The Commercial Company based in Digital Laser Switzerland, which is part of the Nomura group, denied any involvement in the jetra Flash crash which saw OM lose 90% of its value.

“The claims circulating on social networks which connects the laser to the” sale of investors “are in fact incorrect and deceptive,” wrote the firm on X.

Laser Digital then shared its controlled mantra portfolio addresses, which none of which shows deposits to exchanges or sales activities.

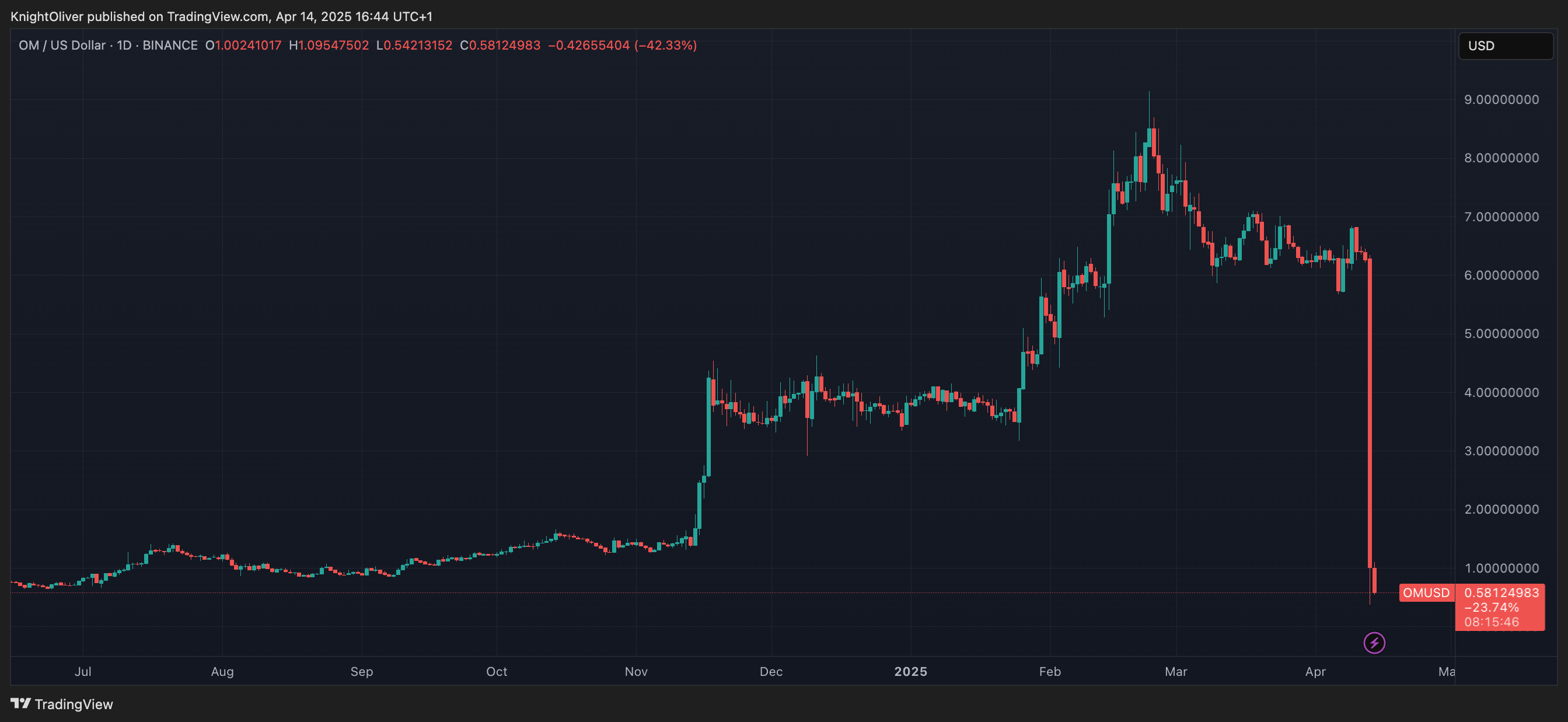

Speculation remains hiker about the reasons why OM collapsed so violently. The Mantra team insists that this was due to wider market pressures and centralized closing of force, which led to a liquidation cascade.

OKX said price volatility has occurred due to an increase in the volume of negotiations associated with an initial drop in prices on various exchanges outside OKX, before spreading on the wider market.

Before the accident, 17 portfolios deposited 43.6 million OM ($ 227 million) to trade, this led to a panicked response from holders while the Mantra team holds 90% of the supply of token, stimulating the initial sale.

OM is currently negotiating $ 0.57, down 90% compared to the summit of the day by $ 6.14, the negotiation volume increased by $ 2.6 billion, according to CoinmarketCap.