Pea

encountered substantial sales pressure, lowering up to 5% before bouncing and potentially forming a double -bottomed model that points to a continuous rise, according to the Coindek Research technical analysis model.

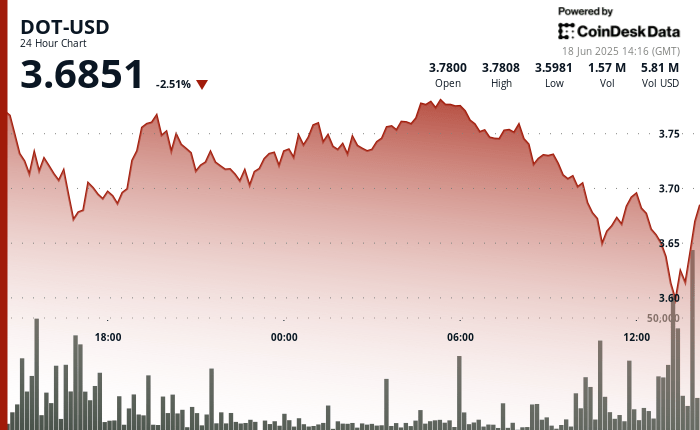

After initially attempted to establish an upward trend with a peak at $ 3.787, Dot encountered strong resistance and formed a downward inversion diagram, according to the model.

During recent negotiations, the DOT was down 2.6% over 24 hours, exchanging about $ 3.63 after finding support at $ 3.59. The wider market gauge, the Coindesk 20, fell 0.5% at the time of publication.

Prices’ action shows a double -bottom potential pattern forming with the improvement of the momentum, suggesting more upward if it maintains the higher support at the price level of $ 3.62, showed the model.

Technical analysis:

- DOT experienced a 24 -hour volatile period with a substantial beach of 0.193 (5.1%), initially trying to establish an upward trend with an $ 3.787 peak before meeting strong resistance.

- The price action has formed a downward reversal model because the dowry failed to maintain above the level of $ 3.75, followed by an accelerated sale at a high volume during the 10:00 and 1:00 p.m. when the volume increased to almost 4 million units-well above the average of 24 hours.

- The support emerged at $ 3.594, although the current price structure suggests a risk of additional decline, the dowry closed near session with indicators of momentum of weakening.

- During the last hour, Dot experienced significant volatility with a sharp drop of $ 3.643 to a minimum of $ 3.594, followed by a recovery attempt.

- The price found solid support in $ 3.594, triggering a V -shaped recovery which increased the dowry by 1.3% to $ 3.642.

- The recent price action constitutes a potential double-bottom model with the improvement of the momentum, suggesting the possibility of continuing the movement upward if dowry can maintain support above $ 3.62.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.