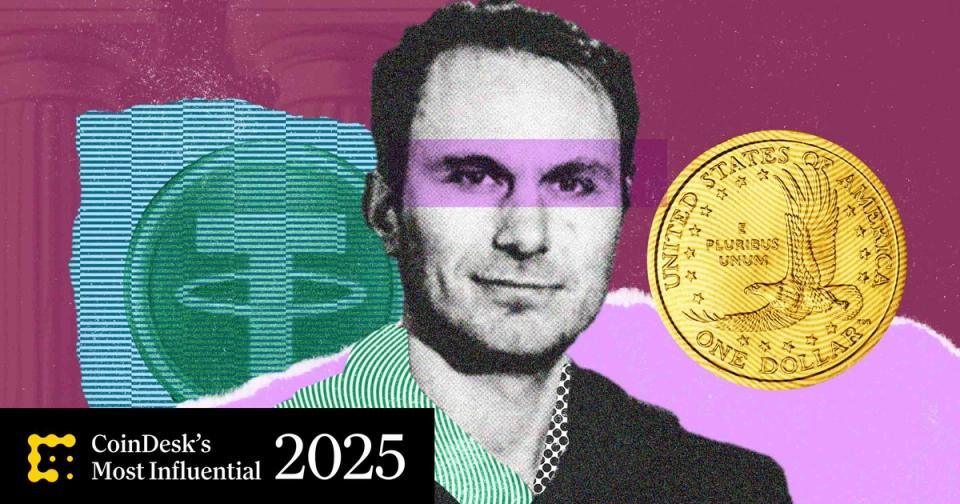

In 2025, Paolo Ardoino, CEO of the issuer of the world’s largest stablecoin, has evolved from just another cryptocurrency executive to one of the most impactful figures in the global transformation of financial infrastructure. Tether, the company behind the $185 billion USDT market cap, is increasingly blurring the lines between blockchain innovation and traditional banking power.

This feature is part of CoinDesk 2025 Most Influential List.

Tether has long been held with serious suspicions about the somewhat opaque nature of the reserves supporting USDT. Today, in a world of tighter regulation and the proliferation of competing stablecoin issuers, Tether finds itself at the forefront of one of the fastest-growing cryptocurrency sectors, with Ardoino at the helm.

Tether uses first US stablecoin law to reinvent its business

The growth of the stablecoin sector has been one of the crypto industry’s most notable success stories in 2025, supported by the introduction of formal regulatory regimes in major jurisdictions around the world. This has been particularly important in the United States, where the GENIUS Act, the first major crypto bill to become law in the United States, was passed in July after being closely scrutinized by a number of Wall Street banks and other traditional financial institutions (TradFi).

Hot on the heels of GENIUS, Tether unveiled the USAT dollar stablecoin, specifically designed to meet the American stablecoin issuance standard. USAT marks the first time Tether has introduced a product built around a US regulatory framework, demonstrating the evolution of both the company and the industry as a whole, given the criticism and scrutiny Tether has historically faced over its flagship USDT product.

Ardoino told CoinDesk that Tether is introducing USAT to “create a more professional and digital approach to money that can rival PayPal.” To that end, Tether tapped TradFi giant Cantor Fitzgerald — whose former CEO and chairman Howard Lutnick is now U.S. Commerce Secretary — as its reserve custodian and federally chartered crypto bank Anchorage Digital as the USAT issuer. Ardoino also named Bo Hines, a former White House crypto adviser, to head its USAT division, a further sign that it was meeting policymakers on their home turf.

Tether has seized the opportunity of regulatory acceptance of stablecoins in the world’s largest capital market to position itself as a compliant financial services provider alongside esteemed partners.

The introduction of clearer regulations on the issuance of stablecoins, their treatment as financial instruments and rules on how they are collateralized have contributed to a sharp rise in the sector’s market capitalization, which reached $300 billion in October, an increase of more than 45% since the start of the year. USDT’s dominance in the sector stood at 60% at the end of November.

Tether’s balance sheet becomes a weapon of expansion

Tether’s influence in the cryptocurrency sector is not defined by stablecoins alone, however. Under Adoino’s leadership, the company is transforming from a simple token issuer to a financial infrastructure provider thanks to its massive balance sheet.

Tether’s 2025 profits surpassed $10 billion in the third quarter, with an almost unimaginable 99% profit margin, according to Ardoino. This somewhat stunning balance sheet strength has given Tether the piles of dry powder needed to transform itself into an investment or development bank in all but name. Ardoino said in July that its investment portfolio had expanded to more than 120 companies, investments made with its profits.

The company has applied for an investment fund license in crypto-friendly El Salvador, where it is headquartered and where Tether has previously invested in bitcoin mining operations. Tether expanded its mining interests in 2025, acquiring a 70% stake in Brazilian agribusiness company Adecoagro to explore BTC mining with surplus renewable energy. Ardoino said in May that it wanted Tether to become the largest Bitcoin miner by the end of 2025, after investing $2 billion in energy production and mining operations.

Tether’s mining interests have expanded beyond “digital gold” to physical gold, with reports that the company has held discussions with mining groups about investing in the gold supply chain, such as refining and trading. Tether had acquired a minority stake in precious metals investment firm Elemental Altus in June and holds $12.9 billion in gold. Ardoino called the yellow metal “bitcoin in nature” during an appearance at Bitcoin 2025 in May.

Ardoino extends Tether’s reach to Italian soccer giant

A completely different but no less interesting venture from Tether is the Juventus football club. Based in Turin, northern Italy – Ardoino’s hometown – Juventus are among the most famous and renowned clubs in Italian and European football.

Tether acquired 8.2% of Juventus in February, then increased its stake to over 10% in April to become the club’s second-largest shareholder. Far from the array of crypto companies that have paid clubs and sports leagues to have their name and brand splashed across arenas and uniforms in 2021-22, Tether has sought to take an active role in club management, asking to participate in the club’s capital raise and gain a seat on the board of directors.

The potential for Tether to exert significant influence over the governance of one of the world’s most famous football clubs demonstrates the potential for Tether and Ardoino to build a global footprint that extends well beyond cryptocurrency.