Carnage took place in crypto markets on Friday as trade tensions between the United States and China escalated, with Trump threatening to massively increase tariffs on Chinese goods.

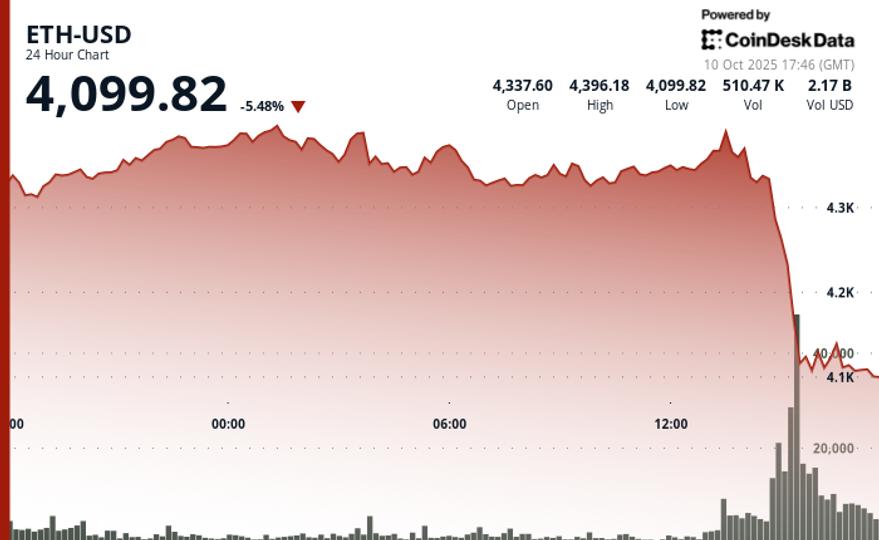

The hardest hit among the components of the CoinDesk 20 crypto benchmark was Ethereum’s native token Ether. plunging 7% from Friday’s session high and hitting its lowest price since late September below $4,100. Its decline has far exceeded that of Bitcoin 3.5% drop below $118,000 and 5% drop in the index.

The widespread market downturn triggered a cascade of liquidations across crypto derivatives markets, wiping out more than $600 million in leveraged trading positions across all assets, according to CoinGlass data.

ETH also led liquidations with over $235 million in long positions wiped out during the session. Longs are leveraged bets seeking to profit from rising asset prices.

Technical failure

Behind the liquidation cascade was ETH’s breakdown of critical support levels, CoinDesk Research’s technical analysis model suggests.

• Selling pressure materialized around 2:00 p.m. UTC with volume of 372,211 units, almost double the 24-hour average of 190,747 units.

• Volume-based resistance confirmed around $4,287.

• Primary resistance identified at $4,141 during a failed recovery attempt.

• Potential support forming just below $4,100 where buyers have emerged.