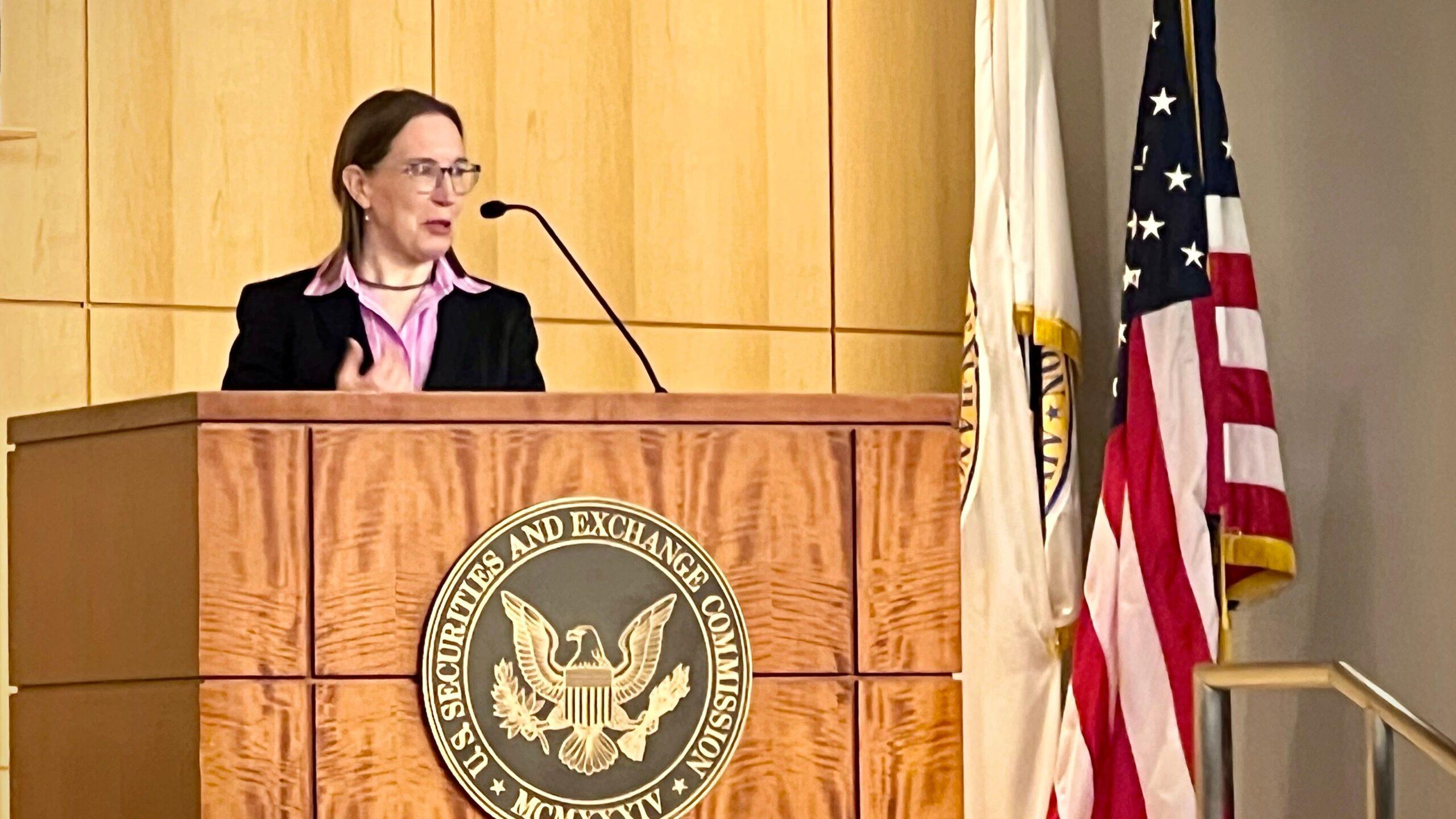

Las Vegas, Nevada – You should not be a libertarian crypto who comes to cry for the help of the government when things go wrong, according to Hester Peirce, the head of the working group on the crypto at the American Securities and Exchange Commission.

“I think that sometimes, when something bad happens in this space, people who are remarkably free thinkers, libertarian people, come to say:” Where was the government? Why don’t you protect me? Hey, crypto mom, where is my bailout? “” She said to a Bitcoin 2025 crowd in Las Vegas, referring to her nickname the industry.

“Come on, let’s have some consistency,” said Peirce. “Yes, you should have the freedom to make your own choices, and when it goes wrong, pick yourself up, dust yourself, learn and do better next time. And it’s the best way to move forward.”

Since the Republicans took control of the SEC, in particular Commissioner Peirce and the newly arrived president Paul Atkins, they worked to issue declarations and directives to carve out of the cryptographic sector of the jurisdiction of the agency, including the same, the cryptocurrency and certain stablecoins. But there remains a way to develop the policies that the agency began while the legislators of the congress also work on the new laws which could still establish its program.

The SEC has a lot of current authority to clarify the nature of the cryptography titles, said Peirce, but if people want an American federal regulator for retail, they will need the congress to produce legislation to get there. She asked her audience the question on Thursday, if they wanted a federal cryptography regulator.

“NO!” Someone shouted.

“There you go, you have an answer,” she joked.

Peirce said most of the cryptographic tokens are not themselves titles and, therefore, the commercial platforms that manipulated them should not register with the SEC unless they also affect the world of securities.

Asked about the same, which, according to a press release from the agency, apart from its application interests, Peirce proposed it as an example of the place where investors must turn to themselves.

“Be an adult,” she said. “If you want to engage in speculation, go ahead. But if something is wrong, don’t complain about the government.”

And as for the trend of companies that put digital assets in their own treasury bills, she said that public enterprises had the right to do what they like – as long as they disclose it correctly.

“They can make their own decisions,” she said. “I am agnostic.”