Islamabad:

The National Assembly approved on Thursday the budget of 17.6 Billions of rupees, as well as 463 billion new taxes, bringing the digital economy as the tax laws, but almost canceled the largest measure of application the most important application to prohibit economic transactions by non -eligible persons.

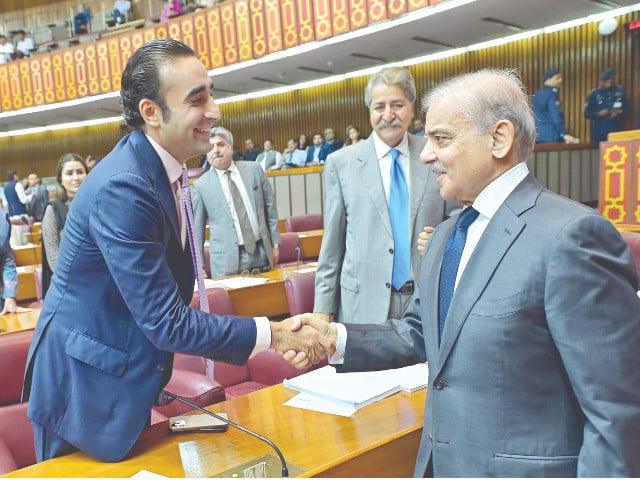

The National Assembly approved the second budget of the government of Prime Minister Shehbaz Sharif with a comfortable majority. During a vote on a clause, the government of the coalition brought together the support of the 201 members of the National Assembly against 57 votes from the opposition parties.

It was also the second budget presented by the Minister of Finance Muhammad Aurangzeb to the National Assembly. With the approval of the Assembly and the subsequent assent by President Asif Ali Zardari, the 2025 financing law will come into force from Tuesday.

The National Assembly approved a budget of 17.6 Billions of rupees for the financial year 2025-26, which makes the largest allowance of 8.2 Billions of rupees for payments of interest.

Defense expenditure would consume 2.55 rummage of rupees, the most important expenses on the budget, excluding the expenses of the armed forces development program and military pensions.

The subsidies are the third largest head with more than 1.1 billion of rupees, followed by more than 1 billion of rupees for pensions, 1 billion of rupees for development spending and 917 billion rupees to direct the civil government.

The National Assembly also approved to effectively exempt the income from the National University of Beaconouse, the Federal University of Ziauddin, Punjab Police Welfare Organization and officers of the Beuvevolent Fund and EndeSeved Family Scheme of the tax.

The tax on national logistics cell contracts (NLC) has been set at a minimum of 3% of the gross value of contracts. But if total responsibility is greater than the tax collected, the NLC will be invoiced at the normal tax rate of 29%, according to the bill approved by the National Assembly.

The arrest powers for the Federal Board of Return will remain in the law, but with the inclusion of some additional guarantees, as said by Pakistan Bilawal Bhutto Zardari and Vice-Prime Minister Ishaq Dar.

This is the best budget that any government can give in difficult circumstances, said President FBR when speaking at L’Express PK Press Club. He declared that certain fundamental principles had been established in the budget, in particular deterrence against fraud and the framework of a registration of taxpayers for sales tax purposes.

To discourage the use of cash, President FBR said that the National Assembly had approved of not granting expenses in the event of cash payment value of more than 200,000 rupees. Likewise, input tax adjustment has also been refused on cash payments of supplies beyond a certain threshold, he added.

Langrial said that foreign sellers and digital markets have also been submitted to the Tax Law Region.

The National Assembly approved 463 billion rupees of new tax measures, including 36 billion rupees which were introduced after the presentation of the budget in the National Assembly on June 12. The largest budget measures were to impose taxes, both on sales and income, on online platforms, electronic commerce, cash delivery by mail and digital services taxes such as streaming.

