When US President Donald Trump signed the first major bill dealing primarily with crypto issues in July 2025, it was just the latest step in a years-long campaign to get lawmakers to craft dedicated rules for the crypto industry. The president’s signing on July 18, 2025 began a new process by federal regulators to define specific regulations and explain how they would enforce those regulations around stablecoins, which themselves represent only a small segment of the overall crypto market.

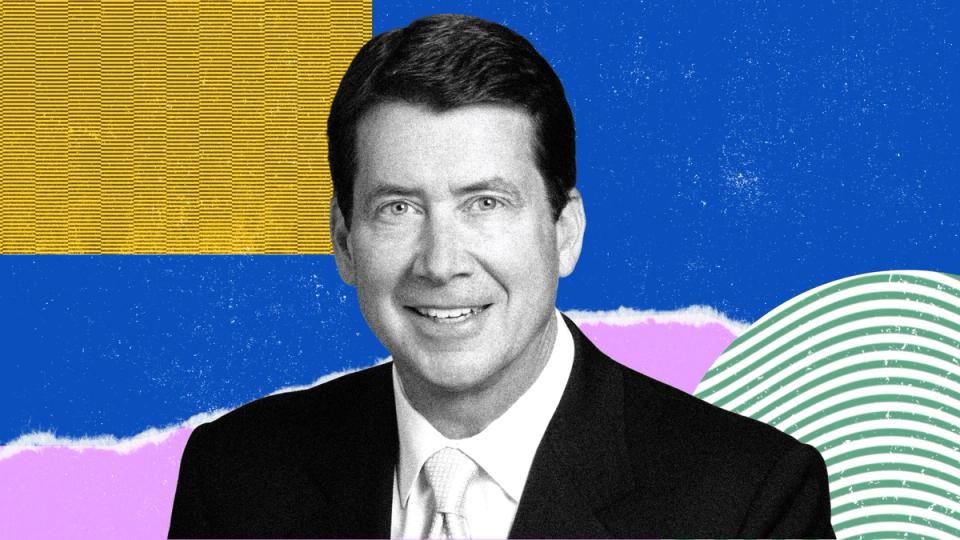

Senator Bill Hagerty, a Republican representing Tennessee, introduced the Guiding and Establishing National Innovation for Stablecoins in the United States Act – better known as the GENIUS Act – in February, beginning the process of crafting a law setting rules for stablecoin issuers wanting to do business in the United States and ordering federal banks and financial regulators to get to work creating specific guidelines for such companies.

To be sure, Hagerty is part of a group of lawmakers including both Republicans and Democrats who drafted the bill, voted it out of committee, moved it through the Senate and ultimately to the House of Representatives (which originally had its own stablecoin bill that was ultimately scrapped in favor of the Senate project).

In a speech at Bitcoin 2025 in Las Vegas earlier this year, Hagerty called the bill the most bipartisan product the Senate Banking Committee has produced in a decade.

“It took a lot of work,” he told the panel a few months before the bill passed. He argued that the bill would reduce counterparty risk, reduce transaction costs and reduce the working capital required to operate accounts receivable.

“If I think about the main selling points to my colleagues, the cost savings, the efficiency gains, it’s all good,” he said of the bill. “But if you think about the impact that this has on the dominance of the dollar in the world, the dollar has been the reserve currency of the world, and we’ve seen a slow deterioration of that. This is going to turn things around and bring us back to the forefront.”

Stablecoins, already a rapidly growing part of the crypto market, continue to see new issuers enter the market and are expected to reach a market cap of nearly $2 trillion by the end of the decade, according to some analyses.