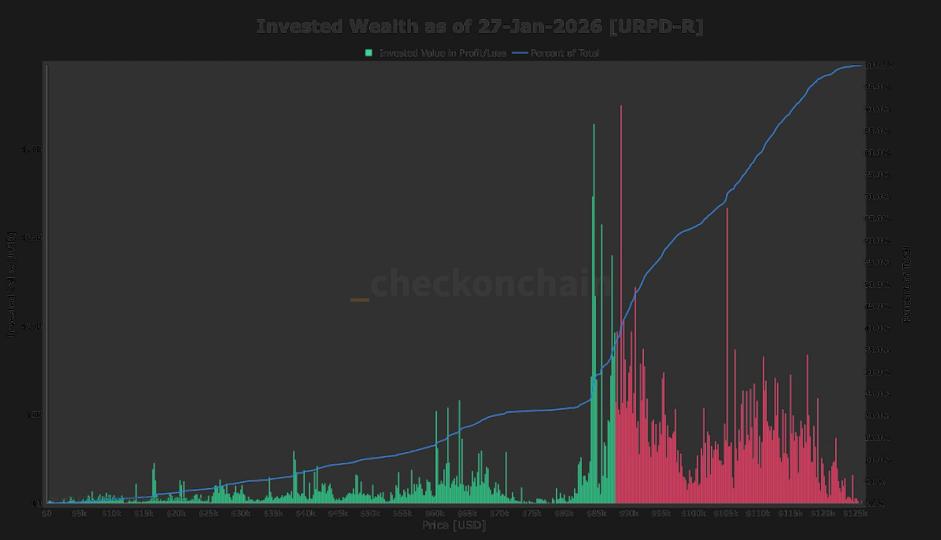

An onchain indicator suggests that most bitcoins Investors are currently under pressure, with 63% of all wealth invested in the largest cryptocurrency having a cost basis above $88,000, according to Checkonchain data.

This means that the majority of capital entered the market at a higher price than BTC is trading at today. Invested wealth refers to the total value of capital deployed into bitcoin when the coins last moved on-chain. This is different from the cost basis, which is the average price at which that bitcoin was acquired.

This idea comes from a metric called UTXO Realized Price Distribution (URPD). The URPD illustrates the price levels at which the existing supply of Bitcoin was last brought on-chain. Each bar represents the amount of Bitcoin whose most recent transaction occurred within a specific price range.

The price of Bitcoin has been limited between $80,000 and $90,000 since November. The URPD highlights the extent to which capital is currently underwater. Tens of billions of dollars are between $85,000 and $90,000. A price move below $85,000 could intensify selling pressure as investors try to limit losses. Long-term holders are already selling at the fastest pace in six months.

What adds to the risk is that there is relatively little supply between $70,000 and $80,000. If the $80,000 level fails, last tested in November, a rapid move towards $70,000 becomes more likely.

Looking ahead to February, Bitcoin is poised to end January unchanged, without the typical relief bounce after experiencing three straight months of decline. Historically, February has been a strong month, with average gains of around 13%, according to Coinglass data. Whether history repeats itself may depend on how the market absorbs the current subsea supply overhang.