The cryptocurrency market shows renewed signs of force, because a close protocol has enabled a key resistance during the time of final negotiation of July 7. The decisive movement came on an exceptional volume which was 61% higher than the daily average, confirming the validity of the escape of an upward triangle model which had formed throughout the day.

Negotiation data shows solid support established by the USD in the range of $ 2.16 to $ 2.17 with several rebounds before ultimately overcoming resistance to $ 2.19 to $ 2.20. The breakthrough was particularly notable during the 60 -minute period ending at 2:04 pm, when it jumped almost 1.13% from $ 2.17 to $ 2.19, forming what analysts describe as a cup of textbooks and a handle model.

This technical development occurs while the wider cryptography market is experiencing a significant dynamic, Bitcoin crossing $ 109,000 and the approach of its summit of $ 111,970.

The total market capitalization of cryptocurrency extended to 3.36 billions of dollars over a 40% increase in the volume of negotiation, creating favorable conditions for altcoins, as if to capitalize on the improvement of the feeling of the market. Despite the action of the positive prices of nargers, the asset remains significantly lower than its summit of $ 20.42 reached in January 2022. Current technical indicators have a mixed image, with 14 green days out of the last 30, but an RSI of 31.09 suggesting occasions of occurrence which could support additional recovery.

Technical analysis

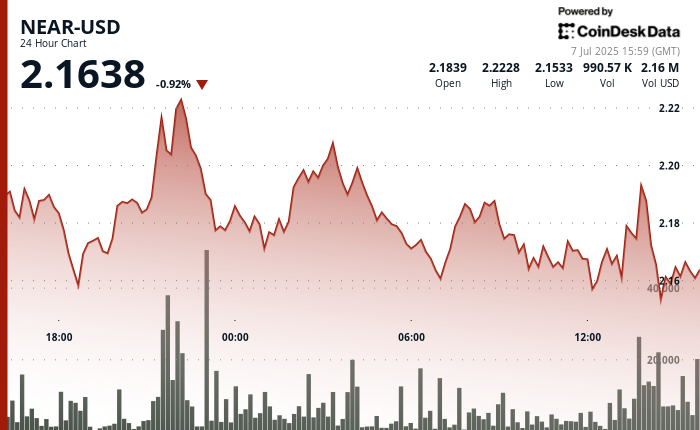

- Near the USD presented notable volatility during the period 24 hours a day, July 6 to 7 to 7 a.m. to 7 p.m., with a price range of $ 2.16 to $ 2.22, representing a 3.15%swing.

- The assets established a key support at $ 2.16 at $ 2.17 with several rebounds, while the resistance at $ 2.19 to $ 2.20 was finally overcome during the last hour on an exceptional volume (1.97 m vs average 24 hours a day, 1.22 m).

- The decisive break above $ 2.19 level, associated with the formation of an upward triangle model throughout the period, suggests an upward extension potential with the next resistance target at $ 2.22.

- During the 60 -minute period of July 7 1:05 p.m. to 2:04 p.m., near the USD showed a strong upward trend, going from $ 2.17 to $ 2.19, representing a gain of 1.13%.

- The assets crossed the resistance of the keys to $ 2.18 with exceptional volume tips at 13: 57-13: 58 (143,856 units)Forming a cup and sleeve motif which led to a decisive break at $ 2.19.

- Support established at $ 2.16 during the backward decline (13: 17-13: 20) Holding firmly, buyers intervene aggressively to feed the subsequent rally which culminated at $ 2.19 before minor benefits occur in the last minutes.

CD20 Whipsaws 1.17% before finding support

The CD20 index experienced significant volatility in the last 24 hours of July 6 3 p.m. July 2:00 p.m., with a significant price range of 1.17% ($ 21.06) Between the summit of $ 1,793.57 and the lowest of $ 1,772.50.

After reaching a peak during the first hours of July 7, the market entered a consolidation phase with a sharp drop of 1.17% to $ 1,772.50 to 1:00 p.m. before going back to $ 1780.94 by the end of the period, suggesting potential stabilization after anterior volatility.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.