The global markets are sailing increased uncertainty following a public spit between US President Donald Trump and Tesla CEO Elon Musk.

Near the protocol demonstrated resilience in the midst of this volatility, recovering from a sharp decrease of 5.2% to establish support at $ 2.42.

The recent price action shows promising accumulation signs, with an increasing volume on the second support test forming a potential double -bottomed pattern on short deadlines.

This technical structure, combined with successful rupture above the resistance zone from 2.46 to $ 2.47, suggests that buyers regain control despite larger market turbulence.

The resumption of N Quart can indicate growing institutional confidence in blockchain infrastructure projects with real public service.

Technical analysis

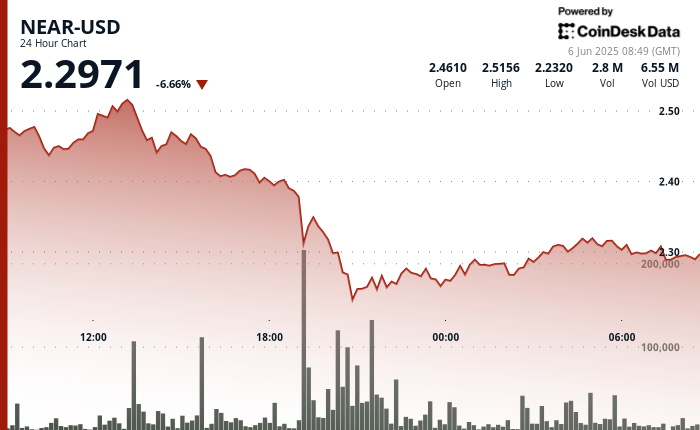

- The quasi-USD showed substantial volatility over a period of 24 hours, with a range of 0.132 (5.2%) between the top of 2.547 and the lowest of 2.415.

- The assets experienced a sharp decline during the 8:00 p.m. on June 4, establishing a level of key support at 2.423 with an average volume of 2.69 m.

- A double -bottom potential pattern formed with an increasing volume on the second support test, suggesting an accumulation at lower levels.

- The resistance was established around 2,462-2,470, the current recovery approaching this critical area.

- During the last hour, the quasi-USD demonstrated a significant bullish momentum, going from 2,433 to 2.455, representing a gain of 0.9%.

- Price action has formed a clear rise trend with notable volume tips at 07:15 (206k) and 07:37 (120k), indicating a strong interest from the buyer.

- A temporary peak of 2.462 was reached at 07:34 before a net withdrawal at 2.445, establishing a new level of support.

- The recovery of this drop led to a final push at 2.458 at 07:54, followed by a consolidation around 2.455.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to ensure accuracy and membership of our standards. For more information, see the complete Coindesk AI policy.