Hello, Asia. Here is what is news on the markets:

Welcome to the morning briefing in Asia, a daily summary of the best stories during the hours and an overview of market movements and analyzes. For a detailed overview of the American markets, see the Americas of the Coindesk Crypto Daybook.

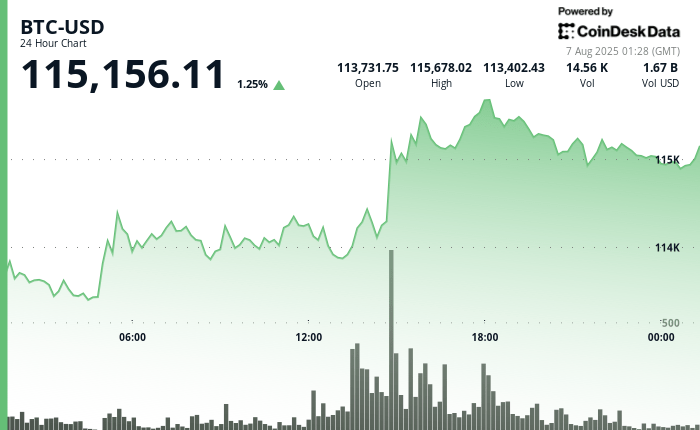

Bitcoin (BTC) walks on water around $ 115,000 Thursday morning in Asia, up 1% in the last 24 hours, while the high post-time correction continues to take place at low volume and a low conviction.

According to Glassnode, BTC has entered what he calls an “air gap”, a low liquidity zone between $ 110,000 and $ 116,000, after having broken down from a major supply group where short -term holders had previously found support.

These areas generally see little trading activity and can either serve as a basis for accumulation, or become a hatch for a deeper drop if the demand does not come back.

“The market is actually re -examined its base,” wrote Glassnode analysts, describing the beach between $ 110,000 (the previous ATH) and $ 116,000 (buyer’s recent cost base) as the new battlefield.

They noted that if the opportunistic purchases appeared, with 120,000 BTC acquired on the decline, prices have not yet recovered the resistance levels convincingly, in particular the ~ $ 116.9,000 threshold which marks the recent short -term entry points.

The profitability of the short -term holder has increased from 100% to 70%, which Glassnode executives is typical of an intermediate phase of the Haussier market. But without fresh hindrances, it could quickly erode the feeling. The ETF flows have become negative, with a BTC outing -1.5K earlier this week, the biggest since April. At the same time, financing rates on the derivative market have cooled, reflecting the reduced lever effect and a more prudent position among speculators.

The enflux market manufacturer offered a similar socket: “The cryptographic markets remain in a fragile retention scheme. Despite a certain relief in the Altcoin space, majors like BTC and ETH still find it difficult to inspire trust, “he wrote in a customer note. “The wider trend? Heavy legs with a more or less bright volume.”

ETH is up 2% in the last 24 hours, trading just below $ 3,600. The Coindesk 20 index, which follows a large basket of cryptographic assets, won 1.69% at 3,815.22.

“Until the BTC and the ETH recover the strength with the volume,” added Enflux, “the path of the slightest resistance could remain laterally down.”

The next market decision probably depends on whether buyers are ready to intervene and build a base in this low volume area, or if another rinse around $ 110,000 is necessary to reset the trend. For the moment, traders remain cautious and the bulls are not proven.

Market movers:

BTC: A potential shock of the Bitcoin offer, driven by drying over -the -counter office reserves and the regular accumulation of businesses, could “lead” the share of BTC prices after a drop of less than $ 110,000, according to market observers.

ETH: Ethereum may have formed a local summit because the sales pressure reaches $ 419 million, its second higher recorded, while the ETH retests a major resistance zone almost $ 4,000 which preceded a drop of 66% at the end of 2024, increasing the risk of a decrease of 25 to 35% by September; Meanwhile, Polymarket’s bettors remain divided, 48% supporting a rally at $ 5,000 despite the lower signals.

Gold: The Gold rally stalled on Wednesday while traders made profits and weighed an increase in the reduction in Fed rates, American trade tensions and a reshuffle of Fed leaders, leaving prices flat after a three -day gain pulled by economic weakness; Spot Gold was exchanged at $ 3,372.11, down 0.24% during the day.

Nikkei 225: The Asia-Pacific markets opened on Thursday, with the Nikkei 225 at the Japan apartment, while investors increased the shoulders of new American semiconductor threats.

S&P 500: US stock contracts were placed on Wednesday evening while traders would digest the new Trump Trump prices, the S&P 500, still up 1.7% for the week.

Elsewhere in crypto:

- Industry leaders encourage the dry green light from Liquid Staking, the opening doors for institutional adoption (the block)

- Roman Storm guilty of conspiracy of silver without license in partial verdict (Coindesk)

- Trump Media tests the “search for truth” using the AI perplexity (Decrypt)