Hello, Asia. Here is what is news on the markets:

Welcome to the morning briefing in Asia, a daily summary of the best stories during the hours and an overview of market movements and analyzes. For a detailed overview of the American markets, see the Americas of the Coindesk Crypto Daybook.

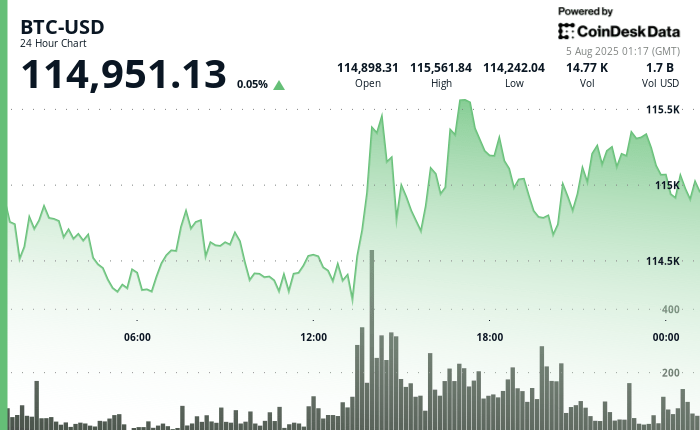

While East Asia is starting its negotiation day, Bitcoin (BTC) changes its hand to just over $ 115,000, staging a modest rebound in last week that saw more than a billion dollars long and BTC effectively test $ 113,000.

The rebound comes in the midst of signs of stabilization in institutional flows, with entries of $ 18.74 million in bit aircraft of $ 18.74 million, a potential reversal after one of the biggest days of ETF never recorded last Friday.

The latest correction, which marked the third consecutive sale of the BTC, was motivated by a macro-bellicist macro cocktail: job data in the United States and a new wave of Washington prices, triggering a wider risk mood in actions and crypto. Altcoins brought the weight of the moving, soil falling by almost 20% over the week and ETH losing almost 10%.

However, despite the decline, QCP capital remains cautiously optimistic.

“The wider structural configuration remains intact,” wrote the company in a note on Monday, quoting the highest monthly fence in the BTC in July.

QCP considers sale as a lever effect rather than a tendency reversal, pointing to post-Malys historical farmers who have crossed the path of renewed accumulation.

That said, the behavior of market coverage suggests that investors do not crown more deeply. On Polymarket, traders currently attribute a probability of 49% that BTC decreased below $ 100,000 before the end of 2025 – up 2 percentage points compared to the day before.

The price reflects a market that is still on board, with a risk of a drop at the price despite the long-term fundamentals, such as regulatory clarity, the growth of initiatives for tokenization of stable-configu.

The following catalyst could occur during the negotiation day in Asia while the reports of American transmitters, which is generally occurring by midday of Hong Kong.

If ETF entries continue and implicit volatility is starting to compress, it can provide the necessary confirmation for the market to adopt the story of the purchase and shake the macro-trees that kept it stuck with neutral.

Market movers:

BTC: Bitcoin is negotiated over $ 115,000, reporting the first signs of market stabilization.

ETH: Ether has about $ 3,700, polymarket traders showing the confidence it exceeds $ 4,000 in August.

Gold: Gold extended his rally for a third session on Monday, going to a two-week higher, because the economic data of the United States increased the expectations of a drop in rate of the Fed of September, the CME traders being now evaluated in 86% like this.

Nikkei 225: The markets in Asia-Pacific opened the increase after US President Donald Trump unveiled plans to greatly increase the prices on Indian exports. The Nikkei 225 in Japan increased 0.54% to the opening.

S&P 500: The shares rebounded on Monday, the S&P 500 increasing 1.47% to 6,329.94, slamming a four -day sequence and marking its best session since May.

Elsewhere in crypto:

- Barry Silbert de DCG returns in gray levels as president in the middle of IPO PUSH (Coindesk)

- Former Chancellor Osborne warns UK is “completely left behind” on the crypto (decrypt)

- Pantera leads an increase of $ 20 million for the decentralized openmind operating system for robots (the block)