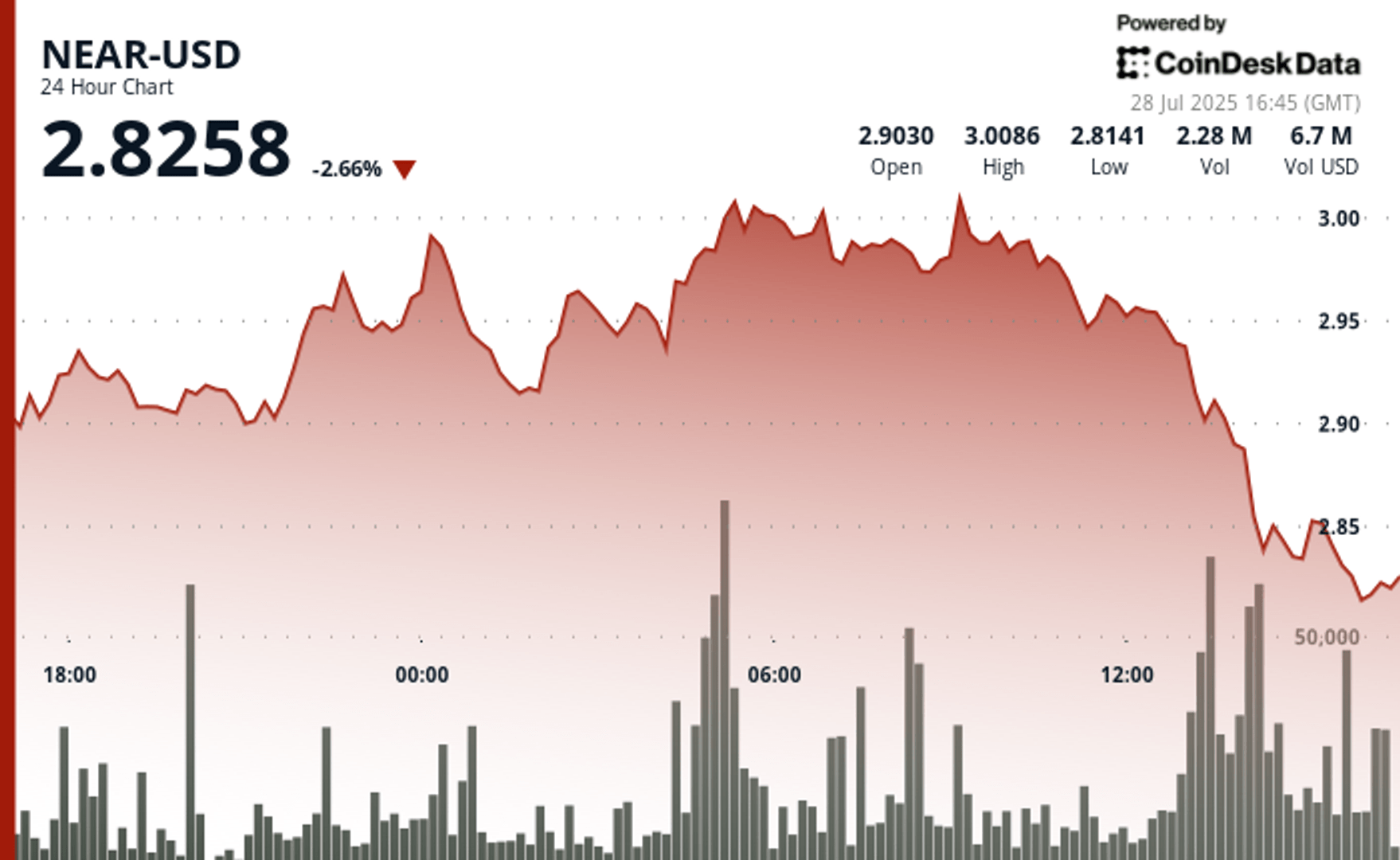

The ear protocol saw the volatility pronounced during the period 24 hours a day from July 27 at 3 p.m. to July 28 at 2:00 p.m. UTC, fluctuating in a range of 5% between $ 2.88 and $ 3.01. The token initially gone from $ 2.90 to a summit of $ 3.01 to 9:00 am UTC on July 28, meeting with the resistance of the company at this level. The price action was marked by a strong increase in the increase until the institutional sales pressure has emerged, indicated by a peak in negotiation volume at 3.10 million, above the average of 24 hours of 2.35 million.

This bullish race was short -lived, because near the opposite reversed during the negotiation time of 1:00 p.m. UTC, from $ 2.94 to $ 2.89 in the middle of an amazing negotiation volume. The magnitude of this sale – more than double the daily average – consists of a possible institutional distribution and a marked change in the feeling of the short -term market. The following 60 -minute window has been downward continuation, the token from $ 2.93 to $ 2.89, forming a decreasing channel between $ 2.93 and a $ 2.88 support.

Several high volume sales throughout the last hour, especially at 13:21, 13:32 and 14:04 UTC, suggest a persistent lower momentum. Commercial activity has dropped sharply in the last minutes, referring to the short -term exhaustion of the market and potential lateral consolidation near the level of $ 2.89. With almost seated at the lower end of its intra -day range, traders can turn to wider macro signals before determining the following movement.

The direction of nearby altcoins and others can ultimately explain if Bitcoin can break above the level of psychological resistance of $ 124,000 and enter a consolidation phase. A successful BTC rupture could trigger a capital rotation in altcoins, preparing the way for an impetus renewed upwards in assets as close.

Technical analysis summary

- Resistance firmly established at $ 3.01, triggering high sales pressure.

- Initial ascent marked by volumes exceeding the average of 24 hours of 2.35 million.

- A net reversal of $ 2.94 to $ 2.89 with a volume at 5.03 million, more than double the average.

- The downward trend channel was formed between the $ 2.93 resistance and the $ 2.88 support.

- Several intra-hour volume overvoltages (200K +) are aligned with strong price refusals.

- The last minutes saw a negligible volume, indicating a possible depletion of the market nearly $ 2.89.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.