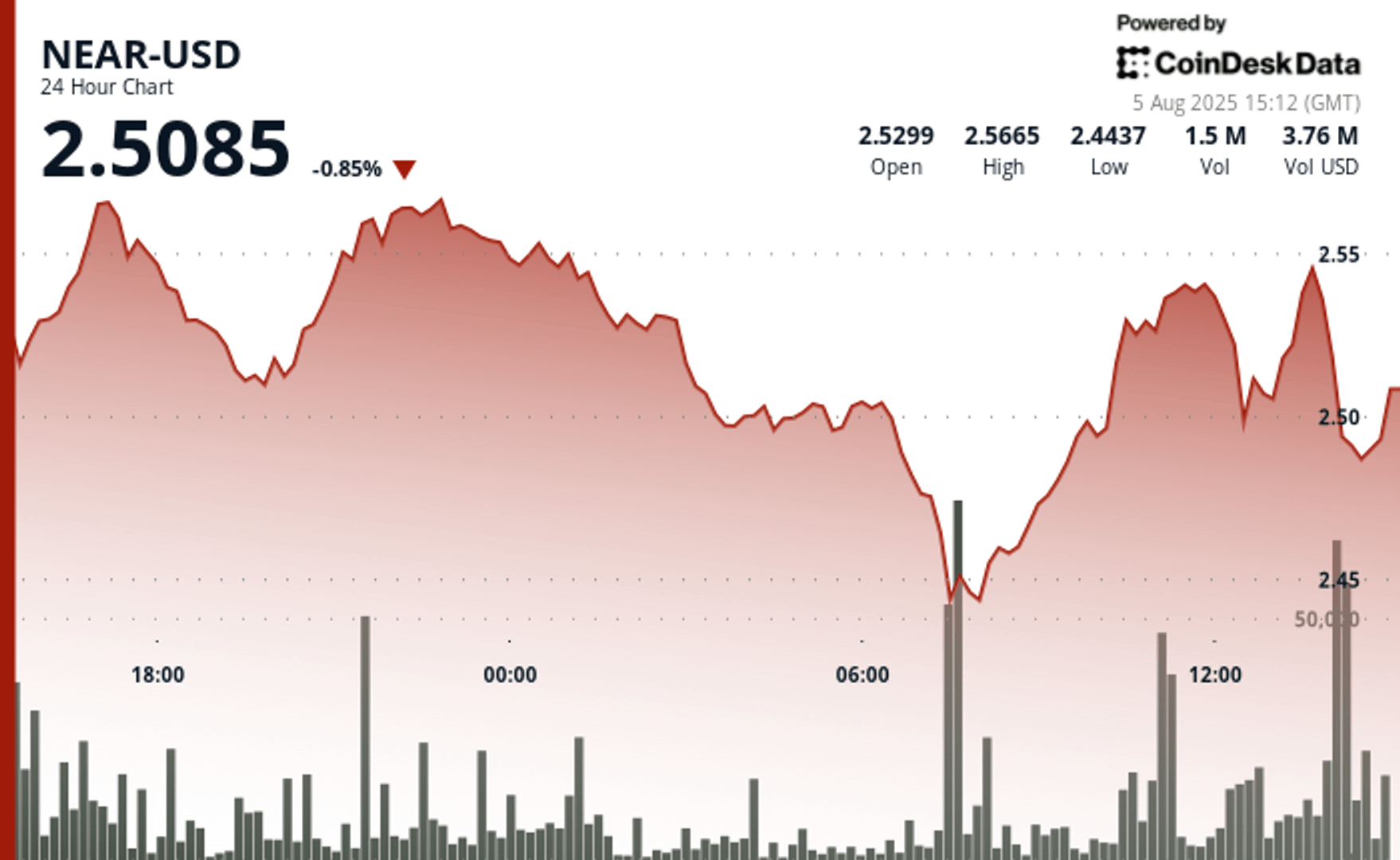

Technical analysis shows a volatile recovery model

Near the extreme volatility trades over 24 hours ending on August 5, 2 p.m. Price swings $ 0.13, marking 5% between $ 2.57 and $ 2.44.

Morning Seloff hits hard at 07:00, driving nearly $ 2.48 to $ 2.44. The volume increases 3.2 million units, confirming heavy institutional dumping.

The support is $ 2.44 with solid volume support. The bulls intervene immediately. The recovery rally pushes almost $ 2.54 per session session. The technical reversal model emerges while buyers defend the key support area.

Technical indicators highlight market dynamics

- Price of the negotiation range of $ 0.13, which represents a volatility of 5% between $ 2.57 and $ 2.44 low during the session

- The morning accident from $ 2.48 to $ 2.44 at 7:00 a.m. triggers a peak in massive unit volume of 3.2 million, confirming institutional sales pressure

- The recovery phase establishes an upward channel with a support of $ 2.52 and resistance levels of $ 2.54

- The last hour from 1:09 p.m. to 2:08 p.m. offers a bullish escape model, displaying 1% gains

- The volume concentration reaches more than 100,000 units per minute for 13: 33-13: 39 window, signaling institutional accumulation

- The volume of trading falls zero in the last three minutes, suggesting an institutional positioning before the potential movement of the rupture

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.