- Nvidia commits $ 100 billion in Openai while strengthening the demand for her equipment

- The partnership builds massive data centers and feeds concerns about circular investment structures

- Analysts warn that the agreement may increase the antitrust exam because Nvidia strengthens the domination of the AI

After her recent surprise of $ 5 billion, Nvidia is again large, this time being brought up to $ 100 billion in Openai alongside providing millions of her chips.

This decision corresponds to a broader scheme in which Nvidia channeurs money in companies that rely on its own equipment, from $ 6.3 billion to Coreweave to NSCAL $ 700 million, effectively strengthening demand for its products while bypassing hyperscalers like Google and Microsoft which are underway to reduce their dependence on Nvidia equipment.

This last investment in the most famous IA company in the world immediately increased Nvidia’s market value by more than $ 220 billion.

Circular structure

The agreement implies a circular structure and will see Nvidia will buy non -voting actions of Openai, which Optaai will then spend mainly on Nvidia systems.

Quoting familiar people with the problem, PK Press Club Said that the partnership will start with an investment and a scale of $ 10 billion while OpenAi deploys more computer power.

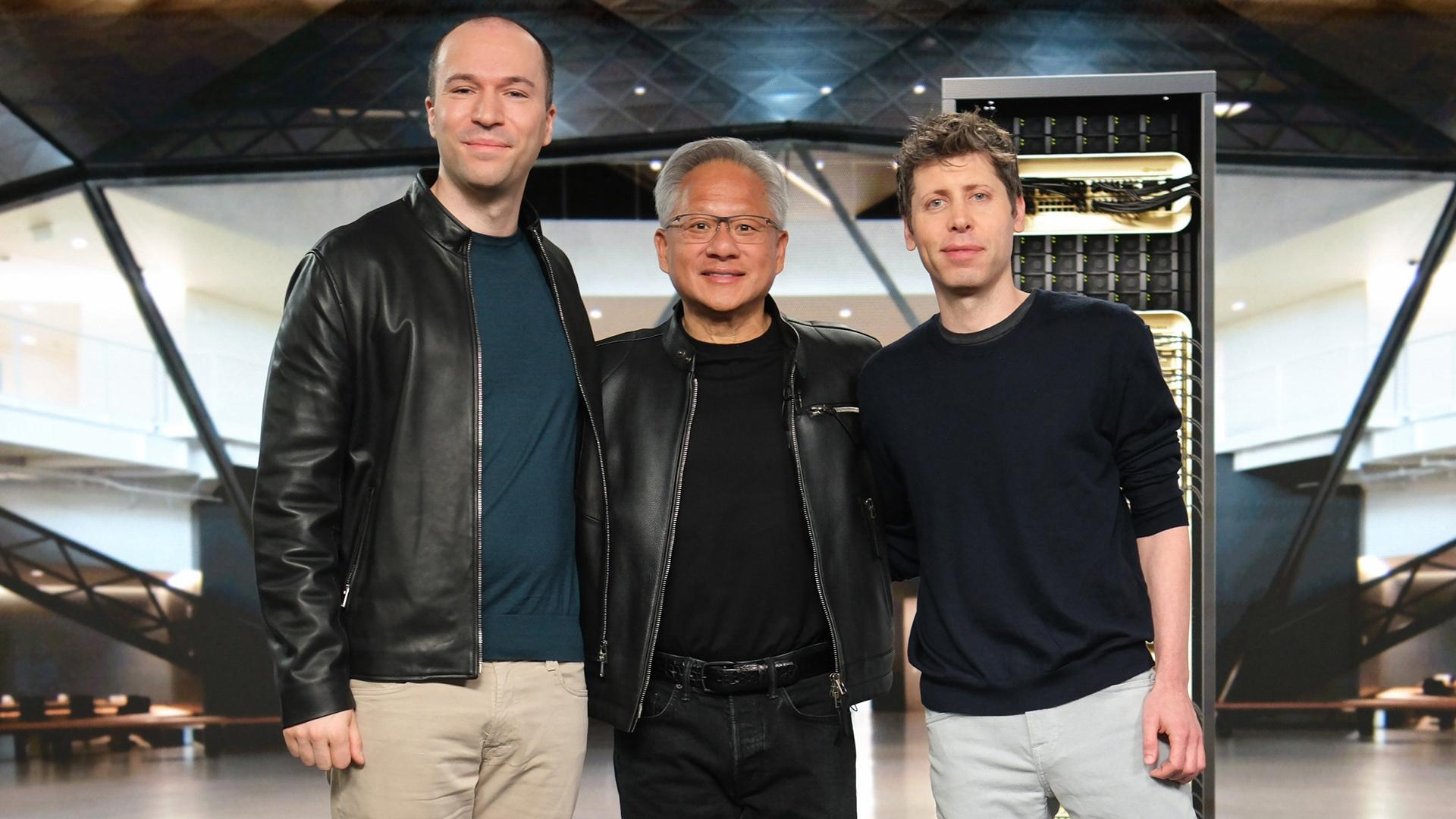

“This is the biggest AI infrastructure project in history,” said Jensen Huang, founder and CEO of Nvidia CNBC‘S Jon Fort. “This partnership aims to build an AI infrastructure which allows AI to pass laboratories in the world.”

He said companies would create data centers capable of executing new generation AI models, fueled by the new Vera Rubin platform in Nvidia.

The first data centers are due online in 2026 and require 10 gigawatts of power, almost equal to the needs of 8 million American households.

OPENAI’s managing director Sam Altman said that the capacity was essential for the company’s ambitions.

“The construction of this infrastructure is essential to everything we want to do,” said Altman. “This is the fuel we need to stimulate improvement, generate better models, generate income, drive everything.”

Analysts welcomed the long -term demand for Nvidia products, but warned against the structure of the agreement.

“On the one hand, this helps to open the opening of certain very ambitious objectives for calculation infrastructure,” said Stacy Rasgon in Bernstein. “On the other hand,” circular “concerns have been raised in the past, which will feed them more.”

Kim Forrest, director of investments, Bokeh Capital, also seemed to be caution. “It seems that Nvidia is investing in its biggest customer. These arrangements can be beneficial for both parties. But there can also be dangers. Being completely linked to each other can cause myopia and can make an entry point so that other chip competitors can enter other AI companies and crown them,” she said.

Market screen Quotes Rebecca Haw Allensworth, antitrust teacher at the Vanderbilt Law School, who says that Nvidia could promote Openai with better prices or faster delivery times.

“They are financially interested in the success of the other,” she said. “This creates an incitement to Nvidia not to sell fleas or to sell fleas in the same terms to other Openai competitors.”

A spokesperson for Nvidia denied that it would be a case, saying: “We will continue to make each customer an absolute priority, with or without any participation.”

To watch