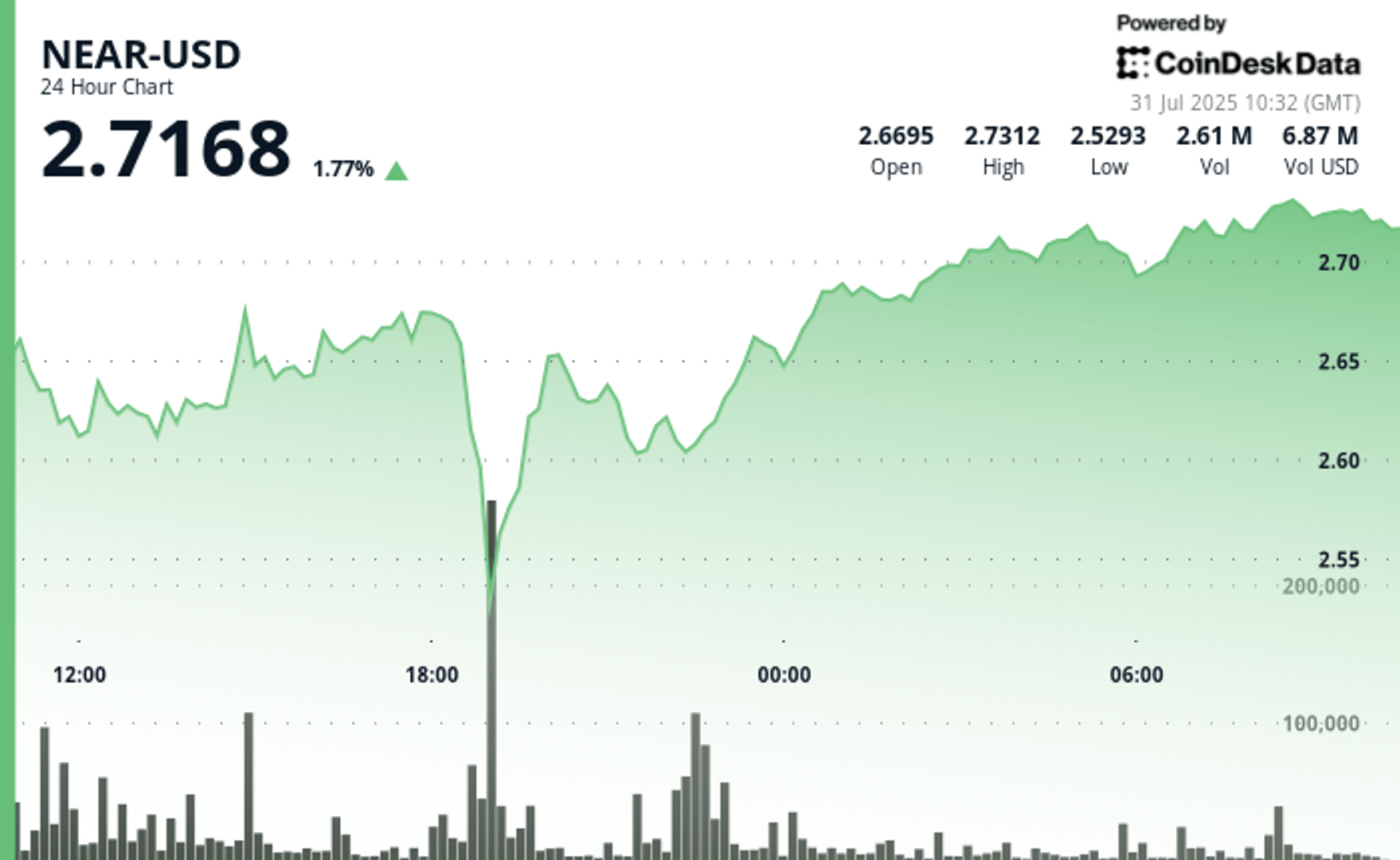

Near the protocol demonstrated a formidable resilience during the negotiation session from July 30 to 31, recovering highly from $ 2.52 in mid-term of $ 2.52 to $ 2.73. The rebound – reaching an 8.27% rebound – coincided with high volume activities, especially among business negotiation offices and institutional asset managers. Analysts interpret this as a sign of strategic accumulation, probably caused by growing confidence in the ambitions of Near’s business blockchain.

The institutional activity was the most obvious on July 30 between 6 p.m. and 7:00 p.m., while almost a steep drop from $ 2.68 to $ 2.52 over a volume peak greater than 9.60 million shares. This sale has defined a critical accumulation area. From this base, almost recovered during the session overnight, corporate merchants defending the level of support of $ 2.52 and the positions accumulated methodically.

The final negotiation time on July 31 – from 09:05 to 10: 04 – offered additional evidence of institutional participation. While the head gains for this hour were only 0.15%modest, a sustained volume of overvoltages greater than 28,000 shares per transaction pushed through the resistance at $ 2,725. Strategic purchases at 09:17, 09:25, 09:52 and 10:01 highlighted the coordinated positioning by sophisticated investors preparing for a longer -term business adoption.

Industry experts note that Narch’s performance is emblematic of a broader trend in which institutional investors selectively allocate capital to layer 1 blockchain protocols with the integration potential of the perceived company.

Summary of technical analysis:

- Commercial fork: $ 2.52 (support) at $ 2.74 (resistance), which represents a volatility of 7.83%.

- Volume peak: 9.60 million shares were negotiated at July 30 at 6 p.m. to 7:00 p.m.

- Institutional accumulation area: $ 2.52 to $ 2.55 identified as key support.

- Final hour trading (July 31, 09: 05-10: 04):

- Modest gain of 0.15% from $ 2.72 to $ 2.73.

- Volume> 28,000 shares at each strategic entry (09:17, 09:25, 09:52, 10:01).

- Resistance at $ 2,725 violated decisively.

- Session net gain: + 2.87% over 23 hours.

- Cumulative institutional rebound: + 8.27% from $ 2.52 to $ 2.73.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.