The US Treasury Market knows its highest volatility in four months, potentially endangering an expected recovery from Bitcoin prices (BTC).

The data on the inflation of the United States for February came smoothly only expected, strengthening the arguments for the interest rate reductions of the federal reserve. Reading has encouraged some analysts to predict the price of Bitcoin at $ 90,000 and more. It is currently about $ 82,000.

“With the cooling by inflation and the fears of recession that are still looming, but no aggravation, Bitcoin could be on the verge of its next major escape, exceeding the range of less than $ 90,000,” said Matt Mena, a cryptographic research strategist at 21Shares, in an email.

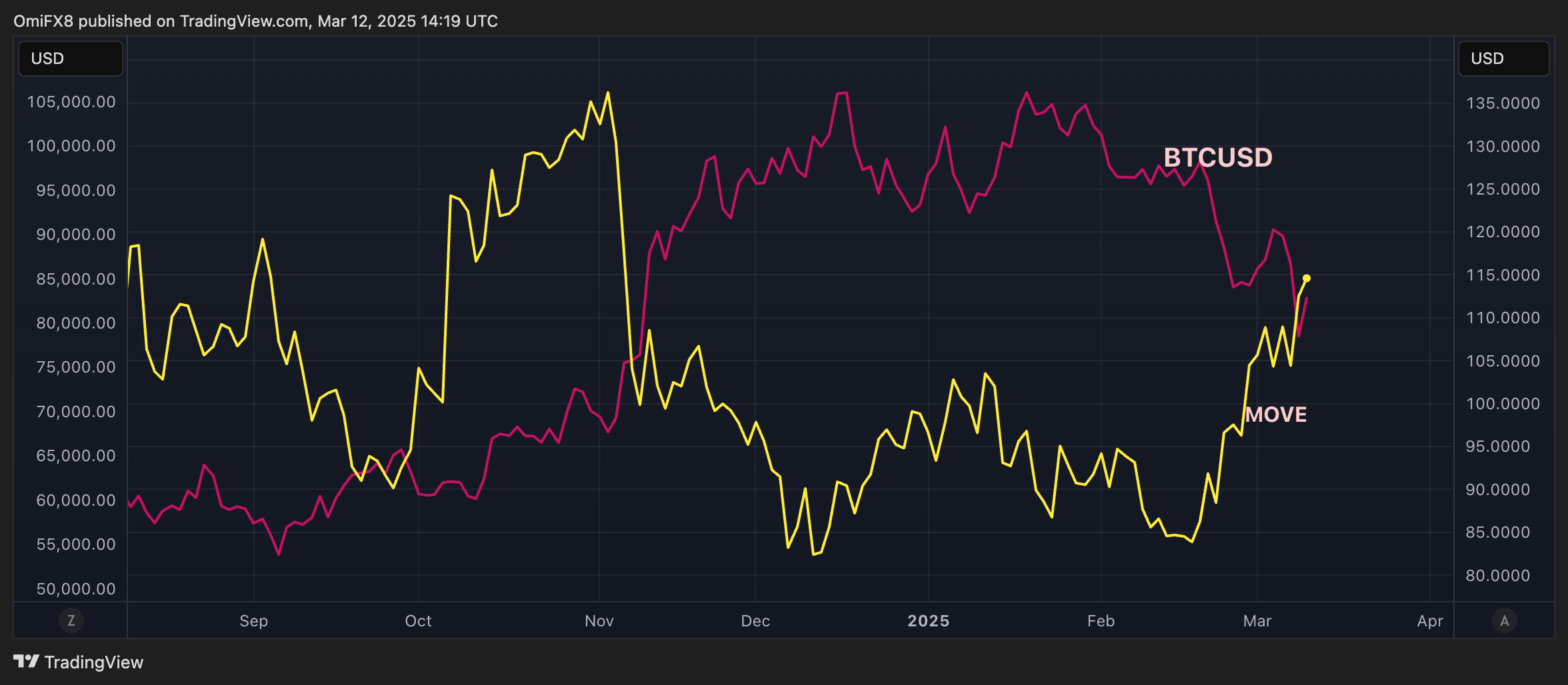

Any recovery, however, could take place more slowly than expected, because the Volatility estimate of the Merrill Lynch option (displacement), which measures the expected volatility of 30 days on the US treasure market, has increased to 115, the highest since November 6, according to Data Source TradingView. He jumped 38% in three weeks.

Increased volatility in the notes of the US Treasury, which dominate global guarantees, securities and finances, has a negative impact on the leverage and liquidity on the financial markets. That Often leads to reduce Risk-Taking in Financial Markets.

The moving index collapsed after the November 4 elections, softening the financial conditions that probably helped BTC overvoltage up to $ 108,000 against $ 70,000.

The cryptocurrency rally culminated in December-January while the move has the substance.