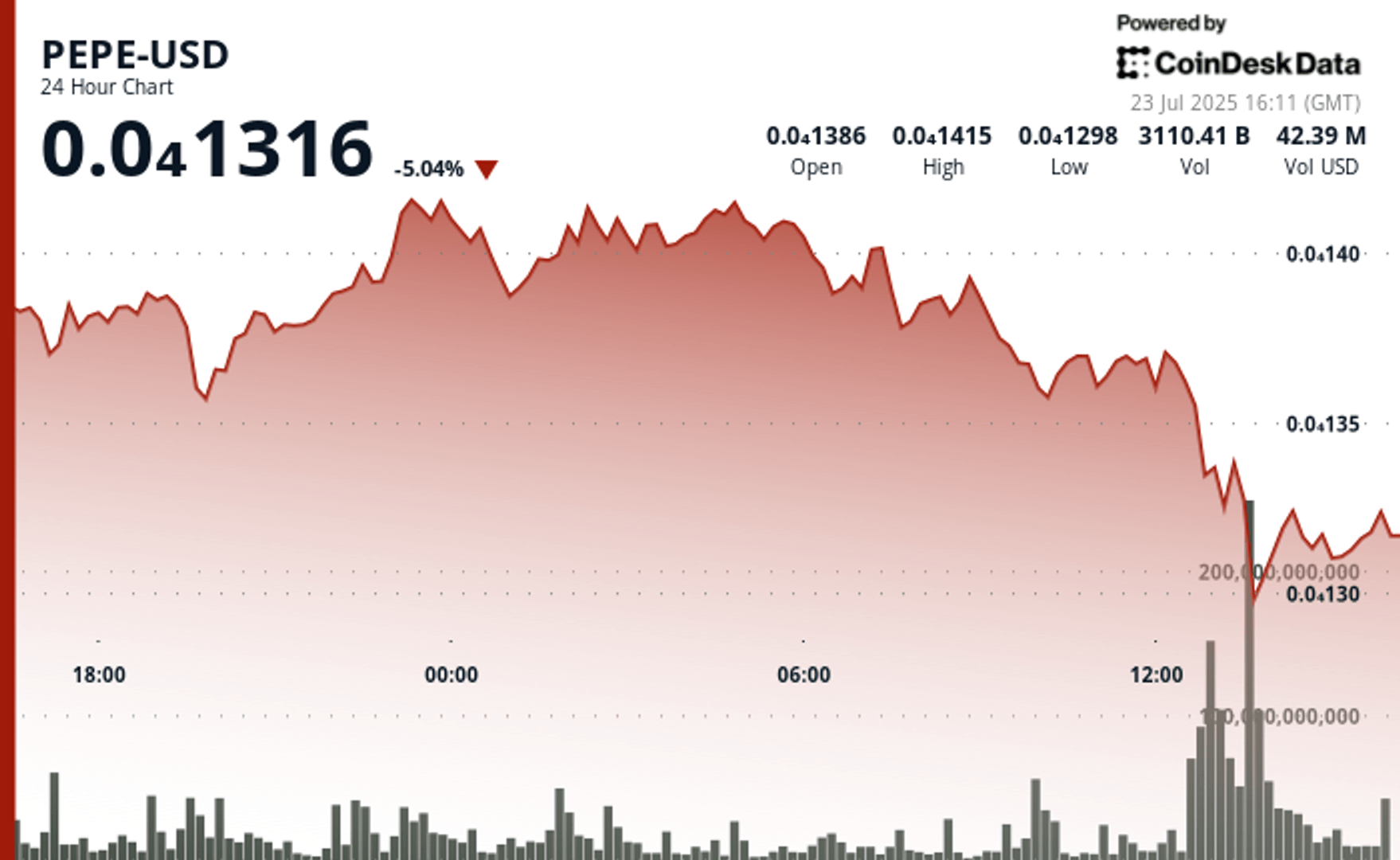

PEPE fell by more than 5% in the last 24 -hour period, from a session of almost 0.000014167 to a minimum of $ 0.000012915, before seeing a slight recovery.

The trading volume reached 13.02 billions of tokens per hour during the sale, more than four times the average of the session of 3.2 Billions, according to the Technical Analysis Data model of Coindesk Research.

Despite the sale, several market indicators suggest a deeper interest of investors. Google’s research requests jumped on July 22, culminating shortly before the accident, according to Google Trends.

Meanwhile, whale portfolio operations in Ethereum, measured by the 100 best addresses, increased by 3.2% in the last 30 days. The PEPE tokens on exchanges fell 2.5% over the same period, according to Nansen data, which suggests that there is less available supply.

At the end of the session, Pepe had recovered some of his losses, stabilizing around $ 0.0000131. The recovery volume has remained high, the average of which between 300 and 400 billion tokens per hour, showing a renewal of the purchase following the withdrawal.

Preview of technical analysis

The action of prices during the session was defined by net oscillations and clear levels of resistance and support. Pepe failed to pierce the fork 0.000014150, forming a ceiling that diverted the buyers several times.

Lowering, the brand of $ 0.000013 acted as a floor where prices have rebounded several times.

The most intense sale came while the hourly volume has increased, suggesting forced outings and large -scale profits. But by session, a constant and stable activity of purchase, with an average of 300 to 400 billion tokens per hour, alluded to a potential rebound.

While the lost vapor of the rally, the underlying trading behavior reflects a familiar model on the same markets: overvoltages focused on the media threw followed by net corrections, long-term holders striking volatility as an entry point.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.