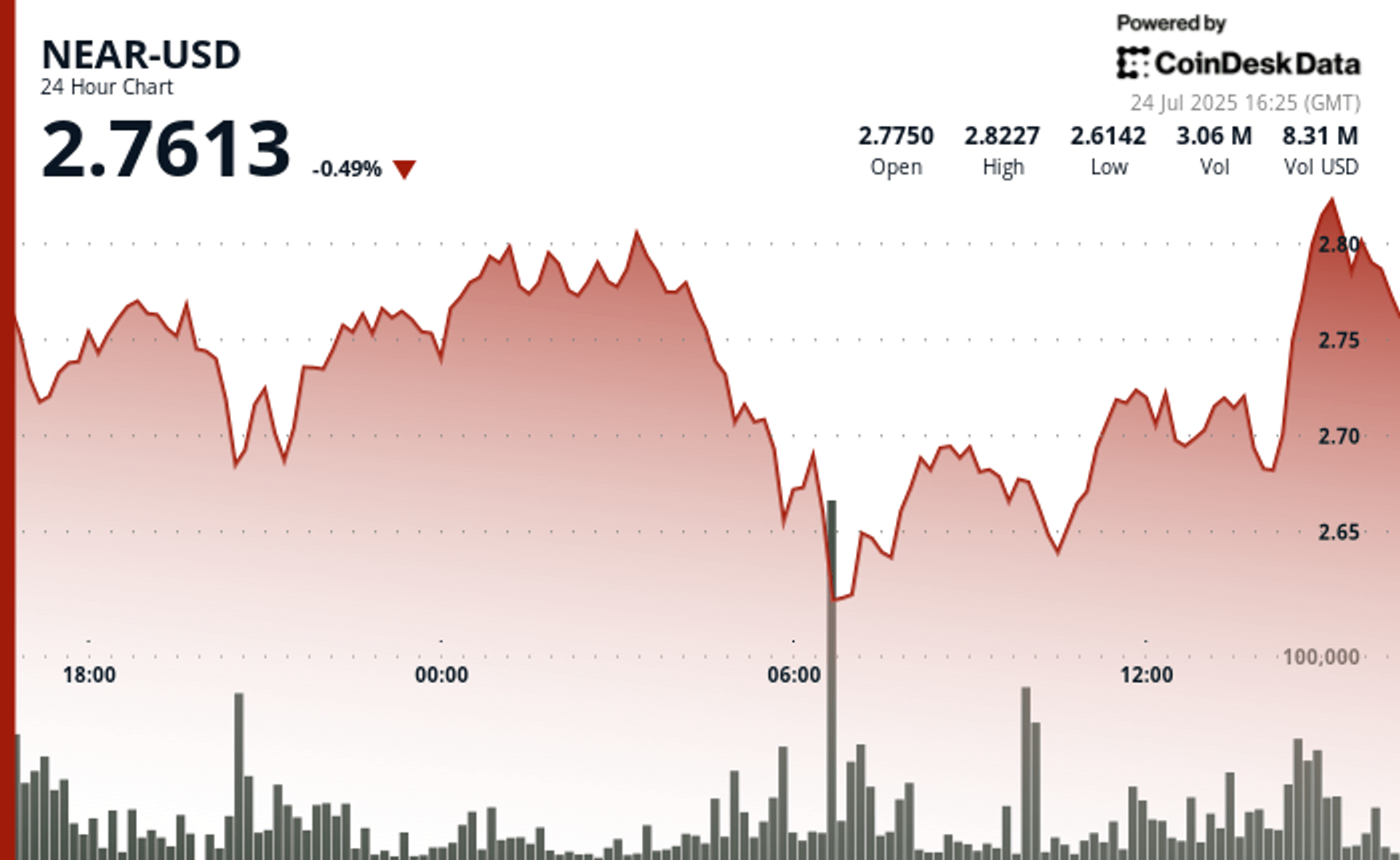

Close to the volatility of notable prices experienced during the 24 -hour period ending on July 24 at 3:00 p.m., his token negotiating between $ 2.59 and $ 2.83. The net decrease of $ 2.82 to $ 2.59 during the hours early in the morning caused a high volume exchange of 7.91 million units, establishing a level of technical support at the low level.

This dislocation of the market has attracted aggressive purchases, which fueled a price resumption of $ 2.81 by the closure, signaling a strong interest of sophisticated investors capitalizing on reduced evaluations.

During the last hour of negotiation, almost sustained upwards, going from $ 2% to $ 2.72 to $ 2.79 despite profit taking near the resistance at $ 2.82. The session established a commercial channel defined with support for $ 2.79, and analysts interpreted the resulting consolidation as a healthy price discovery.

This model has strengthened the previous thesis of strategic accumulation by institutions in the middle of the early volatility of the day.

At the same time, almost announced a strategic partnership with Everclear to build a transversal stablecoin settlement infrastructure targeting the digital asset compensation market of 1 Billion.

The expansion of Everclear at 23 sustained blockchains and quarterly growth of 111% aligns with the use of chain abstraction technology by close to support effective and low -cost transversal transactions.

This collaboration responds to regulatory concerns and the fragmentation of liquidity in the digital asset ecosystem, affirming the resilient positioning of the market and the long -term value proposal despite the recent volatility.

Technical analysis

- Exceptional intra -day volatility range of $ 0.24 representing a spread of 9% between the maximum price of $ 2.83 and the minimum of $ 2.59

- A net morning drop from $ 2.82 to $ 2.59 in 05: 00-06: 00 negotiation session accompanied by a high volume of 7.91 million units

- Technical support level established at $ 2.59 with evidence of aggressive institutional purchase interest

- Prolonged recovery momentum resulting in regular assessment of prices when closed at $ 2.81

- Last hours trading showing a continuous upward dynamic with a gain of $ 2.72 to $ 2.79

- Training of technical channels with a support defined at $ 2.79 and resistance at $ 2.82

- Intrajournal peak from $ 2.82 to 15:20, followed by a measured drop in profit at $ 2.79