A new RS2.5 climate support sample by LIY DE LITRE is imposed on each liter of petrol and diesel. Another new tax of 1% to 3% has been imposed on fuel -based conventional cars to subsidize electric vehicles. Retirees were introduced into the tax net, but only annual pensions of more than 10 million rupees are taxed at the rate of 5%. The fourth new tax is of RS10 Federal Incisis Dusty on each day of a day sold in the country.

The government had claimed the collection of 389 billion rupees during the next exercise at the rear of the greatest measure of application of the prohibition of economic transactions by ineligible persons. The Minister of Finance had warned during his post-bunding press conference that if parliament had not adopted this law, then up to 500 billion rupees, the mini-budget should be presented.

The government on “instructions” by the Prime Minister reduced these strict powers.

The National Assembly has approved that the ban on buying land or residential houses by an unacceptable person will only apply if the value of the property exceeds 50 million rupees. This limit exceeds 100 million rupees for commercial plots or properties. Ineligible people can still buy up to 7 million cars.

President FBR Rashid Langrial said that in the first stage, the government has established the principle of the inadmissible and that the limits can be revised in the future.

At the start of this year, the president of the FBR had informed the Standing Committee of the National Assembly which, due to almost no capacity of the FBR, to audit tax declarations, the success rate in the source survey after having made these purchases was only 3.7%.

The condition of ineligibility will only apply if the value of cash withdrawal from the bank account is greater than 100 million rupees per year. The condition of ineligibility for stock market investment would be applicable, if the cumulative investment in one year is greater than 50 million rupees.

However, ineligible people cannot maintain backup accounts in banks.

The Minister of Finance also announced to exempt a residential ownership owner of payment of up to 6.5% deduction tax at the time of the sale, if the property is sold after having kept it for at least 15 years.

The National Assembly has also approved to increase the income tax rate from the debt of the common funds issued to companies from 25% to 29%. He also approved to increase the tax rate on the benefits earned by granting government loans from 15% to 20%.

The National Assembly slapped a right of federal excise (Fed) of RS10 by a day old chick. The government estimated that around 1.5 billion chicks are produced each year and it will receive 15 billion rupees by taxing a product which is a common diet of the poor and the rich.

The National Assembly approved a 10% sales tax on the import of solar panels.

Powers of judgment against tax fraud

The National Assembly approved to give the arrest powers to the FBR in cases of sales tax fraud after several cycles of negotiations between the PPP and the PML-N.

According to the law adopted by the National Assembly, a person cannot be arrested at the stage of the investigation of fraud to the sales tax. In the event of arrest, the accused will have the right to obtain a deposit of the court. These two new guarantees were added after the last series of negotiations between the PPP and the PML-N on Wednesday.

The president of the Pakistani peoples’ party Bilawal Bhutto Zardari said on Thursday that his party supported the federal budget with all my heart after the government has accepted its requests for exemption from income tax on employees earning 100,000 rupees and reduces the sales tax on solar panels.

However, unlike Bilawal’s complaint, the government has not exempted salaried income from 1.2 million rupees from the tax. The income tax rate over up to 1.2 million annual income will be 1%, against 5% before the budget, according to the bill approved by the National Assembly.

The annual income tax of 1.2 million rupees was exempt from the request of the PPP, said Bilawal Bhutto speaking upstairs of the house.

Bilawal also declared that the government had also accepted PPP reserves concerning access to arrest powers at the FBR. The government has agreed that arrest powers will only be limited to the counterfeit sales taxes and that at the survey stage, no arrest will be made, said Bilawal.

Tax fraud will also be an offense under bail, said the president of the PPP while announcing the agreement of his party with the government on the powers of arrest.

The Express PK Press Club reported Thursday that the PPP refused to vote on the bill due to a proposal to grant arrest powers to the FBR. However, Dar ISHAQ DAR convinced the PPP to withdraw the objections.

DAR also told L’Express PK Press Club that new guarantees had been added in the finance law to respond to the concerns of the PPP.

The PPP president said the government has also increased the BISP budget by 20% at the PPP demand. The government has allocated 716 billion rupees for the BISP for the next exercise.