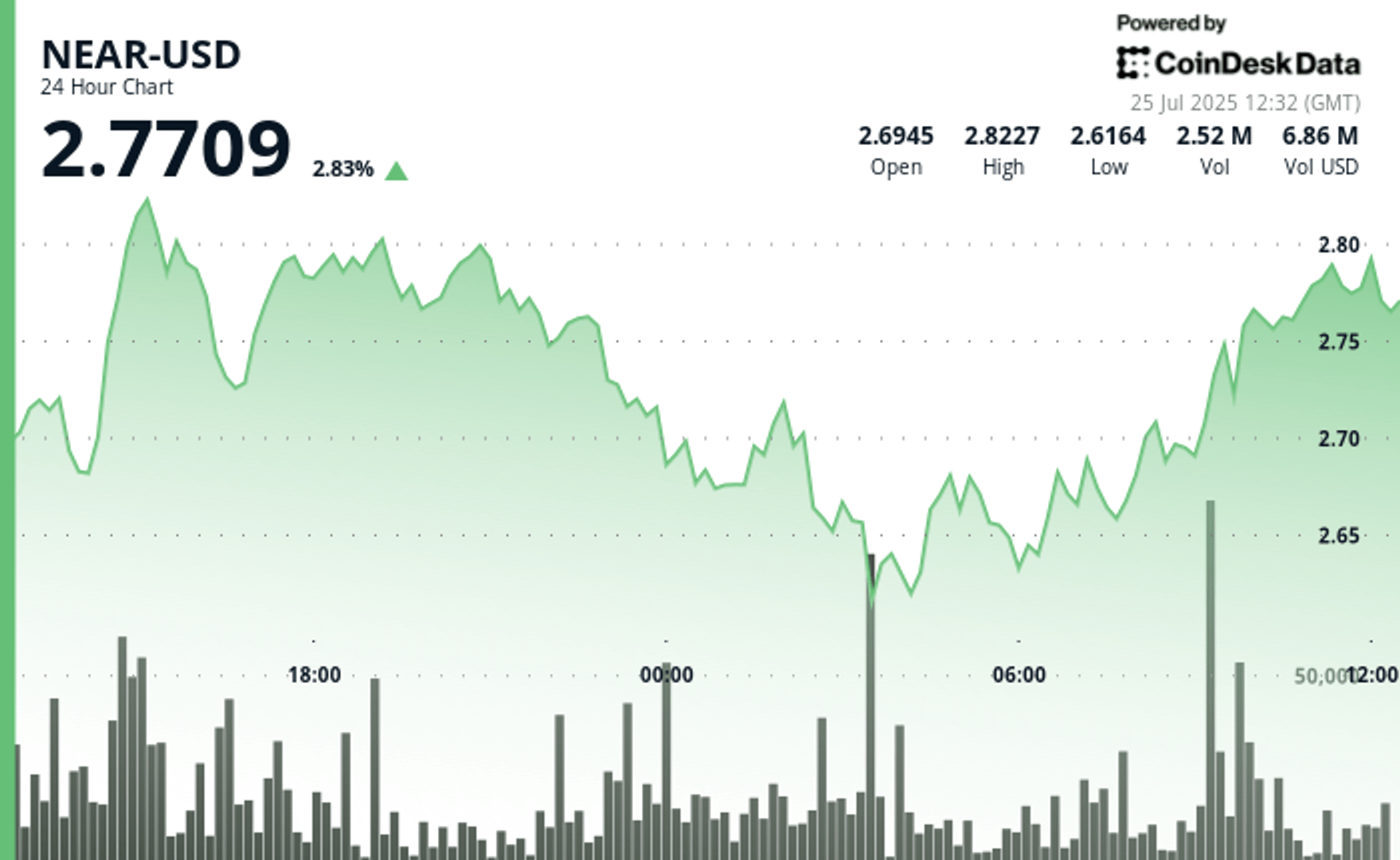

Near the protocol rebounded 0.7% between 11:10 am and 12:09 UTC Thursday, erasing a brief diving of $ 2.77 in a volatile negotiation window marked by sudden institutional entries. The token came from $ 2.79 to $ 2.77 before recovering the session peaks, highlighting a biphase movement characterized by consolidation nearly $ 2.78, followed by a SELOFF and a quick recovery.

The rebound was triggered by a high increase in volume, with more than 123,000 units exchanged after 12:01, perceiving the resistance levels and accumulation of signaling potential by large players. This decision closed a wider gathering of 6.9%, going from $ 2.61 of support overnight to a fence of $ 2.79 among the negotiation window from July 24 to 25, fueled by increased volatility and a rekindled bullish feeling.

Analysts consider overvoltage as a potential configuration for a level of resistance level of $ 2.83, with longer term projections located near a fork of $ 1.95 to $ 9.00 for 2025 and up to $ 71.78 by 2030. The continuous development of transversal puncture with the Solana and the tone is cited as a catalyst for institutional interest and Potential prices.

Haussier impetus of technical escape signals

- The negotiation range of $ 0.22 represents a volatility of 8.50% between $ 2.83 maximum and $ 2.61 at least during the 23 -hour period.

- Solid level of support of $ 2.61 confirmed with a volume greater than 3.18 million daily means.

- Recovery momentum from $ 2.69 to $ 2.79 target target targets of $ 2.83 per breakthrough in the resistance zone.

- Consolidation of $ 2.78 precedes the net support test of $ 2.77 during the volatility of mid-session.

- An exceptional unitary volume of 123,000+ during the overvoltage of the final hour confirms the phase of institutional accumulation.

- Multiple resistance levels broken during recovery establishing new session peaks of $ 2.79.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.