Hello, Asia. Here is what is news on the markets:

Welcome to the morning briefing in Asia, a daily summary of the best stories during the hours and an overview of market movements and analyzes. For a detailed overview of the American markets, see the Americas of the Coindesk Crypto Daybook.

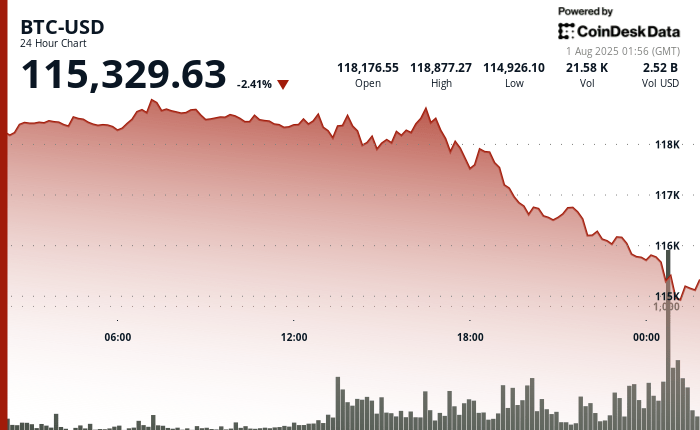

Bitcoin (BTC) should end the week of negotiation in Asia down 2.3% over the day, changing the hands greater than $ 115,300.

A new series of world prices in the White House leads to markets in Asia, with the opening of Nikkei 225 in red with Kopsi de Seoul. Bitcoin is not safe from this either, because historically digital assets also follow the stock markets when the White House announces prices – although it has also started to weaken.

Coinglass data show that around 260 million dollars in long positions have been liquidated in the last 4 hours.

The BTC is struggling with pricing pressure and the continuation of profits after a historic race after the heights of all time.

According to a new cryptocurrency report, Bitcoin has just experienced its third major vigorous wave of the 2023-2025 bull cycle, with 6 to 8 billion dollars of earnings made in late July.

Like the previous phases, this wave was defined by large peaks in the production ratio (SOPR), especially among short -term holders, and a significant sale of 80,000 BTC by an OG whale on July 25.

The new whale cohorts, those that accumulated BTC in the past 155 days, were the dominant sellers, according to the data supplier.

The exchange entries increased to 70,000 BTC in a single day after the sale of the OG whale, a level which generally signals a strong intention to leave the positions at cutting prices.

The sale was not limited to BTC: whales based on Ethereum holding WBTC, USDT and USDC also carried out up to 40 million dollars in daily profits, supporting more the story of the rotation of capital in large.

Historically, these for -profit events were followed by a consolidation period of two to four months before the highest leg, wrote cryptocurrency. This scheme can be played again, with decline appetite investors.

The Premium Coinbase, an indicator that follows price differences between Coinbase and other world exchanges, recently reversed negative, suggesting that American buyers no longer pay a bonus.

Adding to the prudent tone is the return of macro risk. Trump’s tariff climbing, including new measures that specifically target Canada, have shaken wider risk assets. Actions, bonds and crypto have seen decreases in the midst of inflation and disruption of the supply chain.

Without a clear macro catalyst or structural inputs, the risk -taking remains selective and the light of conviction, adding enflux merchants in a note at Coindesk.

“Until the BTC or the ETH can display its own recovery from recent local summits, prices can remain agitated and thematic of rotation rather than trend,” said the market.

Market movements:

BTC: Bitcoin (BTC) is negotiated at $ 115,500, down 2.3% on the day, while the renewed prices of the White House weigh on Asian markets; Despite the drop, the BTC remains linked to the beach.

ETH: The ether (ETH) oscillated nearly $ 3,800 Thursday after having increased by more than 50% in July – its best month since 2022 – as optimistic price targets circulating on social networks, including a popular analyst projecting a break of $ 15,000 to $ 16,000, supported from $ 5.3 billion in the entries of spots and high demand and a high institutional demand.

Gold: Gold increased to $ 3,296 earlier Thursday before moving to $ 3,287.39, down 0.38%, while the purchase of decrease compensates an US dollar firm after the Fed held stable rates and Powell pushed a drop in September in the midst of employment data and an increase in basic PCE inflation.

Nikkei 225: The markets in Asia-Pacific opened less on Friday, with the Nikkei 225 of Japan down 0.65% and the top index Flat trading

S&P 500: The term contracts on S&P 500 slipped Thursday evening while the traders weighed large technical gains and turned to the report on July jobs.

Elsewhere in crypto:

- Tyler Winklevoss has `serious concerns ” on the choice of Trump to direct the CFTC, Brian Quintenz (the block)

- The blockchain focused on stable connection increases $ 28 million to supply Stablecoin payments (Coindesk)

- HKMA’s stable stablecoin regime to shape the future of Hong Kong cryptography (SCMP)