Gold was one of the most efficient assets in 2025, increasing by 38% over a year, exceeding Bitcoin23% in advance. It is not a secret, however, that bitcoin did very much better than gold (and almost everything else) During its short lifespan.

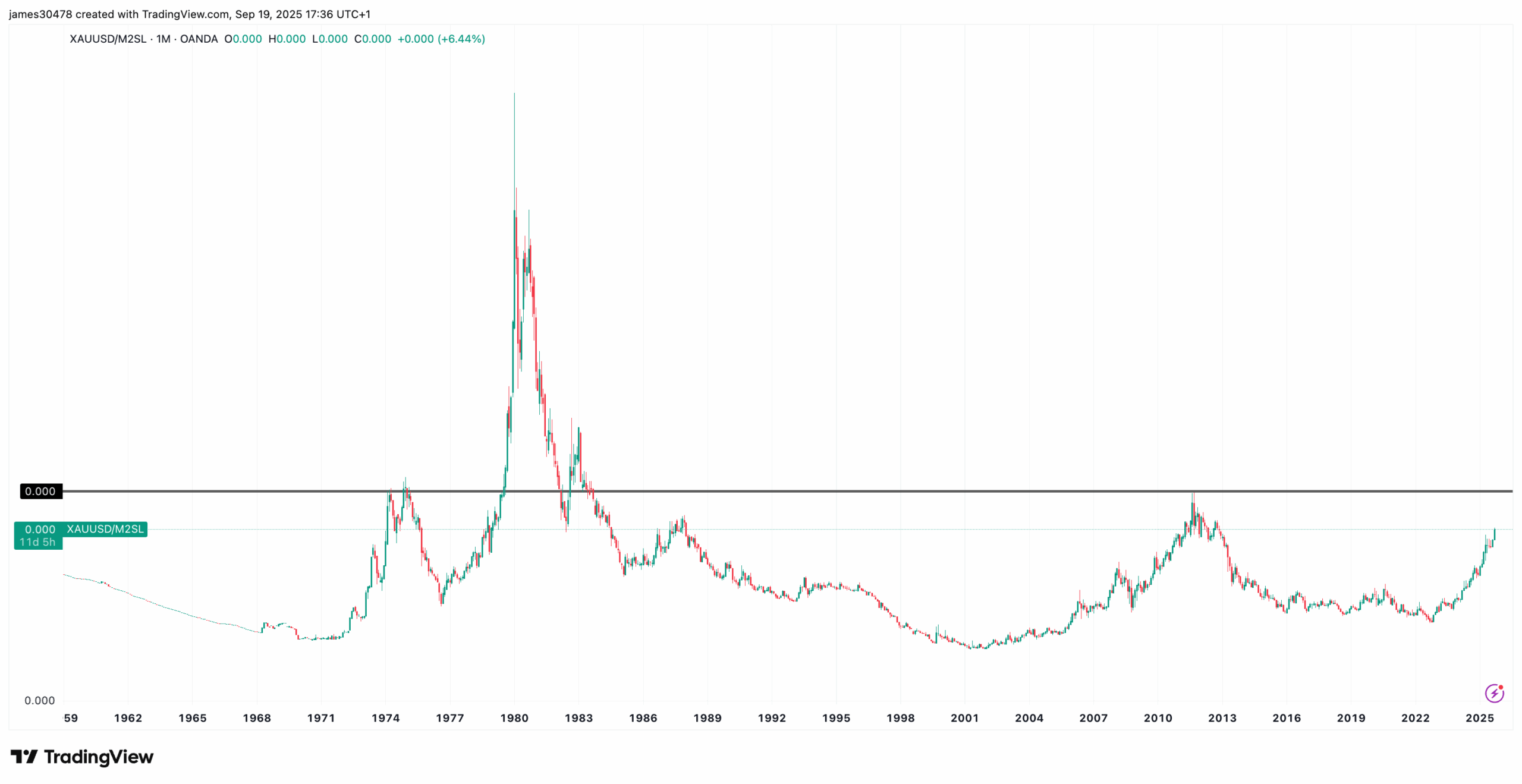

A control of the two popular assets resistant to inflation against a wide measure of the American money supply (known as M2) gives additional information about their performance.

Adjusted for the growth of M2, gold – despite its recent highlight – remains lower than its 2011 peak and almost at the same level as in 1975. The summit of all time for gold against M2 occurred in 1980.

Bitcoin tells another story. Each bull cycle saw BTC reaching a record against M2, including last month when Bitcoin affected both an absolute summit and a new high compared to the money supply.

This contrast could highlight the different roles of the two active ingredients. Gold continues to serve as a longtime cover and stabilizer in the wallets, while Bitcoin behavior shows how new forms of money can react differently to an era of rapid monetary expansion.