When Celestia broadcast her TIA token at 580,000 users in 2023, it was the dish of the day among merchants and investors, the project claiming that the release was aligned with a new “modular era”.

However, despite the rallying of a dizzying price of $ 20 in September 2024, he has since dropped to less than $ 1.65 in a desperate spell stimulated by a series of massive cliffs in the token acquisition calendar.

Tokenomist data show that basic contributors and the first donors, including a multitude of venture capital, could sell tokens bought for relatively cheap in the first free market collection towers.

This coincided with the rushed passage of TIa downwards, although it should be noted that the market capitalization of the token, currently at 1.2 billion dollars, in fact increased by 50% despite the loss of 90% of its value due to the supply scale.

Other examples

The collapse of TIA prices reflects similar titles through more recent tokens. The unlocking of 10.5 billion blast tokens in June, more than half of its offer, brought prices to lows of all time while investors had trouble absorbing the sudden deluge of liquidity.

Berachain also underwent heavy losses after its air tickets and cliffs acquired from the first ones triggered a long pressure, reducing its token almost in two after launch. Meanwhile, the Omni Network token fell by more than 50% in one day after its beginnings when the first beneficiaries rushed to sell.

These cases emphasize how aggressive acquisition hours and the bad post-launching liquidity continue to weigh on the performance of tokens, even among the most excited projects.

What is the next step for TIA: a slow compression or relaxation?

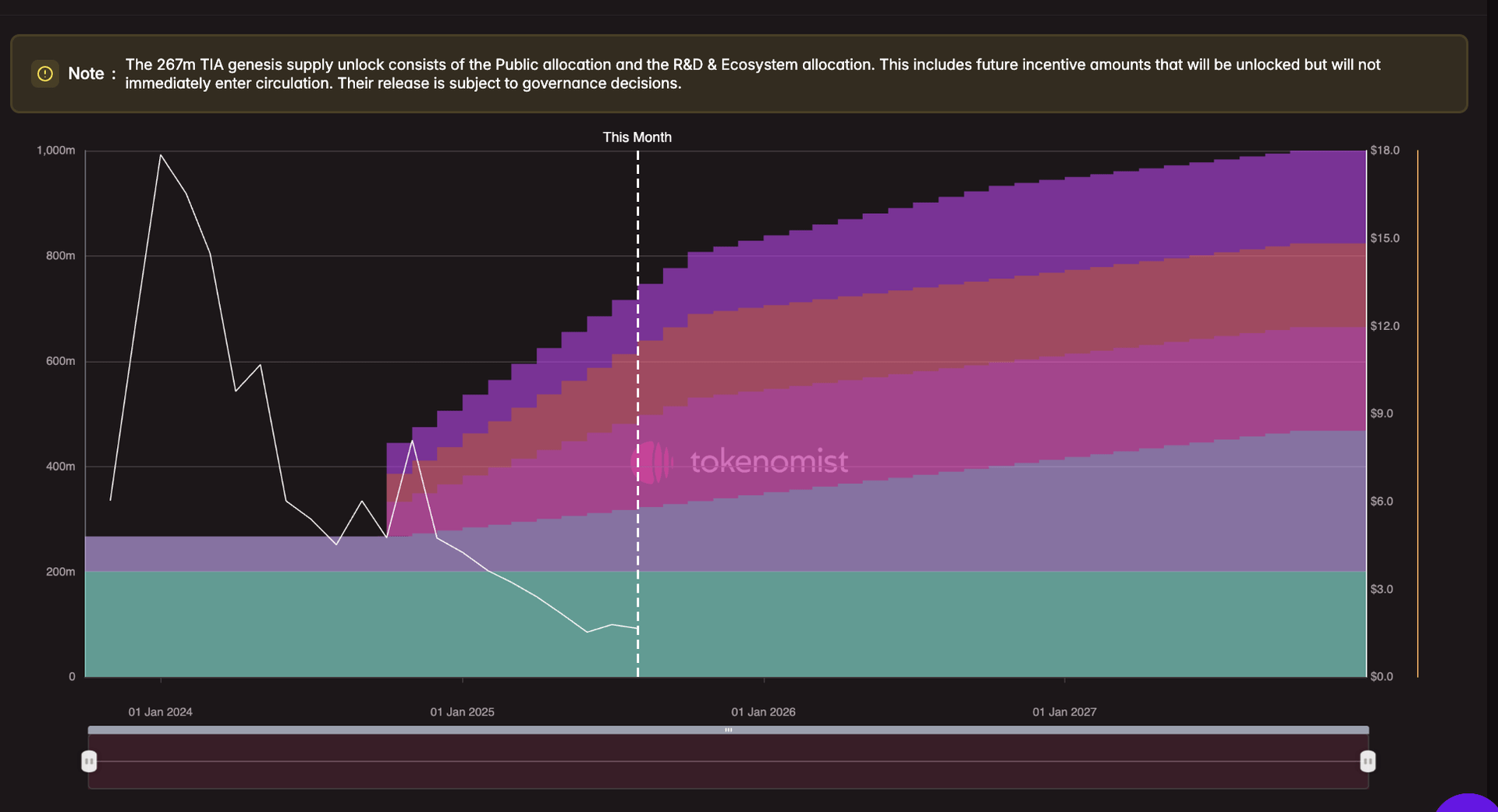

With the Celestia Tia token down more than 90% of its summits, investors are now looking at if the asset is a background or a detangling. After unlocking cliffs from October 2024 which released 176 million tokens (doubling of the supply in circulation), TIA entered a phase of stable linear emissions. About 409 million additional tokens should acquire the start of 2027, adding continuous pressure on the price.

Some traders see a configuration for a short pressure. According to Stix’s trade manager, Taran Sabharwal, a large part of the unlocked tokens was sold over -the -counter, buyers covering themselves by perpetuity. This has led to a high open interest and negative financing, a dynamic which, if it is reversed, could force the shorts to be covered. “The funding is deeply negative,” said Sabharwal. “If it is reset, you might see a pop.”

But unless there is a pressure, the fundamentals remain low. The monthly acquisition continues, the liquidity is slim and the new TIA request is limited. Without a new catalyst, such as the growth of Celestia’s modular ecosystem, the TIA risks more downwards, because each unlocking adds to the sales pressure in an already exasperated market.