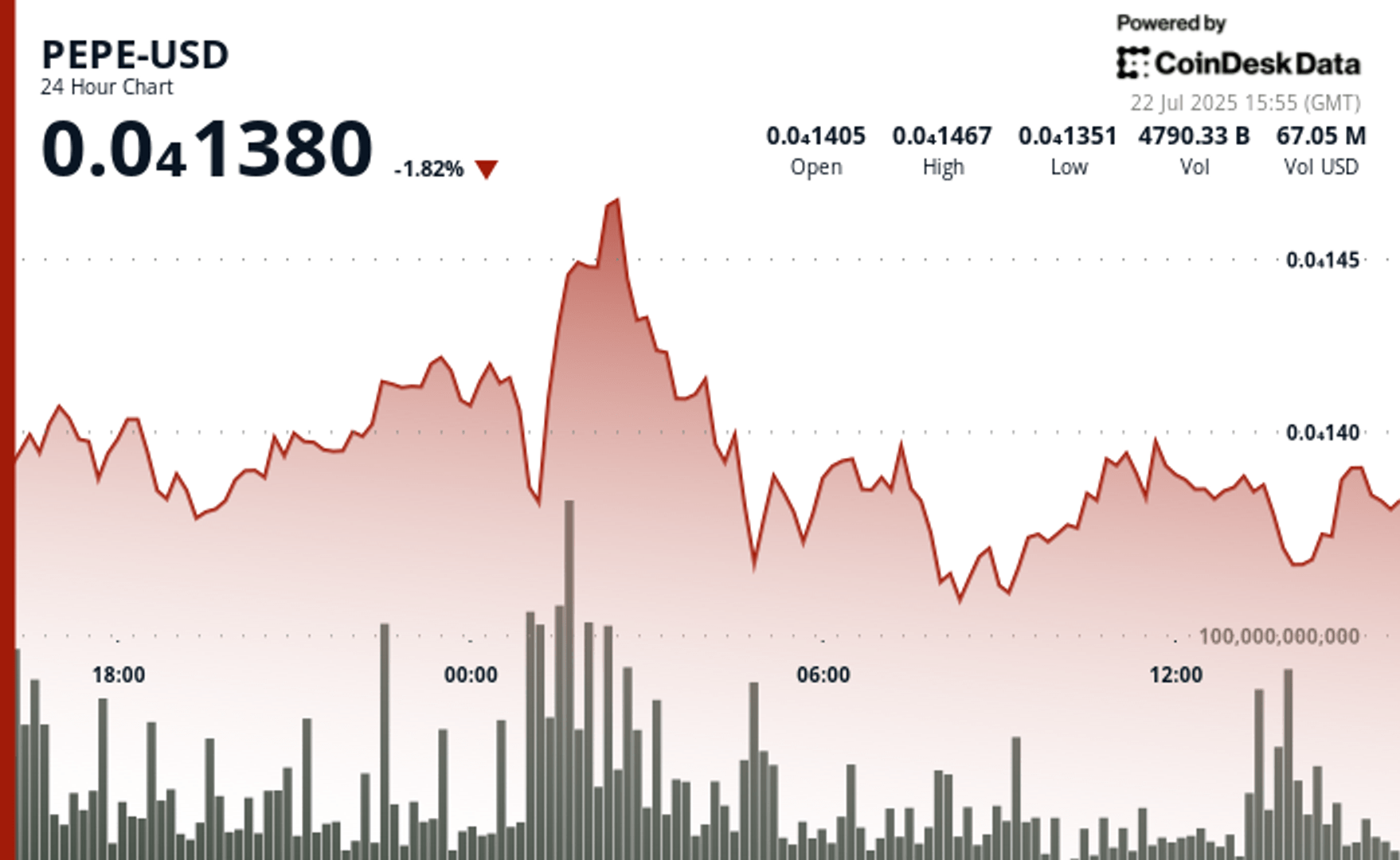

Pepe fell by around 2% in the last 24 -hour period as part of a 5% broader sale which started in the middle of a slowdown in the cryptography market and a wave of high volume sales.

The price went from 0.000014268 to 0.000013568 $ during the session, with 349 billion discharged tokens during the move, according to the Technical Analysis Data model of Coindesk Research.

The cryptocurrency inspired by the memes has briefly rallied to a session top of 0.000014713, supported by 11.7 billions of tokens negotiated in a single wave. But the attempt failed, encountering rigid resistance and triggering a rapid reversal. The net movement has resulted in more than $ 4 million in liquidations, according to Coinglass data.

This high session is now a firm technical ceiling, strengthening the doubts of trader as to a short -term advantage. The relative postal volume on social networks has increased by more than 23% compared to its average 24 hours a day, according to Theie data, suggesting growing interest.

Support came nearly 0.000013618, where buyers showed interest in previous decreases. While the token has briefly moved below this level, it has since recovered to exceed it.

Meanwhile, Nansen’s data show that even if the first 100 addresses containing Pepe on Ethereum increased their assets by 0.11%, exchange portfolios have added 0.24% in the last 24 hours, showing an increasing offer on the market.

Despite the drop, Pepe slightly surpass the same space wider. The Memecoin Coindesk index (CDMEME) experienced a decrease of 2.4% in the last 24 hours, compared to the drop almost 2% of Pepe. In the past month, Pepe increased by almost 55% compared to the increase of 41.7% CDMEME.

The token on the theme of the frogs surpassed after having formed a cross model of gold at the beginning of the month. Crypto Lark Davis analyst on social networks reported a potential target to $ 0.0000,155.

Preview of technical analysis

- The negotiation volume increased to 11.72 billions of token during an attempted rupture, reporting generalized market participation.

- A strong rejection at $ 0.000014713 now serves as a critical ceiling for more than the increase.

- A coherent activity of the buyer has formed a key support almost 0.000013618

- Strong deterioration started with 230.19 billion tokens sold in a concentrated period.

- Massive unloading occurred in successive waves of 237.67 billion, 329.19 billion and finally 349.11 billion tokens. The activity then decreased to zero, signaling the merchant’s fatigue and the lack of conviction for recovery.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.